Picture supply: Getty Pictures

With the FTSE 100 near all-time highs, traders have to look fastidiously for alternatives. And that is very true with regards to development shares.

There’s, nevertheless, one UK inventory that I believe development traders ought to take note of in the intervening time. Regardless of buying and selling at a excessive a number of, it’s higher worth than it appears to be like.

Security first

Halma (LSE:HLMA) is a set of know-how companies centered on security. And it’s been one of many FTSE 100’s best-performing shares over the past 10 years.

That is partly the results of the agency’s spectacular gross sales development. During the last decade, revenues have elevated by a median of 12% per yr – that’s quicker than Apple (8%) or Microsoft (11%).

Shopping for different companies has been a key a part of Halma’s development technique. It appears to be like to amass firms which have main positions in area of interest industries, making them troublesome to disrupt.

That is an inherently dangerous technique – paying an excessive amount of for a enterprise is all the time a risk and it could destroy worth for shareholders. However the FTSE 100 agency has executed very effectively not too long ago.

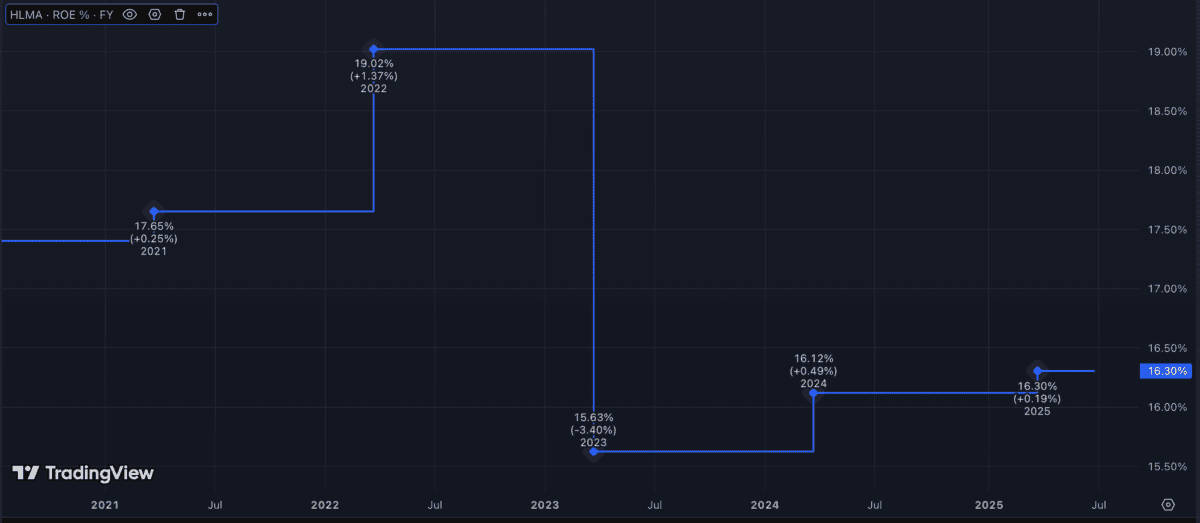

During the last 5 years, Halma’s returns on fairness have been very secure at round 17%. That’s an excellent signal the corporate is managing to keep away from overpaying for its acquisitions.

Supply: TradingView

That is very encouraging, however – as Warren Buffett factors out – it’s attainable to pay an excessive amount of even for shares in an impressive enterprise. Happily, I believe the inventory is definitely unusually low cost.

Valuation

At first sight, Halma doesn’t look low cost. The inventory trades at a price-to-earnings (P/E) ratio of 41, which is extraordinarily excessive in comparison with the FTSE 100 common of just under 18.

Appearances, nevertheless, will be misleading. The corporate’s acquisition-based development technique means the amortisation prices on its revenue assertion are unusually excessive.

Consequently, the agency’s web revenue doesn’t all the time give a superb indication of the money the enterprise generates. That is one thing traders have to pay attention to.

By way of free money move, Halma shares are literally buying and selling at an unusually low a number of in the intervening time. For this reason I believe the inventory is price contemplating at at this time’s costs.

Wanting additional forward, administration expects to have the ability to generate income development of round 7% per yr. And that’s from present operations – with out factoring in acquisitions.

If it achieves this whereas discovering alternatives to purchase companies at enticing costs, the inventory could possibly be a fantastic funding. The corporate’s profitable components may nonetheless have a technique to go.

Development investing

Over the long run, an organization’s shares go up for one in all two causes. Both the underlying enterprise makes extra money, or the a number of the inventory trades at will increase.

Clearly, the perfect funding alternatives are these the place there’s scope for each. And I believe Halma may match the invoice for UK traders.

The underlying enterprise continues to develop strongly, pushed by disciplined acquisitions. So whereas the shares commerce at an unusually low a number of, traders ought to no less than have a look.