Picture supply: M&S Group plc

Resurgent gross sales have propelled Marks and Spencer Group (LSE:MKS) shares sharply greater since October 2022. Earlier than the latest cyberattack (extra on this later), they hit their costliest for nearly a decade at 417.8p every in late April.

But regardless of these beneficial properties, somebody who purchased the FTSE 100 retailer 10 years in the past would nonetheless be nursing some important losses.

At 345.4p, Marks and Spencer’s share worth is 36.7% decrease than it was at this level in 2015, at 546.1p. It implies that £10,000 value of shares purchased again then would now be value £6,328.

Due to some dividend funds delivered in that point — these equate to 86.23p per share — somebody who invested £10k within the retailer would have additionally obtained £1,582 in passive earnings. That may have improved their whole return to £7,910, or -20.9%.

That’s a reasonably shoddy consequence, I’m certain you’d agree. However with its revamped clothes technique paying off and its digital proposition delivering the products, might Marks and Spencer outperform the UK’s large- and mid-cap shares wanting forward?

And will I contemplate shopping for the retailer for my portfolio?

Optimistic worth forecasts

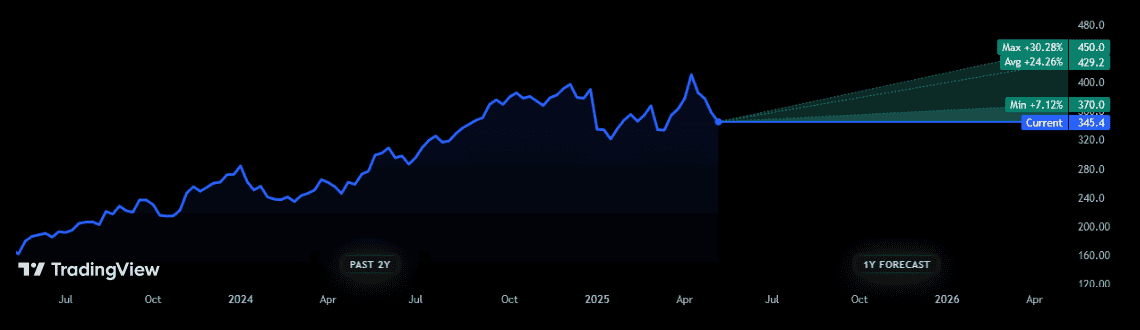

Sadly, share worth forecasts aren’t accessible for the shares for the subsequent decade. Nonetheless, they’re accessible for the subsequent 12 months. And encouragingly, they recommend the retailer will preserve its share worth restoration going.

Because the graph reveals, the 11 analysts with rankings on the inventory are united of their optimism. One particularly bullish forecaster expects the retailer to march to new multi-year highs of 450p.

Ought to I purchase?

On the one hand, it’s maybe no shock that Metropolis brokers are bullish on the Footsie firm. The restoration that long-term buyers had been desperately looking for is lastly right here and continues to ship in spades.

Clothes, dwelling and wonder gross sales rose 1.9% on a like-for-like foundation within the 13 weeks to twenty-eight December, newest financials in January confirmed. Corresponding meals revenues in the meantime had been up 8.9% 12 months on 12 months.

The core clothes division is hanging the proper stability of favor, worth and high quality, and continues to achieve market share. And heavy funding in on-line can also be paying off, with web gross sales rising 11.7% within the final quarter.

Nonetheless, I’m not satisfied the shares are a purchase for me proper now. Its failure to supply full-year steering in January underlined rising uncertainty as customers really feel the pinch. The retailer additionally faces ongoing aggressive threats, and particularly in meals the place the UK’s main supermarkets are embarking on a brand new worth conflict.

I’m additionally involved concerning the implications of the cyberattack final month that halted on-line orders. Within the close to time period, this might take an enormous chunk out of income (web gross sales accounted for 34% of group gross sales within the January quarter). As I kind, on-line orders are nonetheless paused.

And the injury may very well be much more extreme over the long run. On Tuesday (13 Could), the enterprise stated “a few of their private buyer information has been taken.” The reputational injury to the M&S model may very well be important and immediate internet buyers to go elsewhere.

Whereas they’re not with out potential, on stability I’d nonetheless reasonably go away these shares on the shelf proper now.