Picture supply: Getty Pictures

Shell (LSE:SHEL) shares are up simply 4% over the previous 12 months. As such, an funding made a 12 months in the past can be price £10,400 right this moment. Nonetheless, an investor would have additionally obtained round £400 within the type of dividends. So, 8% whole returns. Not unhealthy however not nice.

What’s been happening?

Shell’s share value good points have been modest, regardless of the corporate’s efforts to streamline operations and enhance monetary efficiency. This sluggish efficiency could be attributed to a number of components.

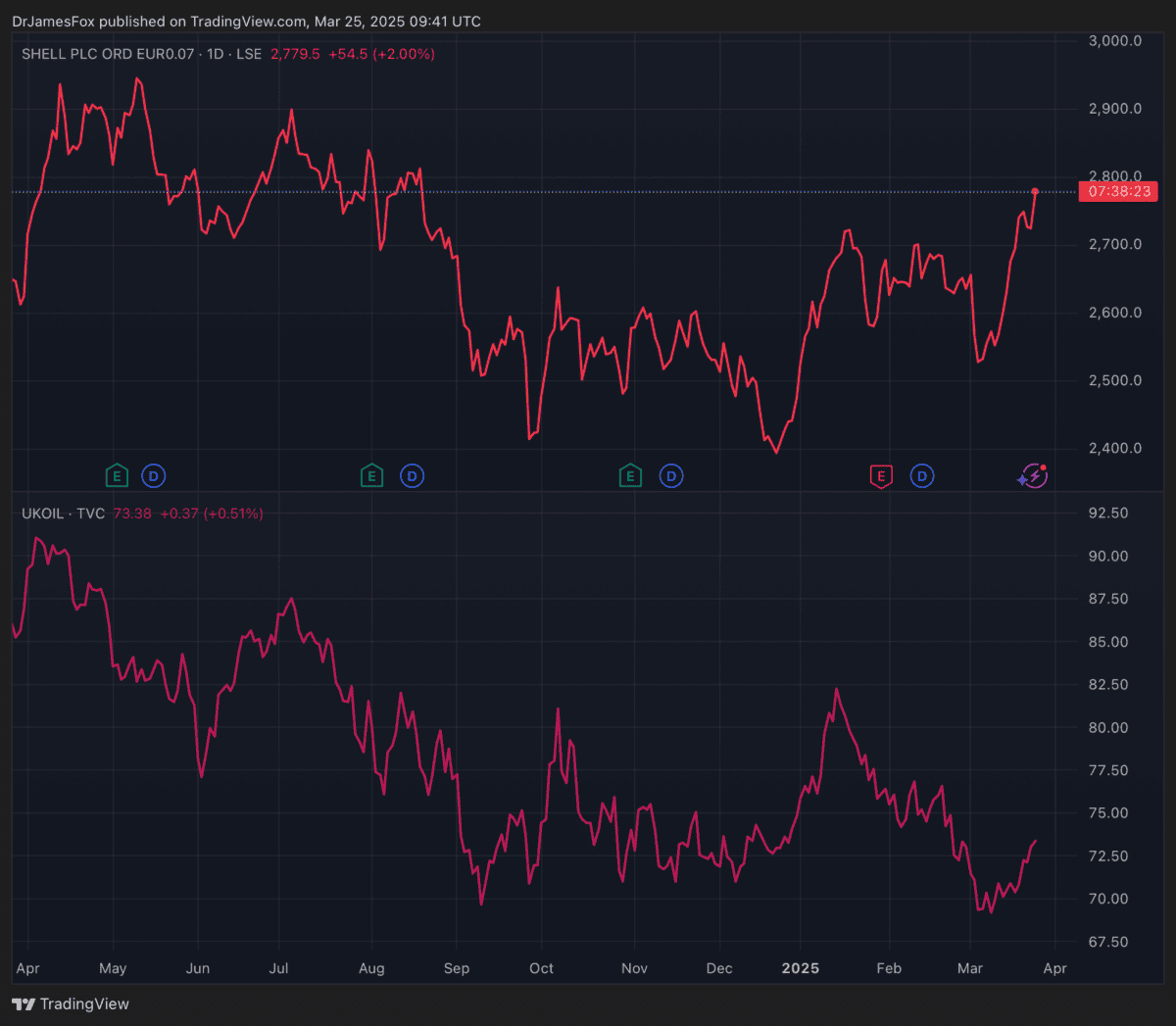

Firstly, oil costs have fluctuated over the previous 12 months, however the common path is downwards. As I write, Brent Crude costs are down 8.5% over the 12 months, and it will have an effect on the underside line.

Whereas Shell has managed to develop its manufacturing by 2%, falling oil and fuel costs have additionally squeezed downstream margins, leading to a 17% lower in earnings attributable to shareholders in 2024. This has dampened investor enthusiasm and restricted share value progress.

Macroeconomic uncertainties have additionally performed a job. China, the world’s largest oil importer, has skilled financial slowdowns, creating uncertainty concerning future vitality demand. Moreover, geopolitical tensions and the lingering results of the Russia-Ukraine battle have contributed to market volatility.

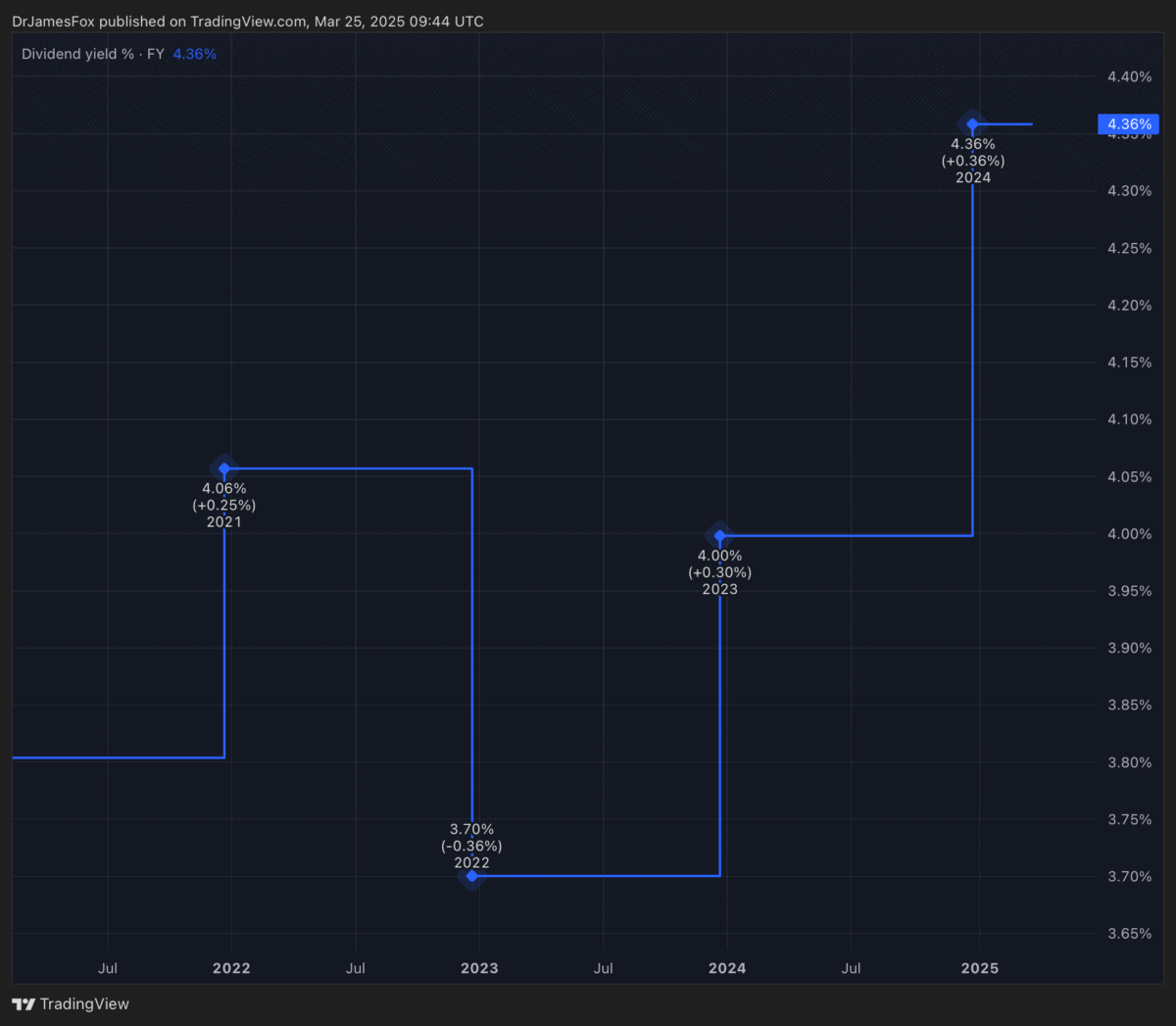

Regardless of these challenges, Shell has made progress in bettering its monetary place. The corporate has lowered its capital expenditure and internet debt, whereas sustaining robust money flows from working actions. This has allowed Shell to launch a brand new $3.5bn share buyback program and improve dividends by 4%.

However what’s subsequent?

Forward of its Capital Markets Day on March 25, Shell mentioned it might look to concentrate on delivering extra worth to shareholders whereas decreasing emissions. The corporate revealed plans to extend shareholder distributions from 30-40% to 40-50% of money stream from operations, whereas sustaining a 4% annual progressive dividend coverage.

Shell additionally raised its structural price discount goal from $2bn-$3bn by the top of 2025 to a cumulative price saving of $5bn-$7bn by the top of 2028, in comparison with 2022 ranges. The corporate additionally plans to decrease its annual capital expenditure to $20bn-$22bn for 2025-2028 — down from $22bn-$25bn — the vary for 2024 and 2025 guided again in 2023.

Furthermore, the corporate goals to develop free money stream per share by over 10% yearly by way of 2030 whereas sustaining a secure liquids manufacturing of 1.4m barrels per day. In the meantime, CEO Wael Sawan sees LNG gross sales rising by 4-5% yearly by way of 2030.

Nonetheless, Shell stays depending on oil and fuel costs. We’re now two months into the presidency of Donald Trump, a person who promised to maintain oil costs low. An finish to the warfare in Ukraine, which can be on his agenda, would probably see the normalisation of provide routes and place downward stress on vitality costs.

Briefly, there are a number of causes I’d count on oil, and presumably fuel, costs to stay decrease over the subsequent 12 months and maybe by way of Trump’s presidency. Regardless of the enterprise decreasing capex and elevating returns, the broader financial outlook issues me. That’s why I’m passing on Shell shares for now.