Picture supply: Getty Photos

Phoenix Group (LSE:PHNX) shares have proved an distinctive funding for dividend buyers for greater than a decade.

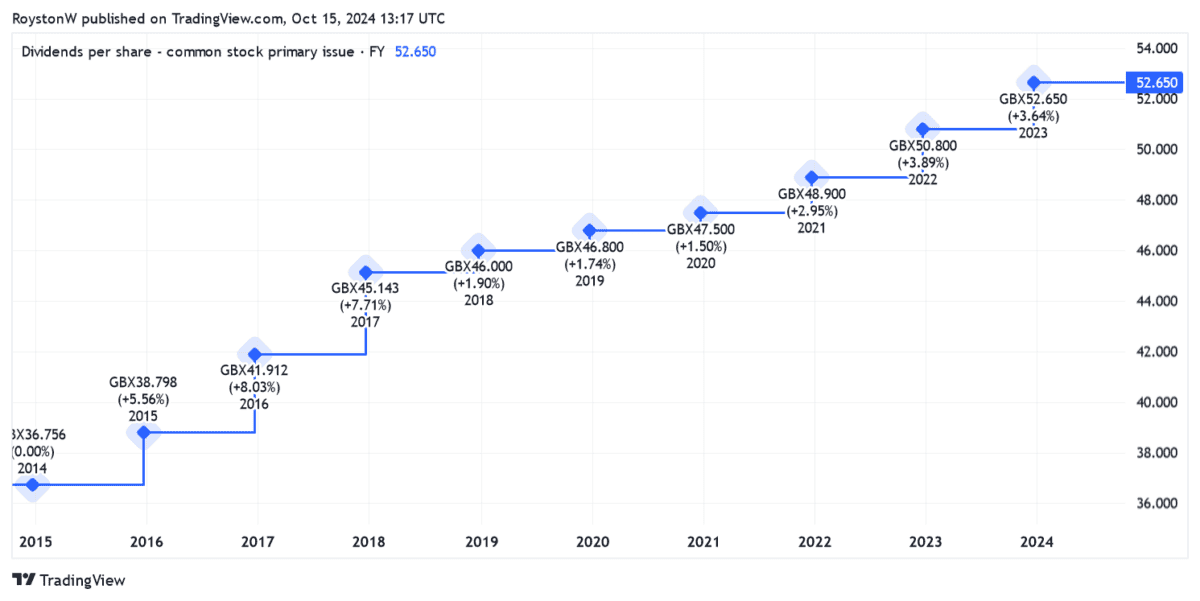

Shareholder payouts have marched steadily greater in that point. And the yield on the FTSE 100 firm has lengthy overwhelmed the index common of three% to 4% through the interval.

Previous efficiency is not any assure of future returns. However encouragingly for earnings chasers, the Metropolis’s group of analysts expect dividends from Phoenix shares to maintain marching skywards.

So how a lot passive earnings may I make with a £10,000 funding in the present day?

11.1% dividend yield

Phoenix’s lengthy observe report of beneficiant and rising dividends displays its dedication to having a wholesome stability sheet. Even when earnings have fallen — which has occurred thrice previously 5 years — money rewards have marched steadily greater.

Final 12 months, the Footsie agency raised the shareholder payout 4% to 52.65p per share. And because the desk under exhibits, dividends are tipped by Metropolis brokers to maintain rising by way of to 2026 no less than:

| 12 months | Dividend per share | Dividend progress | Dividend yield |

|---|---|---|---|

| 2024 | 54p | 3% | 10.4% |

| 2025 | 55.6p | 3% | 10.8% |

| 2026 | 57.3p | 3% | 11.1% |

As you may see, the dividend yields on Phoenix shares are subsequently two to a few occasions bigger than the FTSE 100 common.

And even when dividends fail to develop past 2026, I may nonetheless make a four-figure month-to-month dividend earnings with a lump sum funding.

Compound features

Let’s say that I’ve £10,000 that’s prepared to take a position. If dealer forecasts are correct, this could web me:

- £1,040 in dividends in 2024

- £1,080 in dividends throughout 2025

- £1,110 value of dividends in 2026

If dividends remained locked at 2026 ranges, through the subsequent decade I’d take pleasure in £11,100 in dividends. Over 30 years, I’d make a £33,300 in passive earnings.

That’s not unhealthy, I’m certain you’ll agree. However it’s not as a lot as I’d make by reinvesting my dividends, or compounding my returns.

An enormous passive earnings

If I used this frequent funding technique, I’d — after 10 years, and primarily based on that very same 11.1% dividend yield — have made £22,208 in dividends. That’s greater than double the £11,100 I’d in any other case have made.

On a 30-year foundation, the distinction is even starker. With dividends reinvested, I’d have made a passive earnings of £291,653. That dwarfs the £33,300 I’d have generated with out reinvestment.

With my £10,000 preliminary funding added, my portfolio could be value a staggering £302,653 (assuming zero share worth progress). With a 4% annual withdrawal, I’d have £12,106 of passive earnings, which equates to £1,009 a 12 months.

Shiny outlook

That mentioned, I’m anticipating Phoenix’s share worth and dividends per share to rise strongly over this timeframe, too, a situation that will give me a good greater second earnings.

I count on earnings right here to balloon within the coming a long time, because the UK’s booming aged inhabitants drives demand for pensions and different retirement merchandise.

If it could preserve a powerful stability sheet, Phoenix may proceed paying massive dividends whereas investing for progress, too. Encouragingly, its Solvency II ratio is a formidable 168%, in line with its newest financials.

The corporate faces vital aggressive pressures that might blow earnings and dividends off beam. However all issues thought of, I believe Phoenix shares are value a really shut look proper now.