Picture supply: Getty Photos

Financial savings ranges within the UK have hit report highs above £2bn in 2024. However may prioritising saving as a substitute of shopping for UK shares be costing people numerous money?

I believe so. And contemporary analysis from Janus Henderson Funding Trusts helps that view. It exhibits that money financial savings “returned lower than a 3rd of that returned by shares and shares” within the 9 months to September.

It implies that Britons have actually missed out on tens of billions of kilos.

A £165bn black gap

Based on Janus Henderson, savers earned £58.6bn value of curiosity between January and September, equal to a mean rate of interest of two.93%.

By comparability, the FTSE All-Share Index returned 9.9% by a mix of capital beneficial properties and dividend earnings. In the meantime, the MSCI World Index offered an even-higher return of 13.4%.

The end in actual phrases is jaw-dropping. Utilizing Janus Henderson’s calculations, “savers have missed out on £165bn of returns… by evaluating money curiosity and the return on world equities.”

The report provides that “savers have missed out on £110bn of returns this yr in comparison with investing in UK equities.” Each calculations even permit for 3 months’ family earnings being held in a financial savings account.

Lengthy-term development

This beautiful distinction isn’t only a momentary improvement both. And it’s much more miserable for money savers after we issue within the eroding influence of inflation.

Janus Henderson says that “£100 saved in money has lagged behind rising costs by 3.4% over the past 30 years, that means it buys much less at this time, even with all of the curiosity earnings earned since, than it did in 1994.”

Conversely, that £100 invested in world shares would have crushed inflation nearly seven-fold, or four-fold if spent on UK shares.

A high fund

Previous efficiency is not any assure of future success. However the resilience and wealth-creating energy of the inventory market is why the lion’s share of my cash is tied up in shares, funds and trusts.

I solely maintain some cash in a financial savings account to handle danger, and provides me money to attract on within the occasion of a wet day. Whereas it is a riskier technique, I can take steps to scale back the hazard by diversifying my holdings.

One technique I exploit is to speculate a few of my capital in exchange-traded funds (ETFs) just like the Xtrackers MSCI World Momentum UCITS ETF (LSE:XDEM).

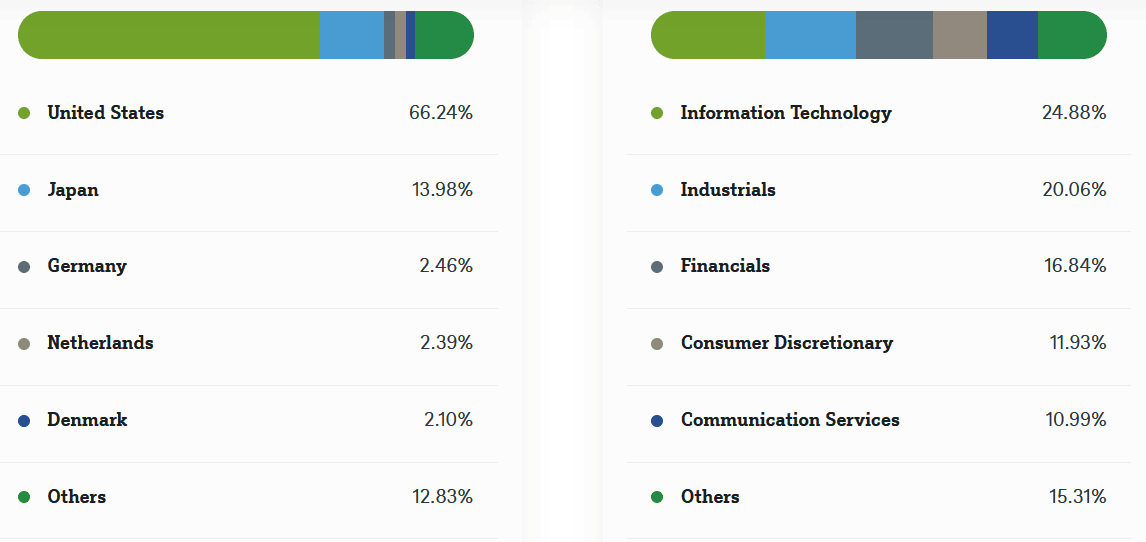

Because the identify implies, this fund invests in shares from throughout the globe, 350 in complete. And so it permits me to unfold danger throughout quite a lot of areas — together with the UK — in addition to a mess of sectors.

I just like the respectable publicity to tech shares together with Nvidia, Apple and Meta. This provides me a chance to revenue from fast-growing tech phenomena together with synthetic intelligence (AI), robotics and quantum computing. However I’m conscious that shares like this might ship disappointing returns throughout financial downturns.

Since 2014, this fund has delivered a mean annual return of 11.9%. If this continues, a £10,000 funding at this time would develop into £348,975 after 30 years.

That’s much better than the £24,568 I may have made by parking £10k in a 3%-yielding financial savings account.

Shares and funds can rise and fall in value. However returns like this counsel my present technique is the proper one for me.