13 years in the past at the moment, Bitcoin skilled its first halving occasion, decreasing the miner block reward from the unique 50 BTC to 25 BTC.

Now, with Bitcoin (BTC) having accomplished 4 halving occasions and block rewards standing at simply 3.125 BTC, the mining trade is constant to remodel, with industrial miners consolidating and diversifying into AI.

On the identical time, a distinct segment pattern of solo mining is rising, in keeping with Bitfinex analysts who spoke to Cointelegraph.

“Regardless of the brand new spike in additional industrial Bitcoin mining, we want to underscore the brand new wave of solo miners and the way hobbyist miners are coming again to the market, due to enhancements in mining swimming pools, effectivity positive factors and area of interest methods,” the analysts stated.

Bitcoin mining in 2024 versus 2025: Rising competitors as output shrinks

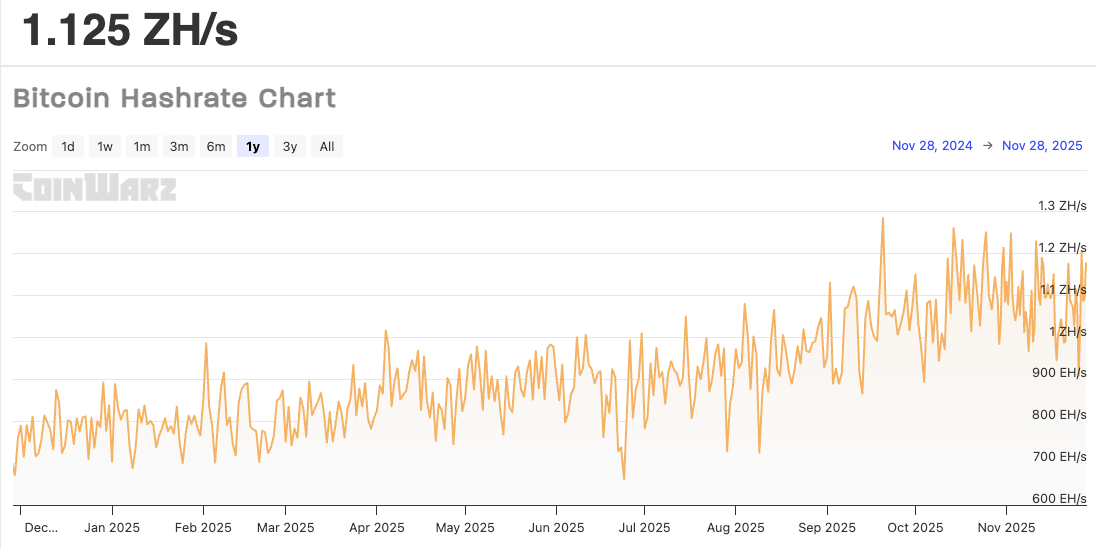

Since final yr, the Bitcoin mining market has grown considerably in scale, complexity and competitiveness, with the worldwide hashrate surpassing the symbolic one zetahash per second (ZH/s) in August, in keeping with CoinWarz information.

“This displays each elevated funding and the deployment of ultra-efficient mining {hardware} such because the Antminer S21 sequence,” Bitfinex analysts stated. “Briefly, the Bitcoin mining market of 2025 is extra industrialized, technologically superior and geographically dispersed than it was in 2024, but in addition extra aggressive and risky.”

Bitcoin hashrate chart from December 2024 to November 2025. Supply: CoinWarz

Regardless of rising competitors, mining output has declined over the previous yr. Bitcoin’s circulating provide added round 155,000 BTC between Nov. 27, 2024, and Nov. 27, 2025, down 37% from 245,000 BTC within the previous yr, in keeping with Blockchain.com.

“2024 was already a tricky yr for miners,” Kristian Csepcsar, chief advertising and marketing officer at BTC mining tech supplier Braiins, advised Cointelegraph, including that miners had been deploying {hardware} at report pace.

Associated: Bitcoin miner hashprice nearing $40, miners again in ‘survival mode’: Report

Nonetheless, even with larger BTC costs, the revenues continued to fall because the hash worth — or miners’ returns earned per unit of hashpower — plummeted amid rising mining competitors, Csepcsar added.

Bitcoin hashprice index hit an all-time low at $34 on Nov. 21, 2025. Supply: HashrateIndex.com

“2024 was tough. At this time is worse. Miners are in essentially the most aggressive setting the trade has ever seen, and no one is aware of how lengthy this may final,” Csepcsar stated.

Solo and hobbyist mining again to the market

Regardless of intensifying industrial competitors and rising prices, particular person miners haven’t disappeared. As a substitute, they’re re-entering the market, supported by diverse enhancements in mining pool know-how, in keeping with Bitfinex analysts.

“Instruments comparable to CKPool — a solo-mining-friendly platform identified for low latency — have helped make this follow extra accessible,” the analysts stated. The corporate additionally noticed a viral social pattern for “lottery wins” by solo miners, notably these utilizing environment friendly, low-noise mining gadgets at residence.

Supply: RedPandaMining

Hobbyist mining — not fairly solo, but in addition not industrial — has seen a mini renaissance,” Bitfinex analysts stated. The pattern has been pushed by the supply of environment friendly, low-cost ASICs, using off-peak electrical energy methods, warmth recycling strategies, and firmware comparable to BraiinsOS, which permits miners to underclock gadgets for optimum effectivity.

Associated: Tether confirms Uruguay Bitcoin mining exit amid excessive vitality costs

“It’s unlikely that these teams might take the hashrate lead in a capitulation state of affairs, as we’re speaking about regular customers with restricted hashrate out there,” the analysts stated.

Within the occasion of serious capitulation from the most important miners, mid-size industrial operations would turn into the brand new main gamers, whereas solo miners and hobbyists would nonetheless be far behind them when it comes to capability, Bitfinex stated, concluding:

“It’s an fascinating sample, however it’s removed from competing with the bigger and extra industrial operators.”

Journal: Koreans ‘pump’ alts after Upbit hack, China BTC mining surge: Asia Specific