Picture supply: Getty Photographs

It’s a good suggestion to all the time have a buying record of progress shares at hand. Within the occasion of a inventory market crash, having a ready-made assortment of shares to purchase might help Shares and Shares ISA buyers act rapidly.

With world battle escalating and commerce tariff tensions rumbling on within the background, a share market correction or crash may properly be on the playing cards. However buyers don’t have to attend for a full-blown crash to select up some bargains.

Listed here are two nice FTSE 100 shares I believe buyers ought to significantly contemplate proper now.

Babcock Worldwide

The UK is dwelling to a number of top-quality defence shares, however Babcock Worldwide (LSE:BAB) is my favorite worth play. At £10.53 per share, its ahead price-to-earnings (P/E) ratio is 20.3 instances, far beneath nearly all different European sector heavyweights.

Fellow Footsie operator BAE Methods, by comparability, trades on a corresponding ratio of 26.9 instances.

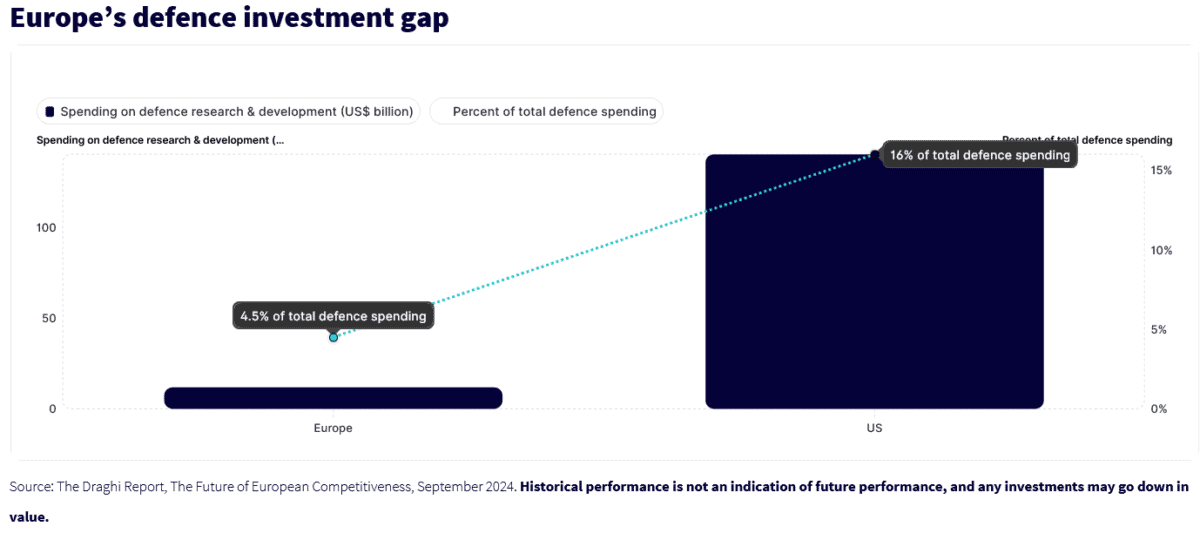

I additionally like Babcock as a result of it generates a far-greater proportion of revenues from the UK and Europe. Spending right here has been considerably decrease in recent times than the US, offering scope for a requirement increase because the area responds to altering Stateside international coverage.

Investing in particular person defence shares will be extra harmful than a sector fund. Undertaking failures within the area can have main geopolitical ramifications, leading to irreversible reputational injury and a lack of future enterprise.

However encouragingly, Babcock has a fantastic observe file on this entrance, as mirrored by its crucial provider standing with the UK authorities. Key companies embrace refitting and upgrading ships and submarines at Devonport, the most important naval base in Western Europe, which it collectively runs with the Ministry of Defence.

Apart from, I believe this threat is greater than mirrored within the cheapness of the corporate’s shares.

Metropolis analysts assume Babcock will report a 57% rise in annual earnings for the monetary yr to March 2025 tomorrow (24 June). Additional will increase of seven% and 10% are forecast for fiscal 2026 and 2027, respectively.

Scottish Mortgage Funding Belief

At 986.9p per share, Scottish Mortgage Funding Belief (LSE:SMT) trades at a near-12% low cost to its web asset worth (NAV) per share. This calls for shut consideration, in my opinion, given its distinctive observe file and future progress potential because the digital economic system booms.

The FTSE belief has risen a powerful 14.5% in worth over the past decade.

I like Scottish Mortgage as a result of it offers publicity to a variety of listed and non-listed firms (96 in all). In addition to standard tech names like Amazon, Meta and Nvidia, buyers can seize a slice of companies whose shares aren’t trade traded like Elon Musk’s SpaceX and Epic Video games.

Buyers should settle for that returns right here may very well be risky if financial circumstances stay powerful. This displays the cyclical nature of the tech business, in addition to the excessive valuations of lots of the belief’s holdings.

However like Babcock Worldwide, I’m optimistic that it may show a prime long-term purchase for buyers to think about.