Picture supply: Getty Pictures

Shopping for low cost shares is usually a great way for traders to maximise their returns. Undervalued shares have scope for substantial long-term worth appreciation if earnings develop. Moreover, firms which can be buying and selling beneath worth take pleasure in a margin of error that may restrict worth falls if market confidence sours.

With this in thoughts, listed below are two of my favorite FTSE 100 and FTSE 250 prospects to analysis as we speak.

Grafton Group

With rates of interest falling, constructing supplies provider Grafton Group (LSE:GFTU) might take pleasure in a singnificant gross sales uplift any further.

The enterprise operates a spread of well-known retail manufacturers reminiscent of Selco and Leyland. Whereas it has operations within the UK, it sources 60% of revenues from European markets together with Eire, Finland and The Netherlands.

Such diversification spreads threat and supplies publicity to totally different progress alternatives.

Grafton’s constructed its footprint by way of a gentle stream of acquisitions. And, pleasingly, the agency nonetheless has a powerful stability sheet it may possibly use to discover additional progress potentialities (it acquired Spanish aircon specialist Salvador Escoda for €132m in October).

There are dangers right here because the Eurozone building sector continues to wrestle. In October, the development buying managers’ index (PMI) remained deep in contractionary territory at 43.

Nonetheless, that is encouragingly the very best PMI studying for 10 months, and could also be an early signal of a possible upswing. With inflation again beneath the European Central Financial institution’s 2% goal, a raft of rate of interest cuts may very well be coming that enhance building exercise throughout Grafton’s areas.

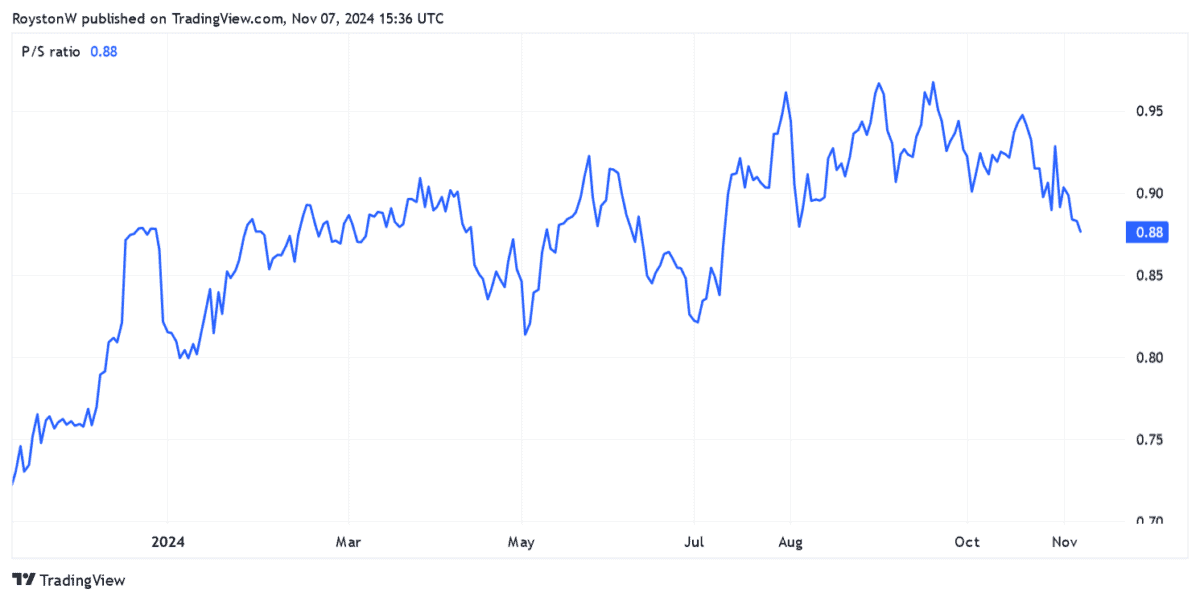

Apart from, I feel the cheapness of Grafton’s shares displays the unsure market outlook. Because the chart beneath exhibits, its price-to-sales (P/S) ratio sits inside worth territory of beneath 1. It’s a terrific share to think about at present costs.

Normal Chartered

Normal Chartered‘s (LSE:STAN) share worth has ripped greater not too long ago. However like Grafton, it additionally gives wonderful worth, for my part.

The financial institution’s price-to-earnings (P/E) ratio is simply 6.8 instances, which is a great distance beneath the index common of round 14.5. It’s additionally beneath the P/E ratios of different blue-chip banks Lloyds, Barclays, NatWest and HSBC.

In the meantime, StanChart’s P/S ratio can also be a rock-bottom 0.7.

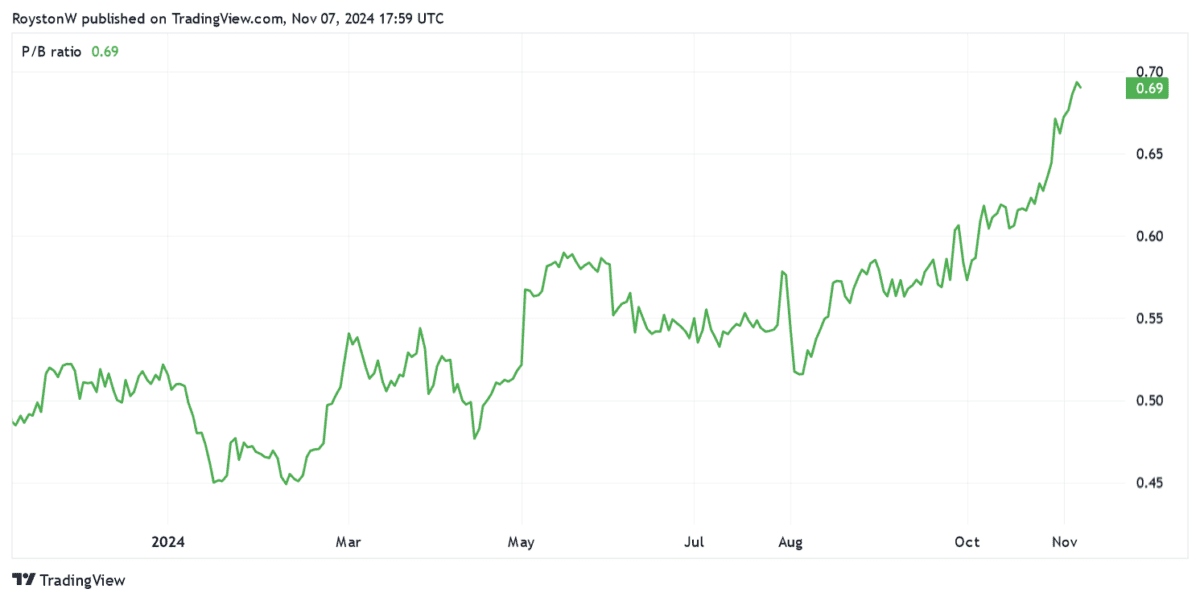

Lastly, a price-to-book (P/B) ratio suggests the agency trades at a reduction to the price of its property, as proven beneath. Just like the P/S ratio, worth territory sits beneath 1.

The financial institution’s low valuation displays the threats posed by China’s troubled economic system. Nonetheless, I imagine that the potential for vital income progress greater than outweighs this threat, and particularly at as we speak’s costs.

Previous efficiency isn’t all the time a dependable information to the long run. However Normal Chartered’s skill to navigate these waters additionally provides me confidence as a possible investor.

It lifted revenue steering once more final month after rising working revenue (at fixed currencies) 12% in Q3. Working revenue’s now tipped to extend 10% this 12 months, and by 5% to 7% in each 2025 and 2026.

With Asia and Africa’s monetary sectors quickly increasing, I feel StanChart may very well be one of many FTSE 100’s best-performing banks over the long run.