Picture supply: Getty Photographs

Searching for the most effective low cost UK development shares to purchase for the New Yr? Listed below are two of my favourites.

Marston’s

Buying and selling situations have gotten more and more troublesome for the normal public home. Altering client habits, low cost grocery store booze, and hovering prices have all smashed profitability acros the sector.

Mixed, these pressures have seen 2,000 pubs shut their doorways for good for the reason that begin of 2020, in line with Altus Group.

However Metropolis analysts don’t maintain any fears for Marston’s (LSE:MARS). They anticipate sturdy earnings development right through to monetary 2027, because the desk beneath exhibits.

| Monetary 12 months ending 30 September | Predicted development |

|---|---|

| 2025 | 56% |

| 2026 | 15% |

| 2027 | 12% |

Marston’s isn’t resistant to broader pressures within the pub sector. However its gross sales are outperforming the broad trade due to its diversified property. Its portfolio contains an excellent unfold of differentiated venues out of your native conventional pub to sports activities pubs, grownup eating pubs, and household pubs.

It’s a recipe that’s proving to be a winner. Reported and like-for-like revenues had been up 3% and 4.8% within the final fiscal 12 months, pushing underlying working revenue 17.9% greater.

Market-beating gross sales aren’t the one spectacular factor at Marston’s. Margins are booming due to initiatives like chopping labour and vitality prices, altering pub menus, and bettering income per buyer.

Final 12 months, the underlying EBITDA margin leapt 190 foundation factors to 21.4%. And Marston’s is focusing on margin enlargement “of 200-300 foundation factors” from this level on as its effectivity technique rolls on.

I’m nonetheless a bit involved in regards to the excessive ranges of debt the pub operator’s servicing. This has dropped considerably, however net-debt-to-EBITDA was nonetheless excessive at 6.5 occasions as of September.

However the cheapness of Marston’s shares nonetheless makes it value a really shut look, for my part. Its ahead price-to-earnings (P/E) ratio is 5.4 occasions, whereas its price-to-earnings development (PEG) a number of is simply 0.1.

Any studying beneath one implies {that a} inventory is undervalued.

TBC Financial institution

Political uncertainty in Georgia makes investing in its native corporations greater threat than traditional. The financial affect of whether or not the nation chooses nearer ties to Russia or the EU shall be vital.

But some Georgian shares are so low cost they’re nonetheless value an in depth look, in my opinion. TBC Financial institution (LSE:TBCG), for example, has a ahead P/E ratio of three.9 occasions and a PEG ratio of 0.2.

A low valuation isn’t the one engaging factor that TBC Financial institution shares with Marston’s. Because the desk exhibits, earnings listed here are additionally tipped to proceed taking off:

| Monetary 12 months ending 31 December | Predicted development |

|---|---|

| 2025 | 20% |

| 2026 | 19% |

This isn’t a shock (to me at the very least) given the continued energy of Georgia’s economic system. Newest knowledge confirmed GDP develop a whopping 11% in quarter three, the type of determine the UK — and with it home banks like Lloyds — can solely dream of.

Cyclical shares like TBC Financial institution are reaping the rewards of this breakneck development. Due to hovering mortgage demand, TBC’s pre-tax revenue leapt 19.1% within the three months to September.

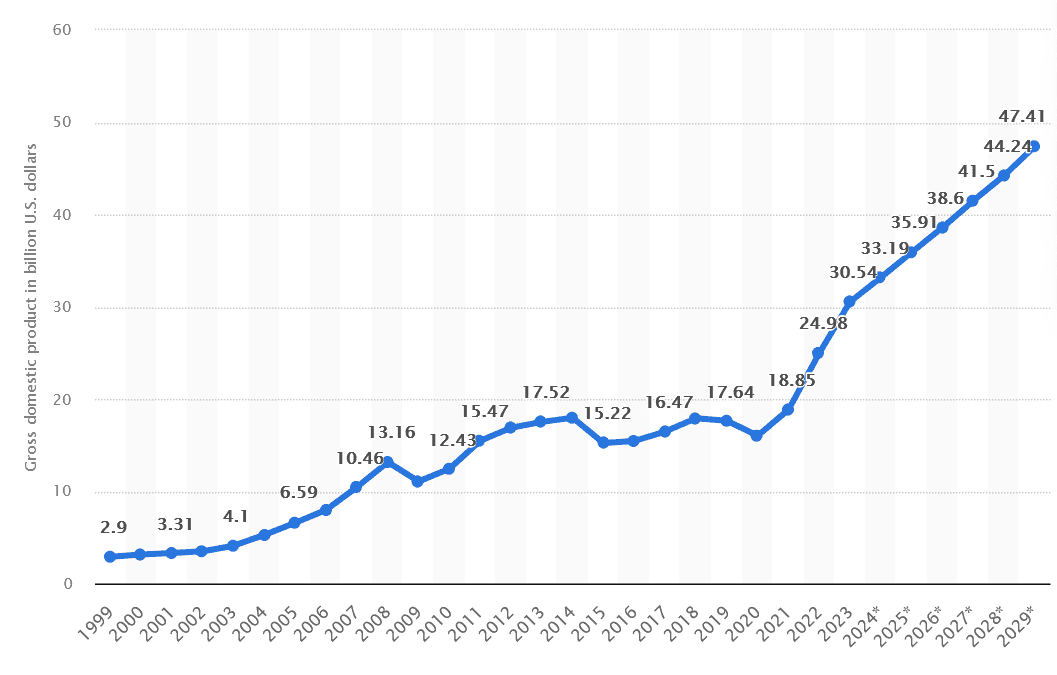

WIth low banking product penetration persisting, I’m anticipating the financial institution to proceed having fun with staggering earnings development because the economic system grows. Analysts at Statista expect supportive GDP development to proceed to 2029 at the very least, as proven beneath:

It’s not with out threat, as I point out. However the chance for additional substantial income and share worth development makes TBC a development share to contemplate.