Picture supply: Getty Photographs

Searching for methods to make a market-beating dividend revenue? Listed here are two high-yield FTSE 100 and FTSE 250 shares — together with a big-paying exchange-traded fund (ETF) — I really feel are value severe consideration proper now.

The ETF

The Invesco US Excessive Yield Fallen Angels ETF (LSE:FAHY) doesn’t, in contrast to most London-listed funds, put money into native or international equities. As an alternative, its portfolio’s loaded with below-investment-grade bonds.

Immediately, greater than 97% of the fund’s tied up in debt devices with rankings of BB or B. A few of the company bonds it holds are from medical specialist CVS Well being, clothes producer VF Corp and media large Paramount World.

Why’s this vital? A deal with riskier bonds clearly comes with a better degree of danger. However the increased yields these bonds subsequently supply additionally imply the fund’s dividend yields are considerably above the ETF common.

For 2025, this stands at a really wholesome 7%. And with 87 completely different holdings, the fund’s structured to cushion the affect of potential defaults on general investor returns.

The FTSE 100 share

Now, BAE Programs (LSE:BA.) doesn’t supply up the identical form of eye-popping dividend yields as this. For 2025, its yield is a healthy-if-unspectacular 2.8%.

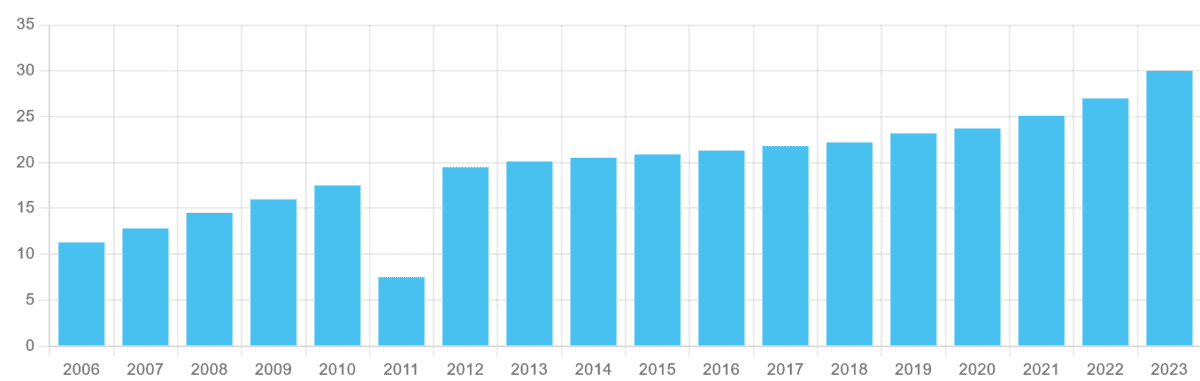

But I imagine the defence large stays a top-tier dividend inventory to think about. Because the chart exhibits, the dividend on BAE Programs shares has risen yearly for greater than a decade. This has allowed traders to offset the affect of rising inflation on their wealth.

BAE Programs’ progressive dividend coverage is because of its spectacular money flows and the reliable nature of defence spending. Even throughout financial downturns, the Footsie agency can count on new orders for its gear to maintain rolling in (its order e-book was a report £74.1bn as of final summer time).

Previous efficiency isn’t at all times a dependable information of future returns nonetheless. Within the case of BAE Programs, a variety of issues, from provide chain points and rising prices to disappointing venture execution, might affect future earnings and dividends.

However, on stability, I’m optimistic the blue-chip weapons builder will stay a powerful passive revenue share.

The FTSE 250 inventory

As an actual property funding belief (REIT), City Logistics (LSE:SHED) is about as much as present a gentle circulate of dividends.

Beneath sector guidelines, firms of this sort should pay a minimal of 90% of annual rental earnings out to shareholders. That’s in alternate for the beneficial tax surroundings they get pleasure from.

Please word that tax therapy will depend on the person circumstances of every shopper and could also be topic to alter in future. The content material on this article is offered for info functions solely. It isn’t meant to be, neither does it represent, any type of tax recommendation.

This doesn’t essentially assure a big and steady revenue over time. The belief’s weighty publicity to cyclical sectors (like parcel companies and retail) might depart earnings, and subsequently dividends, susceptible throughout financial downturns. Larger rates of interest additionally have an effect on earnings.

However on stability, I believe City Logistics is fairly rock strong for dividend revenue. Just like the aforementioned ETF, it’s properly diversified to restrict the danger of tenant defaults on general returns (its prime 10 tenants account for simply 32% of complete rents).

On prime of this, City Logistics has long-term contracts in place to restrict the specter of falling occupancy. As of September, its weighted common unexpired lease time period (WAULT) was 7.6 years.

For this monetary 12 months (ending March), the dividend yield on City Logistics shares is 7.5%. This nudges increased to 7.6% for subsequent 12 months.