Picture supply: Getty Photographs

When shopping for FTSE 100 shares, I all the time add them to my portfolio with the plan of holding them for at the very least a decade.

This has two huge benefits. It offers my portfolio time to recuperate from bouts of share worth volatility, and it saves me making common purchase and promote selections, permitting my investments to compound over time with out frequent interruptions.

However my plan isn’t set in stone. A share’s funding case can quickly deteriorate for all kinds of financial, business, or company-specific causes. So I could also be compelled to reluctantly promote.

Shopping for any inventory market instrument entails taking a danger. Nevertheless, there are many shares in my portfolio I really feel assured of holding onto for the long run.

With this in thoughts, listed here are two FTSE 100 shares I plan to carry for at the very least the subsequent 5 years.

Persimmon

Occasions have been powerful for UK housebuilders. Purchaser demand has slumped in response to increased mortgage prices. And the sector isn’t within the clear but given the specter of persistent inflation and its potential impact on rates of interest.

However the long-term outlook for Persimmon (LSE:PSN) stays tremendous vibrant in my view. My bullishness has improved additional following this week’s Finances too.

Housebuilder’s share costs have benefitted this 12 months from Labour’s pledge to construct 300,000 new properties every year. On Wednesday, Chancellor Rachel Reeves gave these plans stable foundations. She pledged £5bn for subsequent 12 months alone to construct reasonably priced residential properties.

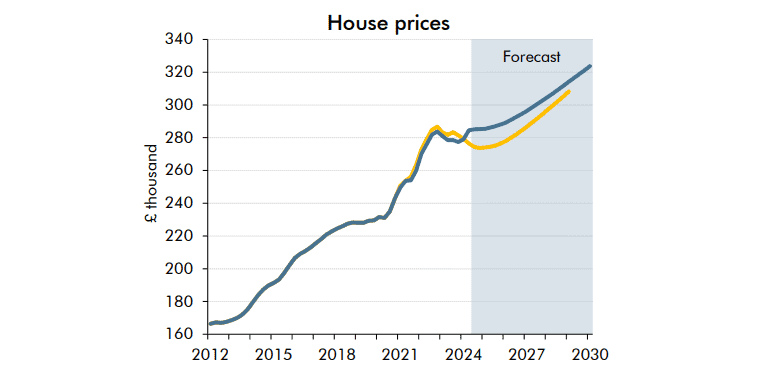

Additionally on Wednesday, the Workplace for Finances Accountability (OBR) hiked its home worth forecasts for the subsequent few years.

Value progress of 1.7% and 1.1% is tipped for 2024 and 2025 respectively, and a couple of.5% between 2026 and 2030.

This double-whammy of constructive information noticed housebuilding shares soar following the Finances. Persimmon’s share worth has risen 16% this 12 months, and I anticipate it to proceed rising strongly as constructing exercise ramps up and market situations stabilise.

Diageo

Embattled drinks big Diageo (LSE:DGE) could possibly be set to endure extra near-term bother. The alcoholic drinks market stays underneath stress from weak client spending, as Campari‘s horrible third-quarter buying and selling replace this week confirmed.

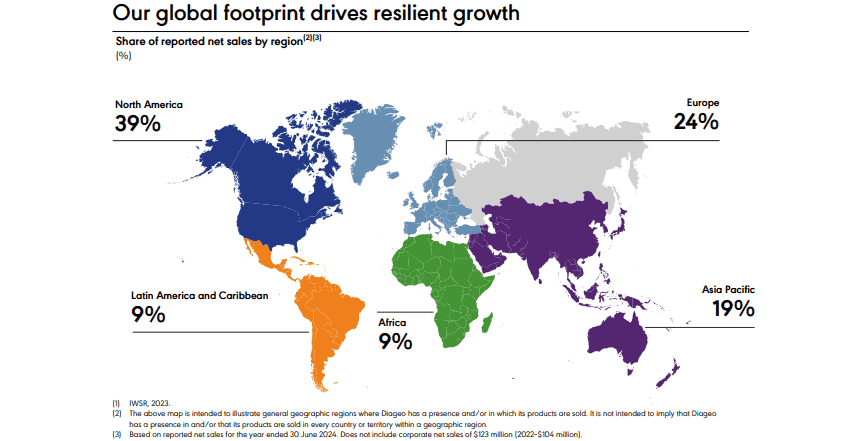

Diageo has had gross sales issues of its personal, and particularly in its Latin American and Caribbean markets. Its share worth has slumped 13% in 2024 in consequence.

However I’m backing the Smirnoff and Captain Morgan producer to bounce again, after which some. Its five-star manufacturers stay as in style as ever, so demand ought to recuperate when financial situations enhance.

Diageo is taking steps to higher exploit the upturn when it comes as nicely. Measures embody revamping its route-to-market channels within the US, restructuring its Nigerian operations, and boosting productiveness financial savings.

The corporate’s substantial rising market footprint additionally offers it scope to capitalise on fast-growing markets in Asia, Africa, and South America.

Diageo’s share worth has skilled volatility earlier than. And like on these events, I’m anticipating it to spring again strongly once more.