Picture supply: Getty Photos

Again in September, writers at The Motley Idiot have been speculating on whether or not Rolls-Royce (LSE: RR) shares might presumably break by way of the 500p mark. The remainder, as they are saying, is historical past. The Rolls-Royce share worth is at the moment at 809p, bringing the three-year return near 800%!

Subsequent cease £10? I wouldn’t rule it out after studying by way of the FTSE 100 firm’s full-year earnings name on 27 February.

Listed here are two attention-grabbing takeaways from the decision for Rolls-Royce buyers like myself.

Upgraded mid-term steering

In its 2023 annual report, Rolls-Royce set out formidable mid-term steering (outlined as 2027). This was for working revenue between £2.5bn and £2.8bn, working margins of 13%-15%, and free money movement between £2.8bn and £3.1bn.

In its 2024 report, the corporate considerably upgraded its medium-term steering (2028). It’s now focusing on underlying working revenue of £3.6bn to £3.9bn, a 15%-17% working margin, and £4.2bn to £4.5bn in free money movement.

The biggest enchancment will come from civil aerospace the place we goal an 18% to twenty% margin within the mid-term.

CEO Tufan Erginbilgiç

Within the earnings name, the chief government set out quite a few components that can drive greater working revenue in its key civil aerospace division.

First, Rolls-Royce has been optimising long-term service agreements (LTSAs) by renegotiating contracts. That is boosting aftermarket margins.

Subsequent, it goals to make Trent XWB widebody engine gross sales break even and even worthwhile by the mid-term. These engines energy the Airbus A350 household. It is a shift from traditionally promoting at a loss to safe LTSAs.

Crucially, Rolls-Royce is considerably extending time on wing — the interval engines function and generate income earlier than requiring upkeep — by way of design enhancements and data-driven optimisations. It’s spending £1bn by the top of 2027 to enhance time on wing. Finally, this can scale back store visits and enhance margins.

In the meantime, enterprise aviation is ready for double-digit progress, led by Pearl engines, and outpacing the broader market. Lastly, extra contract renegotiations will conclude by 2026.

Within the name, Erginbilgiç additionally mentioned: “We see the potential for this [civil aerospace] enterprise to ship a greater than 20% margin past the mid-term.”

Mini-nukes

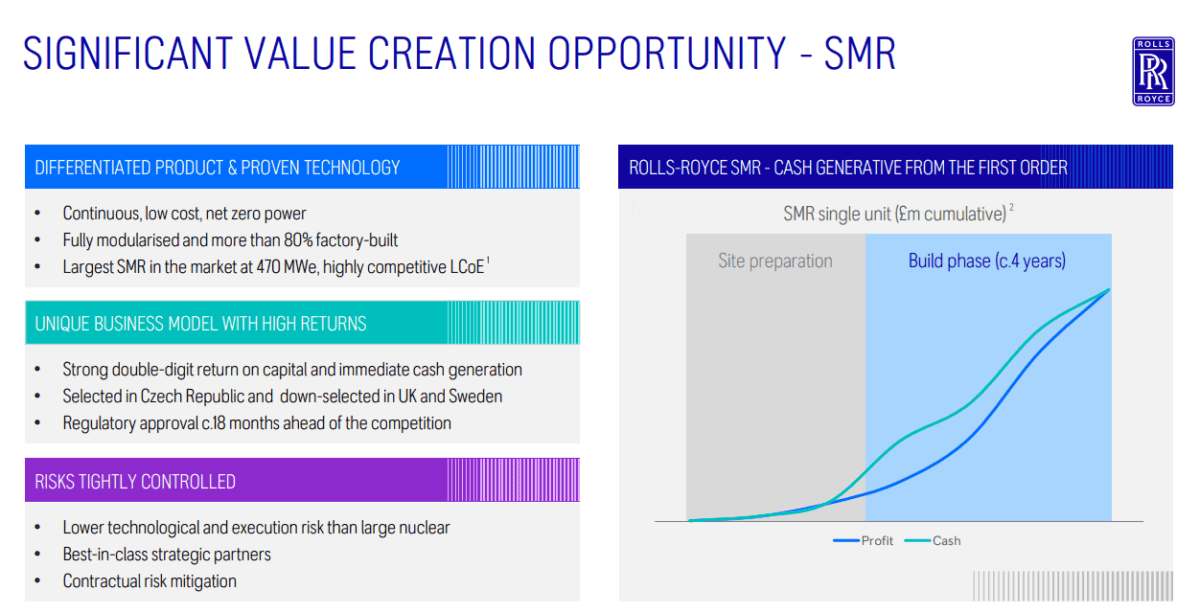

Subsequent, the corporate gave buyers extra particulars on small modular reactors (SMRs), or ‘mini-nukes’.

We’re uniquely positioned to win on this giant and rising [SMR] market and create vital worth.

CEO Tufan Erginbilgiç

Rolls-Royce has been chosen to ship as much as six SMRs within the Czech Republic and shortlisted for tasks within the UK and Sweden. Nevertheless, there’s a danger that it doesn’t make the lower, which might be a big setback. Lacking out within the UK might undermine its success in securing contracts with abroad governments.

Importantly although, superior funds from clients will make sure that SMR contracts are “instantly cash-flow generative”. In different phrases, margin safety is constructed into the preliminary contracts, permitting Rolls to realize constructive margins on the very first SMR.

Consequently, Erginbilgiç confirmed: “We count on to generate a powerful double-digit return on capital from SMRs.”

Every unit might price round £2bn. Primarily based on Worldwide Vitality Company forecasts for 2050, administration estimates a complete addressable market of round 400 of its 470-megawatt SMRs. This highlights the large long-term alternative.

Rolls-Royce inventory is costly at 30 instances subsequent 12 months’s forecast earnings. However I believe it could be value contemplating on any vital dip.