Picture supply: Getty Photos

Penny shares are inherently dangerous attributable to their small market caps and unstable costs. With out the strong basis of a long time of enterprise and dependable funding, a small drawback can derail a small firm.

As a extremely risk-averse investor, I are inclined to keep away from penny shares for that cause, however I additionally recognise the chance. In spite of everything, even at present’s mega-cap shares have been penny shares in some unspecified time in the future.

So for buyers trying to get in early and purpose for life-changing wealth, the attraction is obvious.

With that in thoughts, I’ve recognized two micro-cap shares that I feel may gain advantage from the latest uptick in gold curiosity following US inflation information.

Serabi Gold

Headquartered in Cobham, Serabi Gold (LSE:SRB) explores and excavates for gold and copper in northern Brazil.

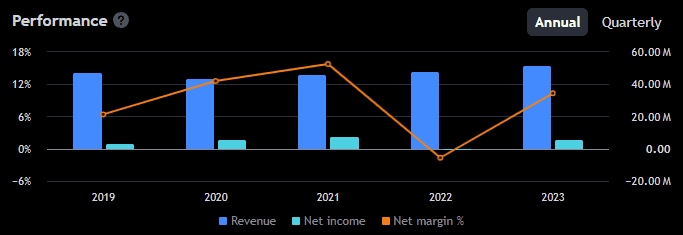

Much more than gold, Serabi has been on a tear this 12 months, up over 120%. In actual fact, a latest value surge took it simply exterior of penny inventory territory to 108p. However with an £80m market cap, it’s nonetheless very a lot a micro-cap inventory.

Much more spectacular than the worth surge is earnings, up 339% previously 12 months. Clearly, it struck gold! This additionally means it has a low price-to-earnings (P/E) ratio of round 5, properly under the business common of 9.9.

That implies there could possibly be extra room for progress.

With an expectation of sturdy future money flows, it’s now estimated to be undervalued by 87%. What’s extra, earnings are forecast to proceed rising at a charge of 37.8% per 12 months.

My core concern is that it’s coming near a five-year value excessive. That would result in vital promoting strain if buyers look to take revenue. Plus, it’s carefully tied to the gold value so any drop there’s more likely to harm the share value.

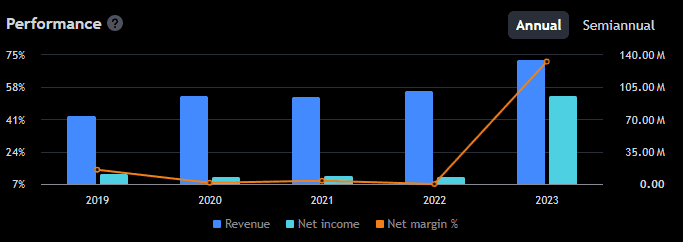

Metals Exploration (LSE: MTL) is one other micro-cap mining outfit that benefited from this 12 months’s gold value progress. It’s up 76% 12 months to this point and 344% over 5 years.

The enterprise is headquartered in London however operates within the Philippines. It excavates for gold and valuable metals from mines north of the capital, Manila. Regardless of a better £88m market cap, the shares, at solely 5p, are less expensive than Serabi.

And never attributable to poor efficiency — earnings elevated 213% previously 12 months with income shut behind. Money has additionally been rising steadily because the firm turned worthwhile in 2020.

Consequently, it’s estimated to be buying and selling at 90% under truthful worth utilizing a reduced money circulation mannequin. It additionally has a squeaky clear steadiness sheet, with no debt and $191m in fairness.

There’s a massive ‘however’ although, and in contrast to Sir Mixalot, I don’t like massive buts.

Earnings are forecast to say no by a mean of 60.3% per 12 months for the subsequent three years. That’s not fully stunning — contemplating the latest progress — however it received’t look good within the interim outcomes. It might spook shareholders and result in a fall in value. And the worth is already very unstable, rising 117% earlier this 12 months solely to crash 35% straight after.

So it’s not for faint-hearted buyers like me!

As talked about above, I don’t have the danger urge for food for unstable penny shares so I received’t be shopping for both inventory. However for courageous buyers trying to acquire publicity to gold, these two exhibit higher progress potential than related opponents I’ve researched and are price a glance.