Picture supply: Getty Photos

With markets at report highs — even within the normally sluggish FTSE 100 — it may be difficult to seek out high quality progress shares buying and selling at cheap valuations. Nevertheless, I feel these two match the invoice, and will subsequently be value enthusiastic about for a Shares and Shares ISA.

Uber

First up is Uber Applied sciences (NYSE: UBER). Hardly per week goes by with out me utilizing its app for taxis or meals delivered. I just lately booked prepare tickets on there for a visit to London and acquired 10% off a journey on the different finish.

On the finish of December, there have been 171m energetic month-to-month customers (14% greater than the yr earlier than). Gross bookings grew 18% in This fall (or 21% at fixed foreign money charges), serving to income leap 20% to $12bn.

Whereas progress is nothing out of the abnormal for Uber, what’s new is the corporate’s profitability. It has gone from incinerating billions a yr to producing practically $7bn in free money circulation final yr. Earnings are anticipated to go a lot larger in future.

Star hedge fund supervisor Invoice Ackman just lately took an enormous $2bn stake within the inventory. He has a wonderful monitor report of recognizing high-quality companies that show to be undervalued.

Ackman stated: “We consider that Uber is among the greatest managed and highest high quality companies on the earth. Remarkably, it might probably nonetheless be bought at an enormous low cost to its intrinsic worth.”

The inventory’s buying and selling at a ahead price-to-earnings (P/E) a number of of 30, which is cheap for a market chief rising the underside line very strongly.

What might go mistaken? Nicely, if self-driving taxis from Waymo and Tesla ever grow to be mainstream, Uber’s driver-based mannequin could possibly be disrupted. It is a real long-term danger, assuming these deep-pocketed corporations construct their very own networks.

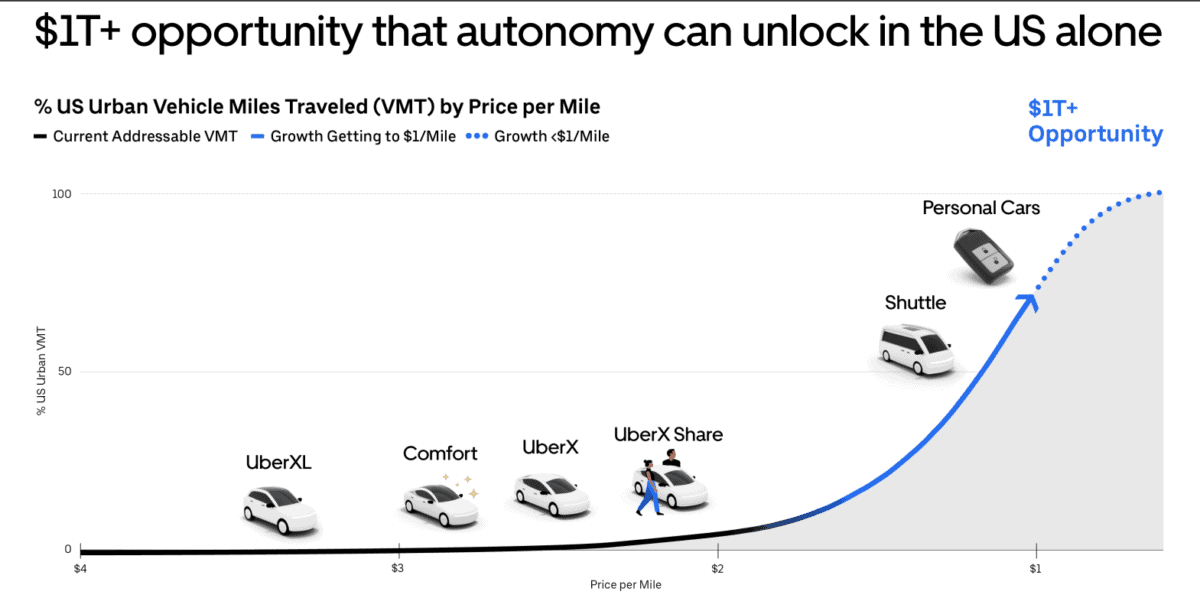

That stated, Uber has partnered with a number of main autonomous car (AV) corporations, spying a $1trn+ market alternative within the US alone. The pondering is that if AVs ultimately drive down the per-mile value as a result of there are not any drivers to pay, each bookings and Uber’s income might explode larger.

Ashtead Know-how

The second inventory is AIM-listed Ashtead Know-how (LSE: AT.). It is a firm that rents out specialist subsea rental gear to the worldwide offshore power trade. That features each renewables (wind generators) and oil and fuel.

Fuelled by an acquisition-driven progress technique, income soared 52% to £168m final yr, with underlying working revenue coming in larger than anticipated at £46.6m. The compound annual progress fee in earnings over the previous 5 years stands at 41%.

Within the buying and selling replace for 2024, CEO Allan Pirie stated: “With one of many largest and most technologically superior rental fleets within the trade and a continued concentrate on operational excellence, we stay assured within the Group’s capacity to generate substantial long-term worth for shareholders.”

Dangers right here embrace financial downturns or international power value shocks, which might sluggish exploration and decrease demand for rented gear. The agency’s additionally a small-cap valued at £426m, so doesn’t have the monetary firepower of a agency like Uber.

However, I like the chance/reward set-up right here. The share value is down 33% in six months, leaving the inventory on a low ahead P/E ratio of 11.6. At 531p, I feel the inventory could possibly be a hidden gem and is worthy of additional analysis.