Picture supply: Getty Pictures

Rates of interest are falling, and which means that these of us with cash in financial savings accounts will begin to obtain much less passive revenue. In reality, with rates of interest set to fall to round 3.5% in 2026, savers will possible solely obtain a modest premium to the focused price of inflation.

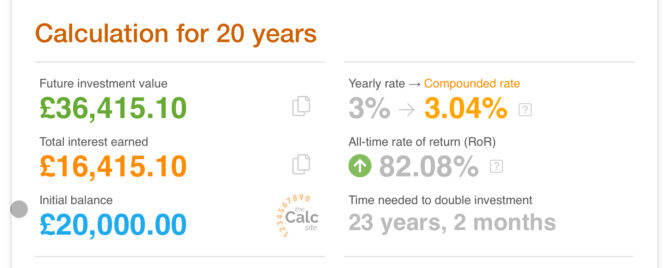

Simply check out this illustration. £20,000 in a financial savings account with a 3% yield generates a really restricted return. Assuming a long-term common inflation price of two%, the web achieve can be a mere 1% per 12 months.

Why shares

Buyers may select shares for passive revenue over conventional financial savings as a result of potential for increased returns and inflation safety. UK dividend shares, notably from established FTSE 100 corporations, typically present common payouts exceeding the low rates of interest provided by financial savings accounts.

Whereas financial savings charges can battle to maintain tempo with inflation, dividend shares can provide revenue progress and capital appreciation. As an example, sectors like utilities, healthcare, or client items typically ship constant dividends even throughout financial downturns.

Moreover, tax-efficient funding choices like ISAs permit UK traders to protect dividend revenue from tax. Regardless of market volatility, long-term dividend investing affords a steadiness of regular revenue and the potential for better monetary progress than typical financial savings accounts.

Please notice that tax remedy is determined by the person circumstances of every consumer and could also be topic to alter in future. The content material on this article is offered for data functions solely. It’s not meant to be, neither does it represent, any type of tax recommendation. Readers are accountable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding selections.

Selecting dividend aristocrats

Buyers on the lookout for a gentle passive revenue that grows over time will possible wish to concentrate on shopping for Dividend Aristocrats. These are corporations which have regularly paid and grown their dividend funds over time. After all, previous efficiency shouldn’t be reflective of future efficiency, however a powerful monitor document is all the time appreciated.

Buyers could wish to think about Authorized & Basic (LSE:LGEN). The inventory stands out as a compelling Dividend Aristocrat possibility for traders in search of regular passive revenue progress, with its outstanding monitor document of dividend consistency, having maintained or elevated its payout yearly since 2010. This dedication to shareholder returns has earned Authorized & Basic a spot within the prestigious S&P UK Excessive Yield Dividend Aristocrats Index.

Why passive revenue traders decide Authorized & Basic

There are a number of explanation why passive revenue traders decide Authorized & Basic. One is the underlying power of the enterprise, with a powerful solvency ratio of 223%. What’s extra, Authorized & Basic continues to supply modest earnings progress. CEO António Simões expects mid-single-digit progress 12 months on 12 months, indicating a secure outlook.

Wanting forward, the agency’s monetary targets are encouraging. The corporate goals for a 6%-9% compound annual progress price in core working earnings per share from 2024 to 2027, with an working return on fairness of over 20%. Moreover, it anticipates producing £5bn-£6bn in cumulative Solvency II operational surplus throughout 2025, 2026, and 2027.

Nevertheless, traders are clearly most attracted by the headline dividend yield, which may attain a formidable 9.36% within the coming 12 months. The corporate’s board has introduced plans to develop the dividend per share by 5% for the complete 12 months 2024, adopted by 2% annual progress thereafter.

Sadly, investing doesn’t come with out its dangers. Whereas insurers are recognized for robust free money flows, Authorized & Basic’s dividend payout seems to exceed free money flows, probably presenting a risk to the sustainability of the dividend in the long term.

Nonetheless, that doesn’t imply the enterprise can’t afford the dividends, and the earnings forecast suggests the funds will develop into extra manageable over the medium time period.