Picture supply: Getty Pictures

On the lookout for methods to make an enormous passive earnings for retirement? Listed here are three ideas that would make a spectacular distinction to long-term returns.

Minimize prices

The primary job is to select a monetary product that reduces buying and selling prices and bills as a lot as potential. One of the crucial efficient methods is to decide on a tax-efficient Shares and Shares ISA, or Self-Invested Private Pension (SIPP).

Tax is among the largest bills we face in life. Pleasingly, these merchandise exclude buyers from paying any tax on both capital positive aspects or dividends, which might add as much as an enormous quantity over time.

Buyers also needs to select a dealer that gives low transaction prices and administration charges. Choosing a low-cost product can present one other useful increase to long run returns. And competitors’s fierce amongst suppliers, so store round!

Please be aware that tax therapy depends upon the person circumstances of every shopper and could also be topic to vary in future. The content material on this article is offered for info functions solely. It’s not supposed to be, neither does it represent, any type of tax recommendation. Readers are chargeable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding choices.

Prioritise blue-chip shares

Buyers love the concept of discovering the subsequent Apple, Amazon, or different inventory market minnows that would turn into a worldwide phenomenon. Shopping for small development shares has definitely been a recipe for fulfillment for a lot of inventory pickers.

Nonetheless, a portfolio packed of small-cap corporations like penny shares can also be extraordinarily excessive danger. Not solely can their share costs be extraordinarily risky, over the long run, a large number of smaller equities present disappointing returns as a consequence of powerful competitors, trade pressures, and/or financial stress.

For this reason specializing in secure, blue-chip corporations is often probably the most profitable (and stress free) route for buyers. Companies on the FTSE 100 and FTSE 250 are sometimes market-leading corporations with numerous income streams, aggressive benefits (or financial moats), and sturdy stability sheets.

Largely talking, these types of corporations don’t ship spectacular share worth development. However they do present a stable and dependable return over the long run.

Diversify

The subsequent vital factor to do is to unfold capital throughout a variety of corporations. This helps defend buyers from sector, financial, and even stock-specific shocks that may injury eventual returns.

Share pickers can construct their very own diversified portfolio by shopping for particular person shares. They will additionally open a place in an exchange-traded fund (ETF) which holds quite a lot of completely different belongings. I personal each particular person shares and ETFs in my portfolio.

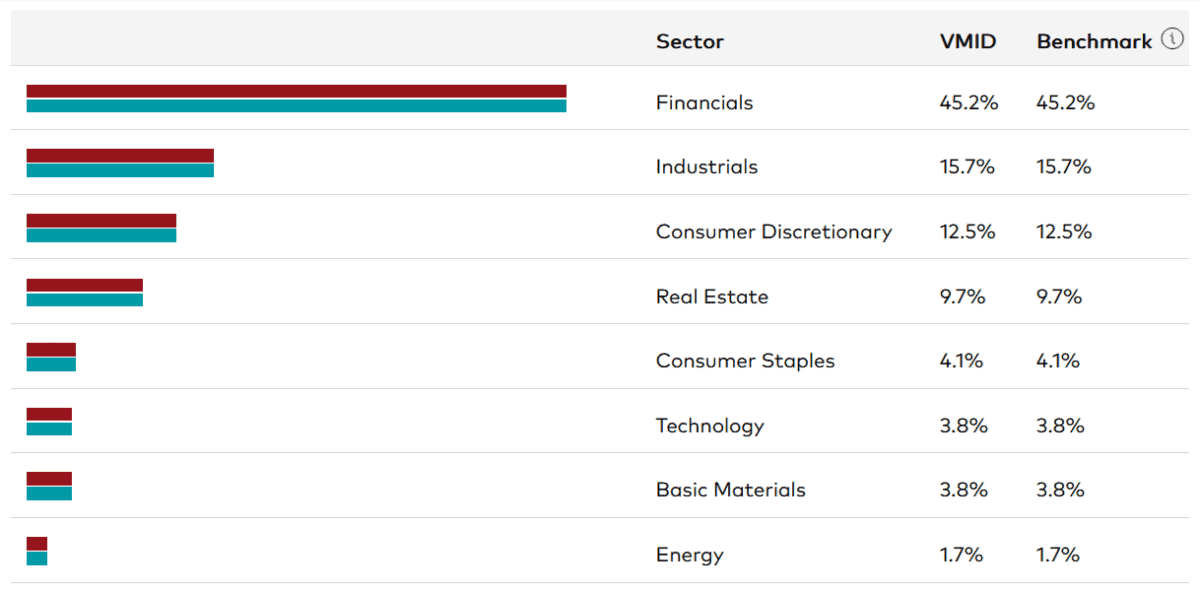

The Vanguard FTSE 250 UCITS ETF (LSE:VMID) is one such fund that would assist me successfully diversify my holdings and construct long-term wealth if I had some spare money.

Because the title suggests, it makes use of the FTSE 250 as a benchmark and has holdings in every blue-chip firm on the index. So it offers me publicity to a mess of various sectors, a taster of which might be seen beneath.

And whereas the fund has a excessive gearing in direction of the UK, lots of the corporations it holds additionally function overseas, giving me respectable geographic diversification.

The draw back nonetheless, is that financial or political turbulence in Britain can spell hassle for FTSE 250 funds like this. However over the long run, investing in such shares is usually a profitable technique.

The FTSE 250 has delivered a median annual return of 11% since its inception in 1992. If this continues, a £20,000 funding beginning in the present day would give me £923,521 after 35 years. This might then flip right into a £36,941 passive earnings if I drew 4% down every year.