Picture supply: Getty Photographs

Once I retire, which I anticipate might be at the least a few a long time from now, I hope to prime up my pension earnings with passive earnings from my Shares & Shares ISA. Collectively, these earnings might make my retirement extra financially comfy and satisfying.

For the final decade, I’ve been investing in UK and US shares as a part of my technique to construct a portfolio massive sufficient to assist me by way of my retirement. Evidently, the cash invested over that interval has added up over time.

Nonetheless, thousands and thousands of Britons are sitting on financial savings that gained’t ship life-changing returns over the long term because of destructive actual charges. So with £25,000 in financial savings, I might look to place that cash to work by investing in shares and funds.

Whereas investing could sound inherently extra dangerous to many individuals, a well-diversified portfolio can really assist handle danger over the long run. Right here’s the way it’s completed.

Mitigating danger

Funds, ETFs (exchange-traded funds), and trackers provide cost-effective methods to unfold investments throughout a number of firms, sectors, and geographical areas.

This permits us as traders to mitigate the influence of poor efficiency from any single funding. These devices additionally enable traders to realize broad market publicity, probably balancing between US, UK, and world markets.

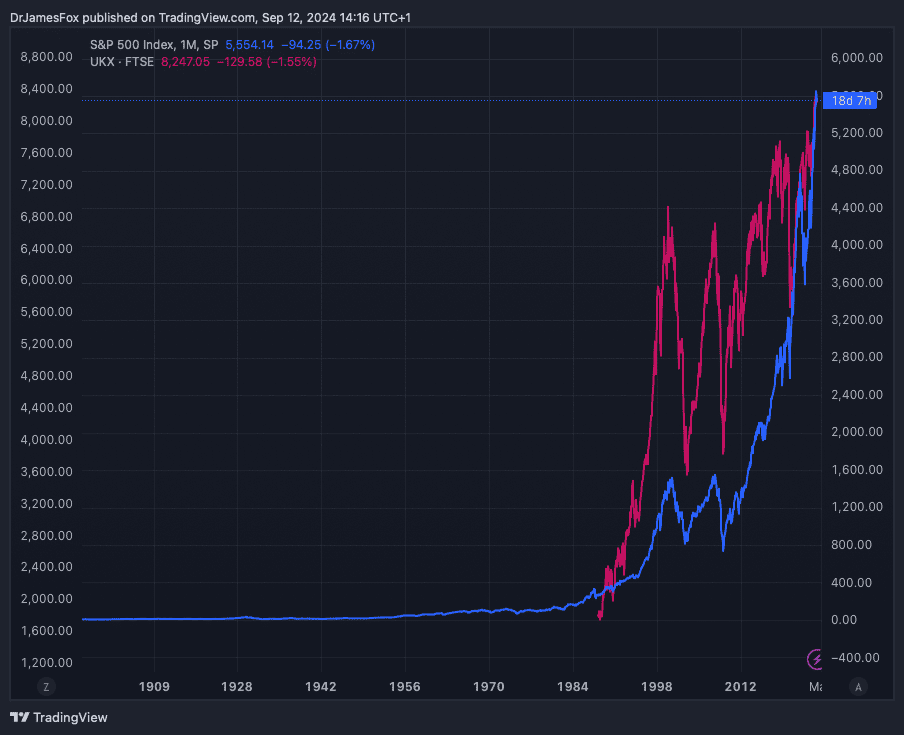

Traditionally, inventory markets have proven robust long-term progress potential. From 1900 to 2023, US shares returned 6.4% yearly in actual phrases, whereas UK shares delivered 5.3%.

Taking a look at barely more moderen statistics, the S&P 500, a benchmark for the US inventory market, has delivered a mean annual return of about 10.7% since its introduction in 1957.

This outpaces inflation and lots of different types of funding. We are able to acquire entry to those returns by merely investing in trackers funds or buying shares in sector particular funds.

Taking this 10.7% fee of return and assuming I can replicate that over the approaching a long time, it could take 20 years for me to show my £25,000 right into a portfolio that would ship £12,000 a 12 months.

A good choice

There are lots of methods to speculate, and this depends upon circumstances and on our targets. Personally, given my occupation and the truth that I put cash into my ISA month-to-month, I want to choose one or two new shares each month — typically re-picks.

Nonetheless, if I have been beginning investing with a lump sum at present, I’d contemplate spreading my cash throughout funds and ETFs, just like the Vanguard S&P 500 UCITS ETF GBP (LSE:VUSA).

It’s among the many hottest ETFs for good purpose. It merely tracks the efficiency of the S&P 500 index, providing European traders quick access to the US inventory market. It gives publicity to 500 of the most important US firms, representing about 80% of the US fairness market capitalisation.

It additionally stands out for its low price, with an expense ratio of simply 0.07%, considerably decrease than many actively managed funds. It’s extremely liquid, making it straightforward for traders to purchase and promote shares with out incurring massive spreads or transaction prices.

In fact, even probably the most numerous of funds can go down in addition to up. Recessions, commerce wars, and precise wars might additionally negatively influence the efficiency of US shares, and this ETF. Nonetheless, quick, medium, and long-term efficiency has been very robust.