Bitcoin hasn’t fared properly over the previous month and continued to drop after falling beneath $100,000. Crypto mining shares additionally felt the ache since their earnings are closely tied to Bitcoin, however a few of those self same shares can nonetheless rally because of their involvement in synthetic intelligence and different initiatives.

These three crypto mining shares can nonetheless rally regardless of Bitcoin’s correction. Bitcoin’s future rebound can also be a very good catalyst for these picks.

Nebius (NBIS)

Nebius is considered one of a number of crypto miners which have pivoted into AI information facilities. The corporate addresses the power and computing bottlenecks that face tech giants, however the firm is closely invested in two manufacturers that may harness AI to achieve extra prospects.

Nebius Inventory Value Yr to Date. Supply: Google Finance

Autonomous automobile developer Avride and edtech firm TripleTen are two long-term investments that add extra worth to NBIS inventory.

Nonetheless, Nebius isn’t sitting and ready round for its giant stakes in these corporations to achieve worth.

Nebius has just lately secured a 5-year take care of Meta Platforms, valued at roughly $3 billion. That partnership got here on the heels of a multi-billion-dollar take care of Microsoft.

These partnerships aren’t totally mirrored in present income numbers, however that didn’t cease Nebius from delivering 355% year-over-year income progress in Q3.

🔟 Shares to HODL for the subsequent 🔟 years!

1/ Nebius$NBIS is constructing next-generation cloud and AI platforms.

One of the bold rising gamers within the AI infrastructure house

There’s a SURGE in tasks requiring AI mannequin coaching, autonomous methods, biotech, information… pic.twitter.com/dGL2BLamI2

— Ray Myers (@TheRayMyers) September 19, 2025

The phrases “Bitcoin” and “crypto” didn’t seem as soon as in Nebius’ Q3 press launch or letter to shareholders. The AI agency appears to have made a whole pivot away from Bitcoin because it shifts its focus towards AI infrastructure.

Goldman Sachs just lately reiterated its Purchase ranking for the inventory whereas elevating its worth goal from $137 to $155 per share. “AI demand-supply imbalance underpins continued power in its core operations,” the agency mentioned in its analysis.

For anybody doubting it, here is the three-page Goldman Sachs report on $NBIS.

The improve was pushed by greater gross sales estimates and an unchanged 7x CY27E EV/Gross sales a number of.

Lowered 2026 Income estimates from $6.6B to $3.8B.

Raised 2027 Income estimates from $5.8B to $7.7B. https://t.co/9ZizWHW6hO pic.twitter.com/aaB0MDQBTo

— M. V. Cunha (@mvcinvesting) November 14, 2025

IREN (IREN)

Whereas Nebius is diversified into different investments and likewise provides a software program stack for its prospects, IREN is solely centered on offering AI cloud providers.

It solves the AI power bottleneck like Nebius, however its 3.2 gigawatt pipeline and skill to provide AI information facilities at scale give it a bonus.

IREN additionally secured a significant take care of Microsoft price $9.7 billion over 5 years. The deal offers Microsoft entry to 200 megawatts. As soon as IREN faucets into its full pipeline, it could actually help 16 offers just like the Microsoft contract.

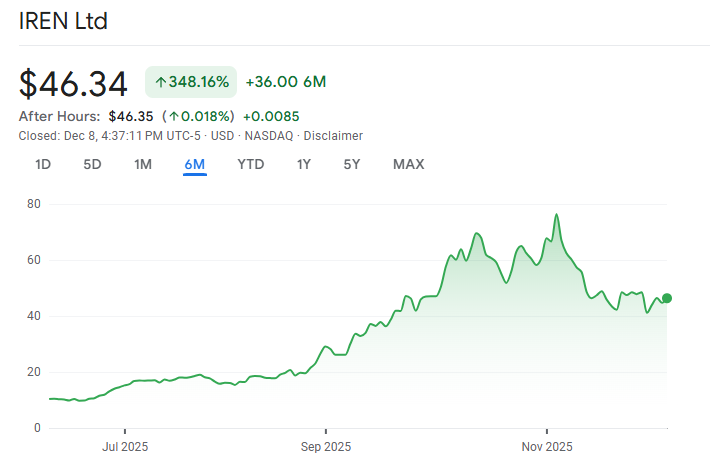

IREN Inventory Value Over the Previous 6 Months. Supply: Google Finance

IREN nonetheless mines Bitcoin, and it represented 97% of Q1 FY26 income. AI cloud providers income didn’t transfer by a lot year-over-year, however the Microsoft deal can gasoline substantial progress in that section.

Proper now, IREN nonetheless closely will depend on Bitcoin however is making the pivot into AI information facilities.

Roth MKM analyst Darren Aftahi reiterated a Purchase ranking for the inventory in November and set a worth goal of $94. That worth goal suggests IREN will greater than double from present ranges.

Terawulf (WULF)

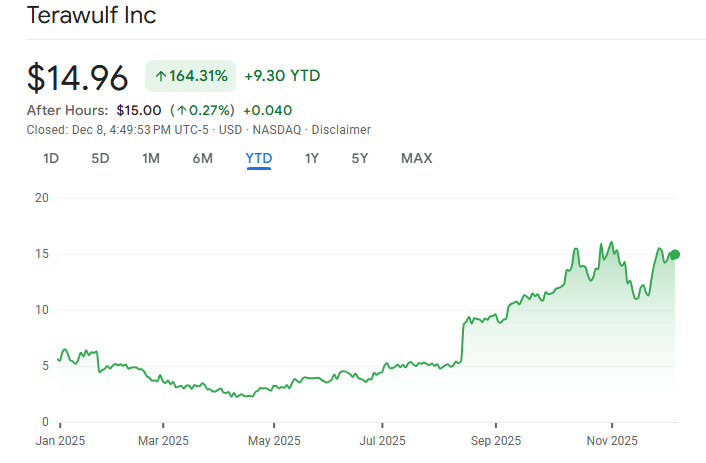

Terawulf is nearer to IREN than it’s to Nebius. It’s one other crypto miner that will depend on crypto however has signed large tech offers that set the stage for an AI pivot. The crypto miner intends to extend its contracted capability by 250-500 megawatts per 12 months.

For context, Terawulf allotted 168 megawatts to Fluidstack for $9.5 billion over a 25-year lease settlement.

Fluidstack is backed by Google, which may open the door to further offers. The lease involves $380 million per 12 months, or $2.26 million per 12 months for every megawatt.

Terawulf Share Value. Supply: Google Finance

Utilizing that conversion fee, Terawulf’s plan to extend capability by 250-500 megawatts per 12 months can translate into an extra $565 million to $1.13 billion in annual recurring income. Bitcoin costs drove Q3 outcomes, however long-term AI information middle ambitions have captivated traders.

“Based mostly on our bullishness for TeraWulf to safe websites and execute on HPC buildouts, we preserve our Purchase ranking and $17 worth goal,” Compass Level mentioned in a analysis observe.

The put up 3 Crypto Mining Shares That Can Rally Even As Bitcoin Value Falls appeared first on BeInCrypto.