Picture supply: Getty Photographs

I don’t have to speculate any cash I park in my Shares and Shares ISA straight away. However why wait? There are stacks of good worth shares ready to be snapped up for the time being.

So, reasonably than sit on the money earlier than the 5 April deadline, I’d reasonably put it to work straight away. This manner, I can get my cash working for me instantly. And as I say, there are some prime shares wanting massively undervalued at this second.

Listed below are three I’m serious about shopping for earlier than the ISA deadline.

Atlantic Lithium

Atlantic Lithium‘s (LSE:ALL) share worth has tumbled as costs of the silvery-white metallic have fallen. It might stay on a downward slant a bit of longer too if China’s financial system continues to splutter.

I feel this could possibly be an incredible dip shopping for alternative for long-term traders, nonetheless. The AIM firm is growing the Ewoyaa venture in West Africa, an asset that might ship spectacular income development.

Recent drilling information on Tuesday (19 March) has reminded the market of its good potential. Atlantic has mentioned high-grade assay ends in 2023 revealed “spectacular intersections” that it notes ought to assist it ship one other mineral useful resource estimate (MRE) improve within the second half of this yr.

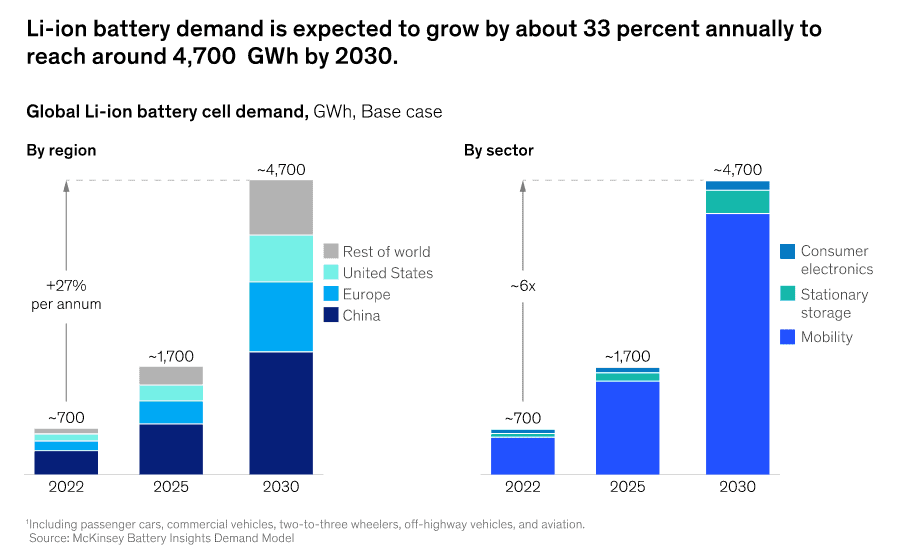

Atlantic Lithium might discover itself in a robust place to use the electrical car growth as soon as Ewoyaa comes on-line. Adoption of cleaner vehicles is tipped to supercharge long-term lithium consumption, because the graphic beneath exhibits.

Central Asia Metals (LSE:CAML) is one other prime mining inventory on my radar as we speak. That is because of its distinctive all-round worth.

At the moment, the Kazakh miner trades on a ahead price-to-earnings (P/E) ratio of 8.7 instances. It additionally carries a big 9.2% dividend yield for 2024.

Central Asia Metals’ flagship asset is the Kounrad copper mine in Kazakhstan. It additionally owns the Sasa lead-zinc mine in North America. As with lithium, demand for these base metals is tipped to rocket because the inexperienced revolution picks up momentum.

Mining for metals is an unpredictable and dear enterprise. Nonetheless, at present costs I feel this AIM share is value critical consideration.

Warehouse REIT

I’m additionally contemplating including Warehouse REIT (LSE:WHR) shares to my portfolio earlier than the ISA deadline. The true property funding belief (REIT) has fallen in worth once more as hopes of imminent rate of interest cuts have receded.

This stays a menace going forwards. However I’m attracted by the increase current share worth falls have given to the FTSE 250 agency’s dividend yields. For this monetary yr its yield now stands at 8.2%.

I’m assured income at Warehouse REIT will rise strongly within the years forward. Rising e-commerce exercise and provide chain evolution will drive robust demand for warehouse and distribution hubs even greater. The rents that REITs like this cost ought to, due to this fact, stay on a wholesome uptrend, helped by a persistent scarcity of latest developments throughout the trade.

Warehouse REIT’s like-for-like rental development accelerated to three.7% within the December quarter.