Picture supply: Getty Photos

The FTSE 100‘s house to all kinds of remarkable shares. By constructing a balanced portfolio of various shares, buyers can steadiness threat and revel in robust and secure returns over time.

Worth shares present buyers with the potential for important long-term capital appreciation, in addition to a margin for error. Progress shares can even outperform the market by rising income at breakneck pace. And dividend shares can ship common revenue and stability, even throughout market downturns.

Listed here are three Footsie shares from every class to think about as we speak. I feel every has the potential to ship important long-term returns.

Worth

Vodafone Group (LSE:VOD) affords glorious worth throughout a wide range of metrics. It trades on a ahead price-to-earnings (P/E) ratio of 10.1 instances, which is without doubt one of the lowest throughout the telecoms sector.

The corporate additionally carries a market-beating 7.2% dividend yield for this 12 months, even after its vow to chop dividends.

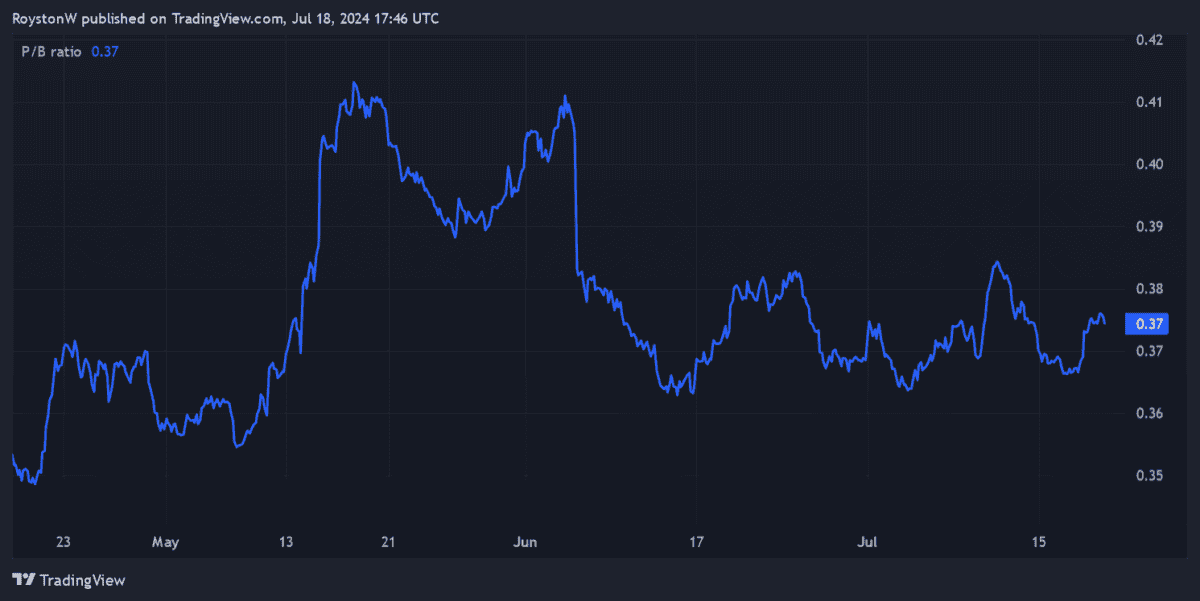

And eventually, Vodafone shares commerce on a price-to-book (P/B) worth of round 0.4. Any studying under 1 signifies a share’s low-cost relative to the worth of its belongings.

Vodafone’s been underneath stress extra lately as a result of adjustments to German telecoms legal guidelines. However extra encouraging buying and selling in its single largest market suggests now could possibly be the time to purchase.

It’s additionally present process an enormous transformation to chop its headcount and increase funding in areas like Vodafone Enterprise. This carries execution threat, nevertheless it may additionally result in important earnings progress over the long run.

Progress

Firms that function in Nigeria have been hit by a sequence of foreign money revaluations lately. This has been the case with Airtel Africa (LSE:AAF), a telecoms operator that provides cell cash and knowledge providers throughout 14 international locations.

Additional falls within the Nigerian naira are potential. But Metropolis analysts nonetheless consider Airtel’s earnings will rebound sharply from this 12 months onwards.

It’s tipped to swing from a $63m pre-tax loss within the final monetary 12 months to earnings of $805m this 12 months. In fiscal 2026, the underside line’s tipped to extend an additional 71% too, to £1.4bn.

With wealth ranges and inhabitants sizes hovering throughout its markets, I feel Airtel may ship gorgeous income progress in the long term. Telecoms trade physique GSMA, as an example, believes 4G adoption in Sub-Saharan markets will double within the subsequent 5 years.

Dividend

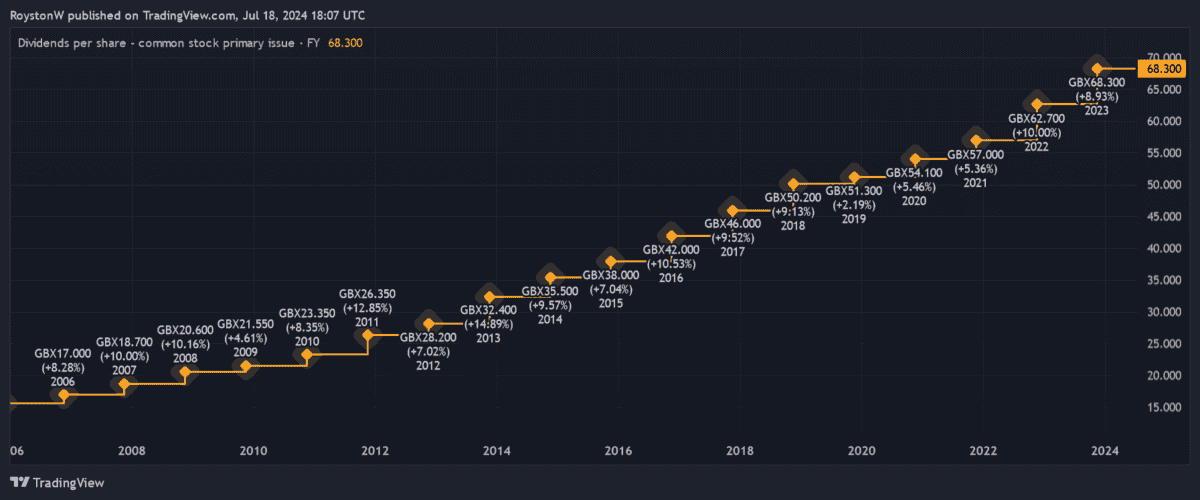

Bunzl (LSE:BNZL) doesn’t carry the biggest dividend yields on the market. For the following three years they vary 2.2-2.5%.

Nonetheless, the assist providers supplier’s gorgeous dividend progress report nonetheless makes it a passive revenue hero, in my view. Annual rewards have risen for 31 years on the bounce, illustrating the agency’s distinctive money era and skill to climate financial downturns.

These will increase have been fairly beneficiant too, at round 9% each year by the interval.

Bunzl’s extremely profitable, acquisition-based progress technique has offered the bedrock to develop dividends 12 months after 12 months. An M&A-led technique like this may be dangerous, however the agency’s glorious report helps soothe any fears I could have.