Picture supply: Getty Pictures

The FTSE 250 hosts a broad spectrum of fantastic shares. Establishing a balanced portfolio of assorted shares permits traders to handle danger and safe regular, sturdy returns in the long term.

Development shares have the potential to extend gross sales and income far quicker than the broader inventory market, and sometimes function in revolutionary sectors and/or rising markets. Dividend shares are normally financially strong corporations that present an earnings throughout the financial cycle.

Lastly, worth shares provide the potential of substantial capital appreciation because the market wises as much as their true wealth. Or at the very least that’s the speculation.

Fortunately, the FTSE 250 is jam-packed with corporations that straddle a number of of those classes. Listed below are three I believe traders ought to critically take into account proper now.

Development

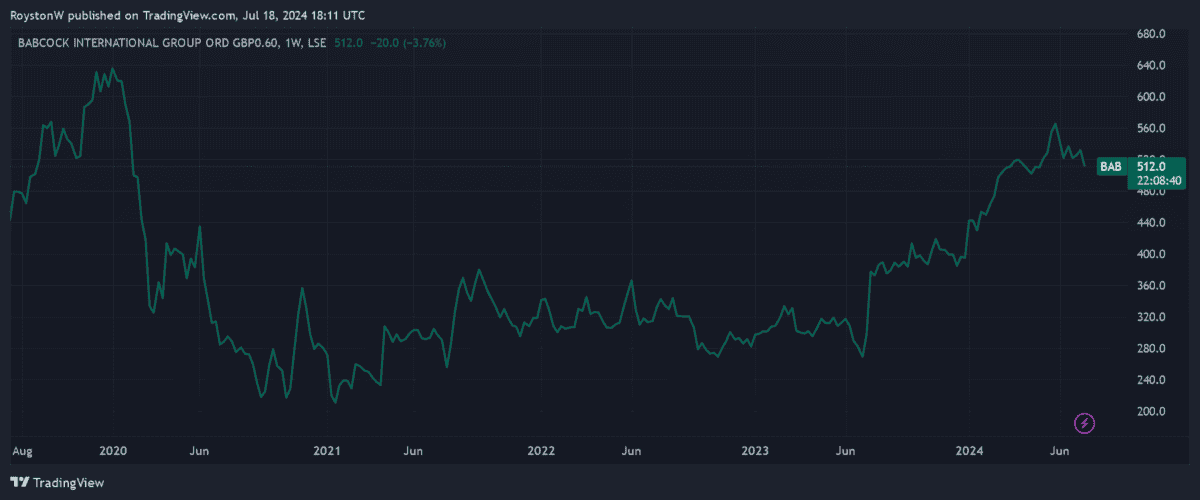

Rising geopolitical tensions imply weapons spending is rising sharply. Babcock Worldwide (LSE:BAB) — which gives engineering and coaching providers to international locations together with the UK, France and Australia — is one enterprise whose gross sales (and share worth) have rocketed of late.

Newest financials confirmed revenues up 11% within the yr to March, at £4.4bn. The agency’s contract backlog in the meantime leapt 9% yr on yr to £10.9bn.

Robust order ranges imply Babcock’s earnings are tipped to rise strongly via the brief time period at the very least. Backside-line rises of 12% and 13% are forecast for monetary 2025 and 2026 respectively.

With Western nations steadily dedicated to defence funds boosts, I believe Babcock could possibly be a high income grower for years to come back too. However I realise that the much less risky world all of us lengthy for may imply its prospects diminish.

Dividend

At 6.3%, property firm Tritax EuroBox (LSE:EBOX) has one of many largest ahead dividend yields on the FTSE 250.

It’s capable of reliably pay massive dividends over time, due to its glorious defensive qualities. It rents out its property to blue-chip corporations akin to Amazon, Puma and Lidl, that means it may count on rents to be paid no matter financial circumstances.

Tritax additionally has its tenants tied down on ultra-long contracts. The weighted common unexpired lease time period (WAULT) on its buildings stood at 9.6 years on the finish of 2023.

A failure to establish new websites may hurt the corporate’s long-term funding case. However on stability, I believe it could possibly be a good way to play Europe’s booming logistics market.

Worth

Actual property funding trusts (REITs) like Assura (LSE:AGR) may stay beneath strain if rates of interest don’t considerably fall. But it’s my opinion that this menace is baked into the ultra-low share costs of many such companies.

This explicit REIT — which builds, owns and operates greater than 600 main healthcare properties within the UK — trades on a price-to-book (P/B) ratio of roughly 0.9.

Any worth beneath 1 suggests {that a} share is buying and selling beneath the price of its property.

Please be aware that tax therapy depends upon the person circumstances of every shopper and could also be topic to vary in future. The content material on this article is supplied for data functions solely. It isn’t supposed to be, neither does it represent, any type of tax recommendation.

On high of this, Assura carries a mighty 8.1% ahead dividend yield. That is greater than double the FTSE 250 common of three.5%.

I believe the enterprise may show a high long-term purchase as Britain’s ageing inhabitants drives demand for healthcare properties.