Picture supply: Getty Photos

Anybody who began investing in 2025 would have had a baptism of fireside. That’s as a result of at the start of April the worldwide inventory market fully tanked. A handful of my shares crashed 30% inside every week!

Fortunately, most shares have since recovered strongly. Each the FTSE 100 and S&P 500 at the moment are solely round 3% off new report highs.

Listed below are three explanation why in the present day’s nonetheless a good time to contemplate beginning an investing journey.

Market volatility creates alternatives

Proper now, the market’s selecting to miss the doubtless injury executed from the sweeping tariffs carried out at the start of April. But when the worldwide economic system’s heading for a big slowdown, sentiment might rapidly bitter.

Furthermore, there are not any ensures the US and China will iron out all their variations. I anticipate extra twists and turns with President Trump within the White Home. Consequently, I feel there’ll in all probability be much more volatility forward this yr.

Whereas which may sound scary for beginner traders, it’s truly the perfect factor that may occur for long-term wealth-building. I did a bit of buying my Shares and Shares ISA at the beginning of April. And people purchases have executed very nicely because the market’s bounced again.

There’s doubtless extra volatility to come back, however it will create alternatives.

Charges are coming down

The second cause now’s a good time to start out investing is as a result of rates of interest are on a downwards trajectory. Earlier in Could, the Financial institution of England reduce borrowing prices by 1 / 4 of a share level to 4.25%.

As issues stand, traders anticipate the speed coming right down to round 3.5% by the top of the yr. That’s assuming inflation doesn’t throw a spanner within the works.

In fact, when rates of interest fall, financial savings accounts return much less. In concept, this could encourage traders to maneuver cash into shares searching for higher returns, pushing up costs.

All issues equal, greater inventory costs imply decrease dividend yields. Due to this fact, now is likely to be a good time to bag some excessive yields earlier than they transfer decrease.

The compounding snowball

Lastly, the earlier somebody begins investing, the extra time there may be to get compounding going. That is the wealth-building miracle the place curiosity begins incomes curiosity.

One FTSE 250 dividend inventory that appears enticing to me proper now could be 4imprint (LSE: FOUR). The corporate specialises in promotional merchandise, promoting and distributing issues like pens, garments, cups and baggage which are customised with purchasers’ logos or messages.

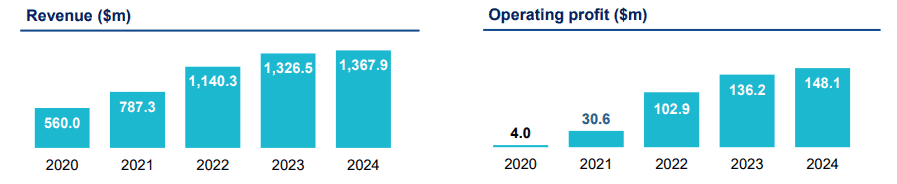

That may sound very low-margin, however the agency truly enjoys strong margins (10.8%). And progress has traditionally been spectacular, rising from $787m in 2021 to just about $1.4bn final yr. Round 98% of income comes from North America.

Nevertheless, the inventory’s down 42% because the begin of February. That is partly on account of uncertainty round US tariffs, which might push up prices for purchasers and even trigger a US recession, thereby dampening progress.

However I feel these dangers are already priced into the inventory, which is buying and selling at simply 11 instances earnings. Including to its enchantment is a 5.3% dividend yield. At its present stage, I feel 4imprint’s price contemplating.