Picture supply: Getty Pictures

There are many ways in which buyers can goal a second earnings in retirement.

Some strategies could also be extra profitable than others. There’s additionally no blueprint for buyers to comply with, because the methods somebody adopts will rely on their particular person circumstances, monetary objectives and threat tolerance.

That mentioned, sure ‘golden guidelines’ exist in terms of saving or investing. No matter private state of affairs, they are often highly effective weapons in creating long-term wealth.

1. Bypass the taxman

The very first thing to contemplate is utilizing a Self-Invested Private Pension (SIPP) or Particular person Financial savings Account (ISA) to take a position. Throughout the ISA class, a Shares and Shares ISA and/or Lifetime ISA can be utilized to purchase shares, trusts and funds listed within the UK and abroad.

With each an ISA and a SIPP, an investor doesn’t pay a single penny in tax on any capital positive factors and dividends. And given the big annual allowances on these merchandise — £20k on a Shares and Shares ISA, and a sum equal to at least one’s yearly earnings (as much as £60k) — the financial savings may be appreciable.

As dividends and share costs (hopefully) develop, the quantity saved on taxes may develop significantly too. Over two-to-three a long time we may very well be speaking many tens — and even lots of — of 1000’s of kilos.

Please observe that tax therapy will depend on the person circumstances of every consumer and could also be topic to vary in future. The content material on this article is offered for data functions solely. It isn’t supposed to be, neither does it represent, any type of tax recommendation. Readers are answerable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding choices.

2. Diversify

With an ISA and/or SIPP arrange, the following factor to contemplate is making a diversified portfolio of shares and different property. This reduces threat, gives publicity to totally different investing alternatives, and usually delivers a smoother return over the financial cycle.

A belief just like the The Metropolis of London Funding Belief (LSE:CTY) may very well be an efficient inventory to contemplate concentrating on this. Courting again to 1932, this is likely one of the oldest London-listed trusts, and has round £2.4bn price of property.

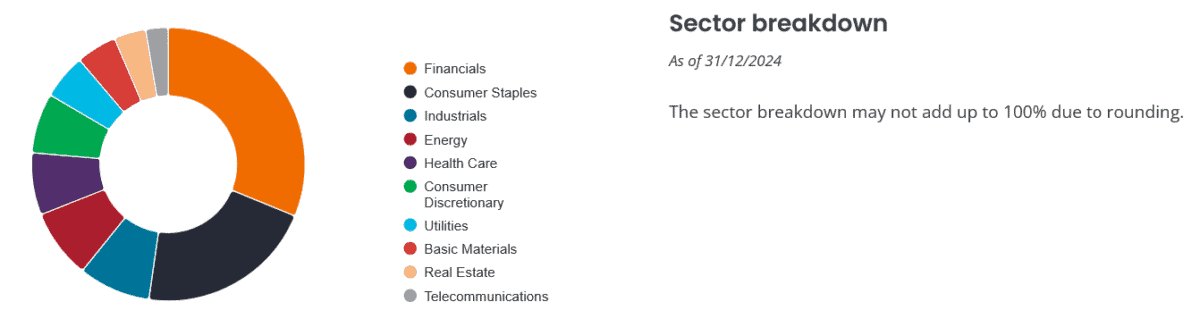

It’s centered on delivering a mix of development and passive earnings via publicity to 10 totally different sectors. A few of its largest holdings embrace HSBC, Shell, RELX, Unilever and British American Tobacco.

Nearly 90% of the fund is tied up in UK equities, which may depart it susceptible if market urge for food for British property developments decrease. However I’m assured it may proceed to be an efficient diversification device over the long run.

Since 2005, the belief has delivered a mean annual return of 6.4%. If this continues, a £500 month-to-month funding over 30 years creates a retirement fund of £553,089.

3. Purchase dividend shares

As soon as they hit retirement, an investor has a lot of choices open to them so as to add a second earnings to their State Pension.

They’ll purchase an annuity, or draw down a share from their portfolio. Alternatively, they may make investments their cash elsewhere (like in buy-to-let property for an everyday rental earnings).

An alternative choice is to focus on a passive earnings from high-yield dividend shares. This could ship a gradual stream of money via common dividend funds in addition to present scope for capital appreciation.

Moreover, this methodology presents the potential of dividend development over time, which may help mitigate the eroding impression of inflation on a person’s passive earnings.