Picture supply: Getty Photographs

In search of the perfect low-cost FTSE 100 shares to purchase this month? We would suppose excessive avenue financial institution Lloyds‘ (LSE:LLOY) shares are price an in depth take a look at the present worth of 53.06p.

At this stage, the Black Horse Financial institution trades on a price-to-earnings (P/E) ratio of seven.9 instances for 2025. That is far under the Footsie common of 14.3 instances.

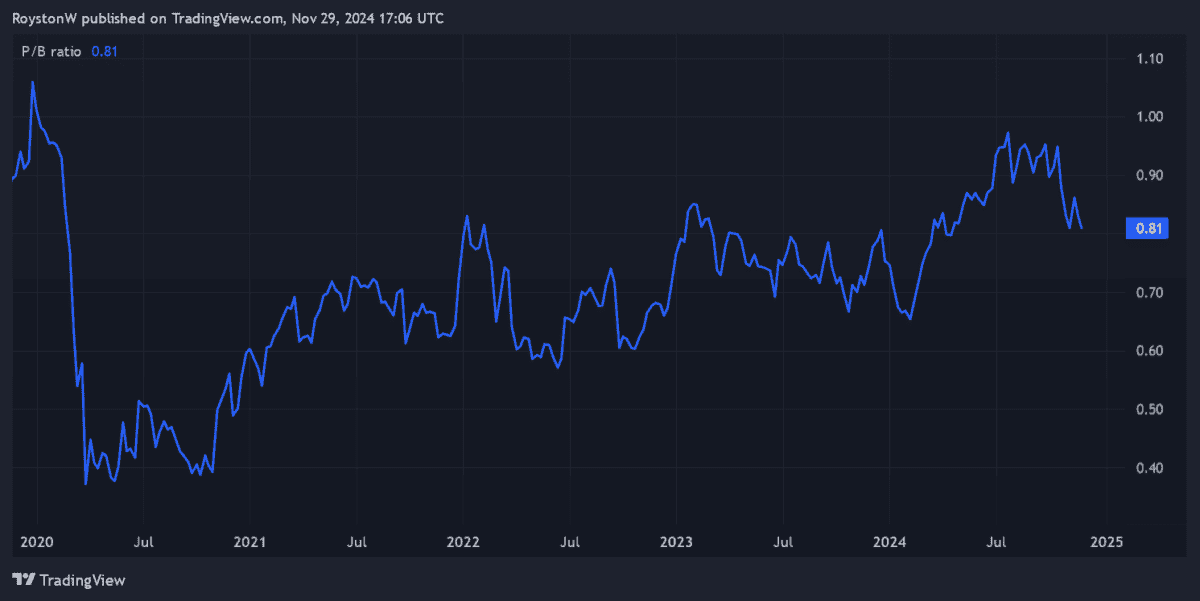

Lloyds’ shares additionally commerce at a reduction to the worth of the financial institution’s property. At 0.8, its price-to-book (P/B) rating sits comfortably under the worth watermark of 1.

Lastly, at 6.4%, the 2025 dividend yield right here on Lloyds shares sails above the FTSE 100 common of three.7%.

On the plus aspect

These numbers are spectacular. However as a possible investor, I want to contemplate whether or not the low valuation right here displays important, and probably unacceptable, inside and/or exterior threats.

There’s so much I like about Lloyds. It has important model recognition, a crucial high quality in an business the place peoples’ cash’s concerned. It’s additionally a market chief in mortgages, a sector which could possibly be set for sturdy progress if (as anticipated) homebuilding within the UK’s accelerated.

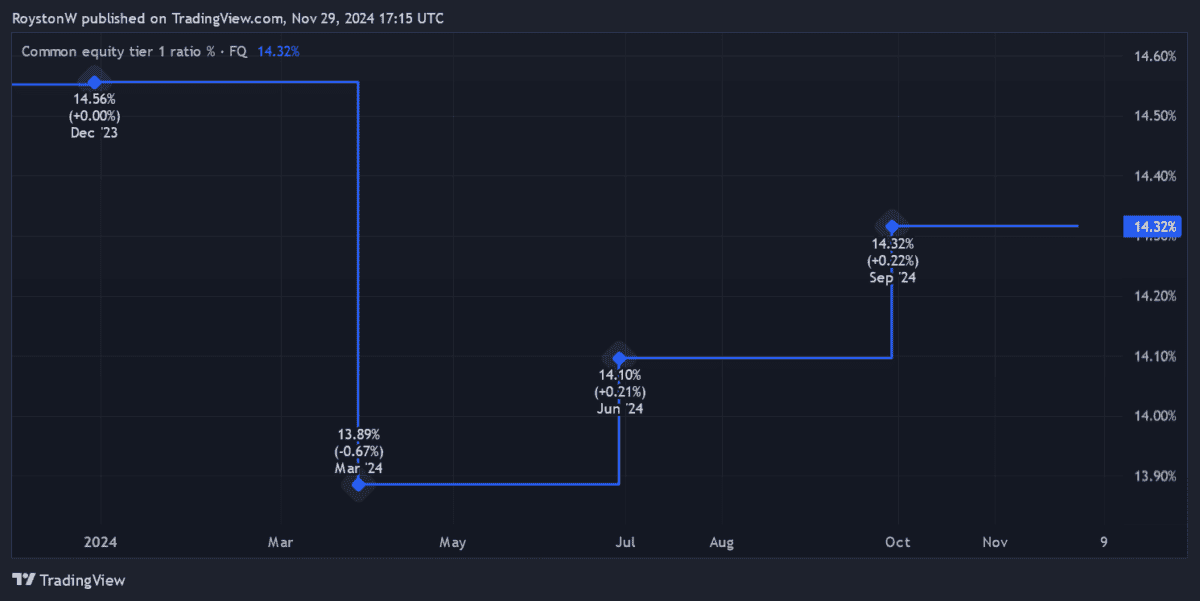

I additionally just like the financial institution’s sturdy monetary foundations. With a CET1 capital ratio at round 14.3% — forward of its 13% goal — Lloyds has important scope to put money into progress whereas additionally persevering with to pay massive dividends.

But regardless of these qualities, I consider the dangers of me shopping for Lloyds shares at this time outweigh these advantages.

Poor gross sales and rising impairments

For one factor, UK-focused banks like this will wrestle to develop revenues because the home economic system flatlines. Information that British GDP grew simply 0.1% within the third quarter following a shock September contraction is a foul omen heading into 2025.

With financial situations remaining powerful, Lloyds additionally faces an additional stream of heavy credit score impairments. I’m notably involved concerning the potential for heavy mortgage-related prices — the Financial institution of England (BoE) thinks half of UK residence loans, equating to round 4.4m, will change into costlier for debtors to service over the following three years, attributable to increased rates of interest.

Competitors and automotive mortgage prices

I’m additionally involved about demand for Lloyds’ credit score and financial savings merchandise going forwards as competitors rises within the UK banking sector.

Challenger banks are aggressively increasing their product ranges to win prospects from conventional operators. And so they may have further monetary firepower to tackle the likes of Lloyds, with the BoE eyeing modifications to Basel III capital requirement guidelines.

Lastly, earnings at Lloyds may take an eye-popping hit if it’s discovered responsible of mis-selling automotive loans. The financial institution’s put aside £450m to cowl this eventuality, however this determine is beneath evaluation as a Monetary Conduct Authority (FCA) probe rolls on.

Rankings company Moody’s thinks complete motor finance claims — a market wherein Lloyds is a number one participant — may complete £30bn. On this state of affairs, share costs throughout the monetary companies business may plummet.

On stability then, I’m pleased to keep away from Lloyds shares regardless of their cheapness. I’d fairly discover different shares to purchase.