Marathon Digital Holdings (NASDAQ: MARA) is the world’s largest publicly traded Bitcoin (BTC) mining firm. Institutional buyers have step by step elevated their positions in Marathon regardless of the block subsidy halving anticipated in April.

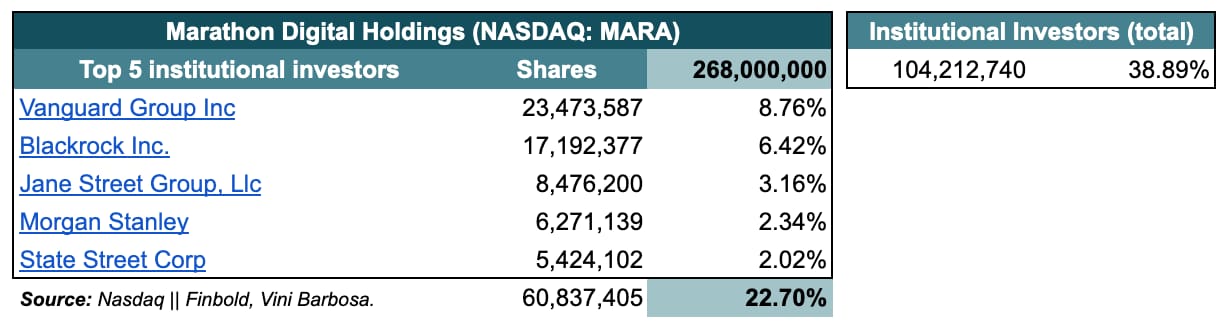

Specifically, institutional buyers personal 38.9% of Marathon’s excellent shares, holding 104,212,740 out of the 268 million. Finbold gathered this information from Nasdaq, which additionally exhibits the highest 5 institutional shareholders of the Bitcoin mining firm.

First, Vanguard holds 23.47 million shares (8.76%). Subsequent, BlackRock and Jane Avenue have 17.19 million (6.42%) and eight.47 million (3.16%), respectively. Morgan Stanley has 6.27 million (2.34%) and State Avenue is the fifth-largest with 5.42 million (2.02%).

These 5 institutional buyers sum as much as 60,837,405 shares and personal 22.7% of Marathon Digital Holdings.

Marathon inventory evaluation

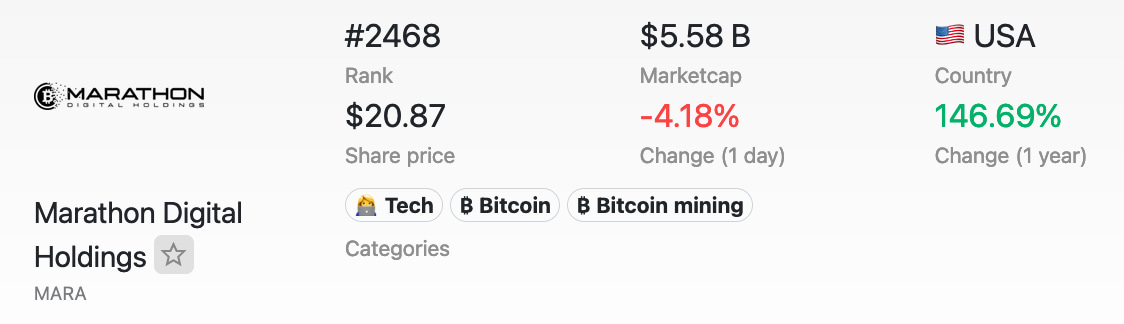

Notably, MARA is the main firm within the Bitcoin mining class, in line with the CompaniesMarketCap index, with a $5.58 billion capitalization. This makes Marathon the two,468th most dear firm on the planet, additionally representing the expertise and Bitcoin classes.

MARA inventory closed March 22 at $20.87 per share. Thus, dropping 4.18% intraday and registering amassed positive aspects of 146.69% year-over-year.

Bitcoin halving and its results on mining firms and institutional buyers outcomes

The core income of Bitcoin mining firms comes from mining BTC and amassing block rewards in charges and block subsidies. Primarily, miners compete with one another to search out the following legitimate block by proof-of-work, measured in hashrate.

Just one miner (or mining pool) has the fitting to say the rewards of every block. Within the case of swimming pools, the members will share the reward proportionally to their contributed hashrate.

Nonetheless, Bitcoin’s block subsidy halves roughly each 4 years or precisely each 210,000 blocks. At the moment, over 98% of the block rewards come from the subsidy, for 900 BTC each day on common. That’s the issuance of latest BTC models by a ‘coinbase’ transaction.

Throughout the halving, Bitcoin mining firms will see their income minimize in almost half if BTC’s worth stays the identical. For that cause, shares like MARA can present some correlation to Bitcoin, price-wise, and its income can undergo from this 12 months’s halving.

In conclusion, institutional buyers proudly owning a major a part of Marathon and different Bitcoin mining firms present a constructive bias in direction of BTC’s worth sooner or later. As of writing, these finance giants personal over one-third of the corporate’s shares.

This highlights an elevated affect from Wall Avenue over Bitcoin’s safety and consensus mechanism. Furthermore, the anticipated income drop unveils the challenges of the sector.