Picture supply: Getty Pictures

London’s inventory market’s an excellent place to search out dividend shares at the moment. Years of share value underperformance permit traders to safe excessive dividend yields, doubtlessly producing a considerable second revenue.

What’s extra, the FTSE 100 and FTSE 250 indices are filled with prime shares with sturdy steadiness sheets and main positions in mature or rising markets. This, in flip, places them in fine condition to offer a sustained and rising revenue over time.

Dividends are by no means, ever assured, in fact. However primarily based on dealer forecasts, the next three shares will present a £1,700 passive revenue within the following 12 months.

This passive revenue determine relies on a £20,000 lump sum invested, unfold equally throughout all three corporations.

Right here’s why I feel these dividend giants are price a detailed look at the moment.

Assura

Assura’s an actual property funding belief (REIT). And, as such, it must pay not less than 90% of annual rental income out in dividends.

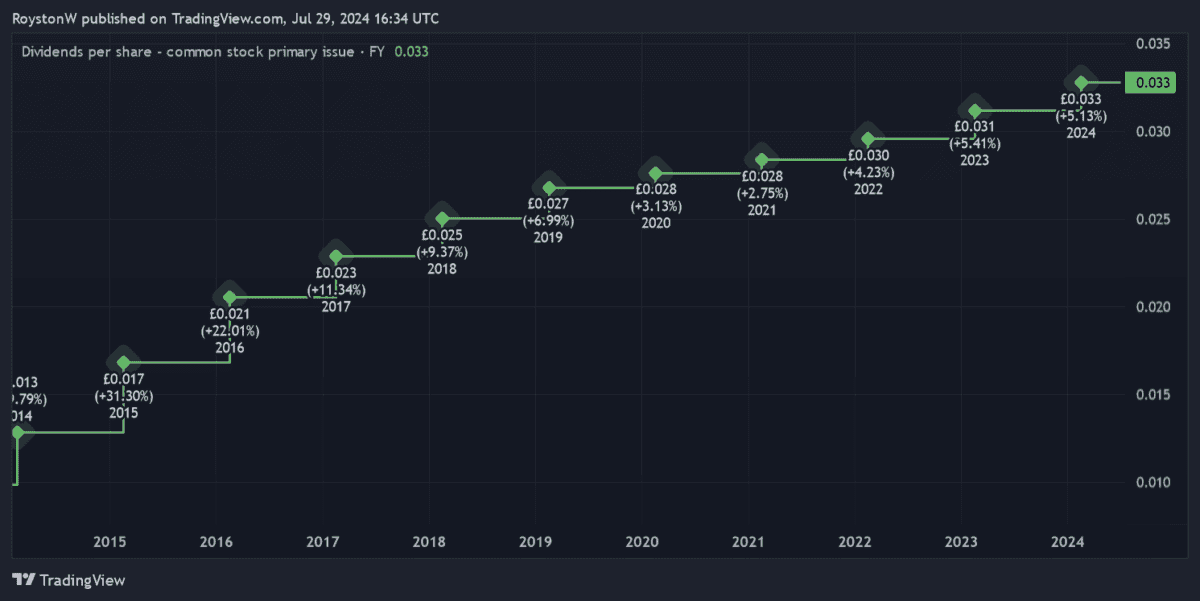

With earnings steadily rising in recent times, this has supplied the spine for shareholder payouts to steadily develop. That is proven within the graphic beneath.

I consider Assura may have appreciable scope to develop earnings (and thus dividends) within the years forward too. Demand for healthcare infrastructure ought to rise strongly because the UK’s aged inhabitants balloons.

I additionally like Assura as a result of the rents it receives are basically assured by authorities our bodies. That stated, future modifications to NHS coverage might endanger earnings right here.

Please be aware that tax remedy is dependent upon the person circumstances of every consumer and could also be topic to alter in future. The content material on this article is supplied for info functions solely. It isn’t supposed to be, neither does it represent, any type of tax recommendation.

Grocery store Revenue REIT

Grocery store Revenue REIT’s one other huge-yielding property inventory price contemplating in August.

Like Assura, it operates in a extremely defensive sector, on this case meals retail. As a consequence, it may be anticipated to pay an honest dividend, even throughout financial downturns.

In reality, annual dividends right here have grown every year since its shares started buying and selling in 2017, even in the course of the Covid-19 disaster.

As Britain’s inhabitants quickly grows, Grocery store Revenue has an opportunity to steadily develop dividends as meals gross sales inevitably rise. Bear in mind although, its share value might stay underneath stress if rates of interest fail to fall meaningfully from present ranges. This might offset the good thing about a big dividend.

M&G

M&G shareholders don’t have the dividend ensures that homeowners of REIT shares have. Nevertheless, Metropolis analysts are nonetheless predicting it to pay a big (and rising) dividend over the following few years, not less than.

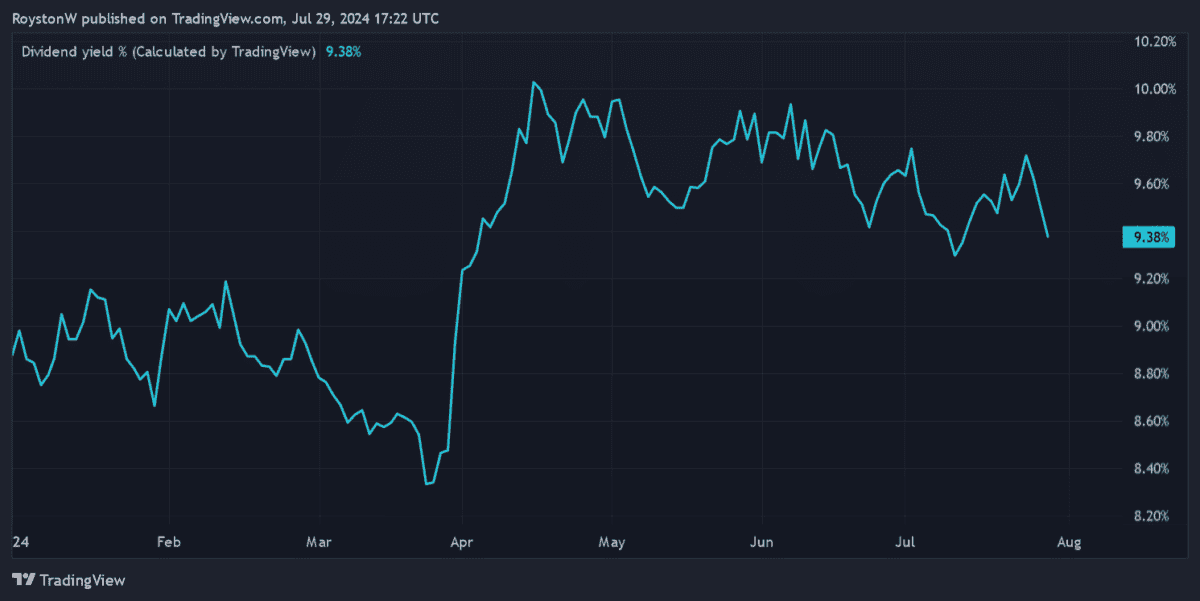

In reality, its 9.4% dividend yield’s one of many largest on the FTSE 100 at the moment.

There’s good purpose why forecasters are so bullish. Final yr, M&G’s Solvency II capital ratio burst by means of the 200% mark (to 203%). This offers it loads of money to mess around with for dividends, in addition to to spend money on its operations.

The monetary providers large faces intense competitors throughout its product strains. However beneficial demographic traits imply it ought to (in my view) stay an excellent passive revenue supplier.