In 2023, Bitcoin miners noticed a revenue surge, but challenges just like the halving occasion loom over smaller gamers.

After dealing with a downturn in 2022, Bitcoin (BTC) miners reported wholesome margins in 2023, particularly these with entry to cheap power.

Based on Compass Mining, firms like TeraWulf and Cipher Mining achieved gross margins exceeding 60%. On common, distinguished mining firms reported margins of practically 47% within the first quarter of 2023.

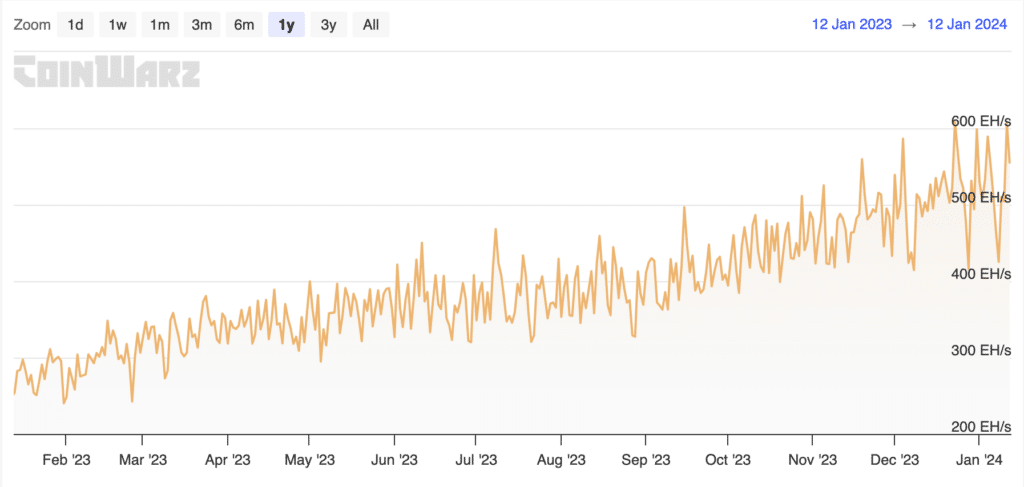

Concurrently, the Bitcoin community’s hashrate, a measure of its computing energy, witnessed vital development over the previous couple of months, reflecting a bullish market cycle.

By Jan. 11, the hashrate surged to a lifetime excessive of just about 700 exahashes per second (EH/s), a substantial improve from 265 EH/s in Jan. 2023, signaling a extra lively and aggressive mining panorama.

Bitcoin hashrate | Supply: CoinWarz

Nevertheless, the business additionally faces challenges. The anticipated Bitcoin halving occasion in April 2024, which is able to halve the block rewards from 6.25 to three.125 Bitcoins, looms giant. With fewer new Bitcoins rewarded for mining, miners might face challenges masking their operational prices, significantly if the Bitcoin value and transaction charges don’t rise proportionally. The discount in rewards might result in much less environment friendly miners shutting down their operations, affecting the general community. Smaller miners might have a value surge to take care of profitability.

The SEC’s approval of 11 spot BTC ETF functions on Jan. 10 has crammed the crypto market with optimism. It’s more likely to have an effect on Bitcoin costs and, consequently, mining income. Let’s delve into these facets to grasp the way forward for Bitcoin mining higher.

You may additionally like: What’s Bitcoin ETF, and which firms acquired SEC approval?

Bitcoin mining recap 2023

2023 emerged as a landmark interval in Bitcoin mining, marked by a number of achievements and developments.

File-breaking income and hashrate

Dec. 2023 stood out as probably the most rewarding month for Bitcoin miners for the reason that market peak of Nov. 2021.

The mining rewards amassed 36,657 BTC, with a major 21.75% originating from transaction charges, largely fueled by inscription actions.

This era additionally noticed Bitcoin’s common market value stabilizing above $42,000, peaking at round $44,000. This market rally pushed the entire mining income in Dec. 2023 over $1.5 billion, the best for the reason that $1.7 billion recorded in Nov. 2021.

Large funding in mining infrastructure

In 2023, a milestone was achieved within the common month-to-month hashrate, surpassing 500 EH/s for the primary time. This surge in hashrate signifies a considerable funding within the mining sector.

An estimated $5 billion was invested in {hardware}, doubling the community’s hashrate from 250 EH/s in This fall 2022 to 507 EH/s in This fall 2023. This funding was accompanied by a corresponding improve in energy capability, estimated at 5.5 gigawatts.

New company mining information

Massive mining firms skilled sturdy success, with Marathon’s MaraPool mining 1,853 BTC from 221 blocks in Dec. 2023, a considerable improve from the 475 BTC in Dec. 2022.

You may additionally like: Marathon Digital acquires Bitcoin mining websites in $179m deal

There was additionally a formidable 18% month-over-month (MoM) improve within the common operational hash price for Marathon Digital, reaching 22.4 EH/s, signaling a strong development in mining effectivity and capability.

Rising profitability and investments

All through 2023, miners loved a 400% improve in common day by day earnings from transaction charges, roughly $2 million per day.

Based on a current Messari report, BTC miners acquired substantial enterprise capital investments in Nov. 2023. Out of 98 crypto-related offers throughout that month, round 90%, totaling $1.75 billion, have been directed in direction of Bitcoin miners.

This previous month in crypto fundraising was led by BTC miners, with Northern Knowledge and Phoenix Group elevating ~$600M and ~$370M respectively.

These offers apart, the remainder of the crypto enterprise market did ~$750M in quantity on 98 offers. pic.twitter.com/CvuwUsgu5c

— Messari (@MessariCrypto) November 29, 2023

This enhance in profitability influenced Bitcoin’s market dynamics, as miners have been much less inclined to promote their holdings, thereby decreasing the promoting strain on Bitcoin.

How did prime crypto mining firms fare in 2023?

Core Scientific (CORZQ)

Core Scientific had a productive 2023, producing 1,177 Bitcoin in Dec. 2023 alone and a complete of 13,762 Bitcoin all through 2023.

This was achieved by an elevated operational hash price of 16.9 EH/s. Their income in Dec. soared to $49.7 million, a 38% improve from Nov., attributed to enhanced mining rewards and an uptick in Bitcoin’s value.

Riot Platform (RIOT)

Riot Platforms witnessed a rise in manufacturing in Dec. 2023, producing 619 Bitcoin at a day by day price of 20 BTC, marking a 35% improve from Nov.

Regardless of a greater efficiency in Dec., the corporate’s efficient utilization price was 69%, elevating questions concerning the decrease mining efficiency in comparison with friends.

Riot Platforms can also be advancing the event of its Corsicana Facility in Texas, aiming to raise its self-mining hash price to twenty-eight EH/s by the tip of 2024.

You may additionally like: Phoenix Group expands mining fleet with $187m Bitmain deal post-IPO

Bitdeer (BTDR)

Bitdeer’s Dec. 2023 efficiency was additionally notable, yielding 434 BTC, a 149.4% improve from Dec. 2022.

This surge in productiveness was achieved regardless of a lower in operational hash price to six.7 EH/s, owing to the retirement of 6,000 legacy mining machines.

The corporate’s strategic enlargement for coming years contains developing a 175MW immersion cooling knowledge heart in Norway and a 221MW knowledge heart in Ohio, with each initiatives slated for completion in 2025.

CleanSpark (CLSK)

CleanSpark witnessed sturdy development in 2023, mining a complete of seven,391 BTC. Their technique closely leaned in direction of “holding,” leading to a Bitcoin reserve improve of three,002 BTC, valued at roughly $126.9 million by the tip of Dec. 2023.

In Dec. alone, CleanSpark mined 720 Bitcoins, sustaining an operational hash price of 10.08 EH/s with a 99% utilization.

Hive Digital (HIVE)

Hive Digital skilled a slight discount of their day by day mining price in Dec. 2023, mining a complete of 282.8 Bitcoin at a price of 9.1 BTC per day.

Regardless of this, their self-mining revenues elevated by 15% to $12 million in December, bolstered by greater Bitcoin rewards and an increase in Bitcoin’s value.

Hive Digital offered 203 Bitcoin, which constituted 72% of their month-to-month manufacturing, and added 80 BTC to their “hodl,” totaling 1,707 BTC valued at $72.1 million as of the tip of Dec.

Crypto mining in 2024: main gamers brace for halving

The SEC’s approval of spot Bitcoin ETFs on Jan. 10 might considerably have an effect on Bitcoin’s market dynamics.

Larry Fink, CEO of BlackRock, highlighted Bitcoin ETFs as a game-changer for the finance business, indicating a considerable curiosity from mainstream monetary sectors.

Furthermore, this improvement might introduce appreciable capital into the Bitcoin market. Analysts have predicted that the approval might result in upwards of $50 – $100 billion flowing into Bitcoin ETFs within the U.S. alone, doubtlessly rising BTC’s market worth.

Within the context of Bitcoin mining, a rise in Bitcoin’s market value, partly fueled by the inflow of capital from ETFs, might positively affect miners’ profitability.

That is significantly related because the Bitcoin mining group braces for the halving occasion in 2024, which is able to scale back the block reward from 6.25 to three.125 Bitcoins. Traditionally, halving occasions have led to a rise in Bitcoin’s value resulting from decreased provide development.

In preparation for the 2024 Bitcoin halving, miners are strategically adapting. Key steps embrace upgrading to the most recent, best mining {hardware}, just like the Antminer S19 XP, to maximise hash price effectivity.

They’re additionally investing in sustainable and cheaper power sources, essential for profitability as block rewards drop. Moreover, miners are constructing money reserves and diversifying into high-performance computing and cloud providers, guaranteeing monetary stability and operational resilience within the face of decreased mining rewards.

Learn extra: What is occurring with defi, as soon as the market mover?