I’ve been constructing a portfolio of progress and dividend shares with my Particular person Financial savings Account (ISA) for years. The following a part of my investing journey is to prioritise funding a Self-Invested Private Pension (SIPP).

With a SIPP, I’ve a possibility to take a position as much as £60,000 every tax yr, in line with what I earn. I even have a wider vary of investments to select from with one among these merchandise than with an ISA.

The large deal for me although, is the large tax reduction traders take pleasure in. For each £1,000 I make investments, the federal government will add one other £250.

Greater- and additional-rate taxpayers can take pleasure in even greater advantages too. Folks in these brackets can take pleasure in tax reduction of as much as 40% and 45% respectively.

Please notice that tax remedy depends upon the person circumstances of every shopper and could also be topic to vary in future. The content material on this article is supplied for info functions solely. It’s not meant to be, neither does it represent, any type of tax recommendation. Readers are chargeable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding selections.

The search for dividends

In current weeks, I’ve purchased Authorized & Common, CRH and Ashtead Group shares for my SIPP. I’ve additionally included a few funds, together with the HSBC S&P 500 UCITS ETF (which tracks the S&P 500 inventory market index).

I purchased Authorized & Common shares to provide me further passive revenue to purchase extra shares. The ahead dividend yield right here sits at an unlimited 8.6%, and I’ve my eye on a number of different dividend shares to assist me construct out my portfolio.

I’m reluctant to spend money on banks like Lloyds and NatWest as a result of UK’s gloomy financial outlook. However shopping for TBC Financial institution Group (LSE:TBCG) helps me sidestep this downside.

This FTSE 250 share is targeted on the quickly increasing rising market of Georgia. So it has robust progress potential. Like all banks, it additionally has dependable revenue streams from mortgage curiosity which it could actually use to pay dividends.

In fact, Georgia’s financial system isn’t resistant to downturns. This implies TBC can be susceptible to bouts of revenue volatility. However a strong long-term outlook nonetheless makes the enterprise a horny funding to me.

GDP per capita is tipped to rise strongly to the top of the last decade, because the chart above reveals. As a consequence, I anticipate TBC to maintain delivering a big and rising dividend as demand for monetary companies steadily will increase.

As for 2024, the financial institution presently affords up an enormous 8.1% dividend yield.

Financial institution on it

Bankers Funding Belief (LSE:BNKR) is one other share I’m hoping so as to add to my pension quickly. It’s paid an annual dividend yearly because the late Nineties! And it’s elevated them with out a break for the previous 57 years.

The belief invests in a few of the world’s largest firms which, in flip, provides it wonderful stability and thus the flexibility to pay dividends yearly. A few of its greatest holdings embrace Microsoft, Accenture, Toyota and American Specific.

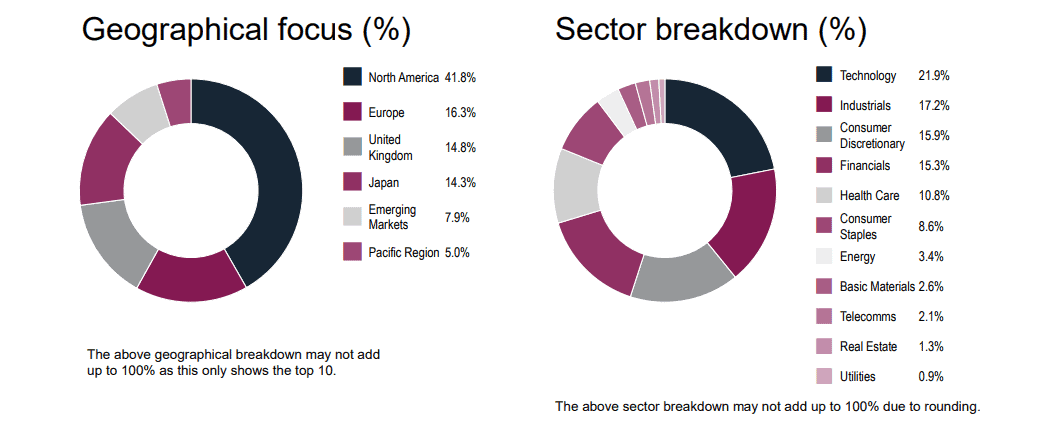

Bankers can be sturdy due to its extremely diversified portfolio. The corporate spreads its capital throughout a broad vary of areas and sectors, because the graphic beneath reveals.

The belief does have a big weighting to cyclical sectors like know-how, industrials and financials nonetheless. This implies it may ship worse returns than different trusts throughout powerful financial occasions.

However as a long-term investor, this doesn’t put me off. Bankers’ distinctive dividend report makes it a prime purchase for a SIPP. For this monetary yr, it carries a helpful 2.3% dividend yield.