After a robust first quarter, the Aviva (LSE: AV.) share worth has tapered off, down 4.7% since this 12 months’s excessive. However over the previous 12 months, it’s outperformed the Footsie and is now close to a seven-year excessive.

The shares are buying and selling at £4.73, barely down from the Could excessive of £4.97.

So the place is the inventory headed from right here?

To search out out, I’m charting some key development metrics which will reveal hidden clues.

Worth-to-earnings

I at all times examine the price-to-earnings (P/E) ratio first to get a tough concept of the worth. If the value is rather a lot increased than earnings the inventory may very well be overvalued, limiting additional development. However a low P/E ratio suggests the value hasn’t caught up with earnings but and additional development is to be anticipated.

At the moment, the common P/E ratio on the UK market is eighteen.4, close to the very best it’s been in a number of years. Aviva’s P/E ratio of 12.7 is relatively low, suggesting the inventory has first rate development potential.

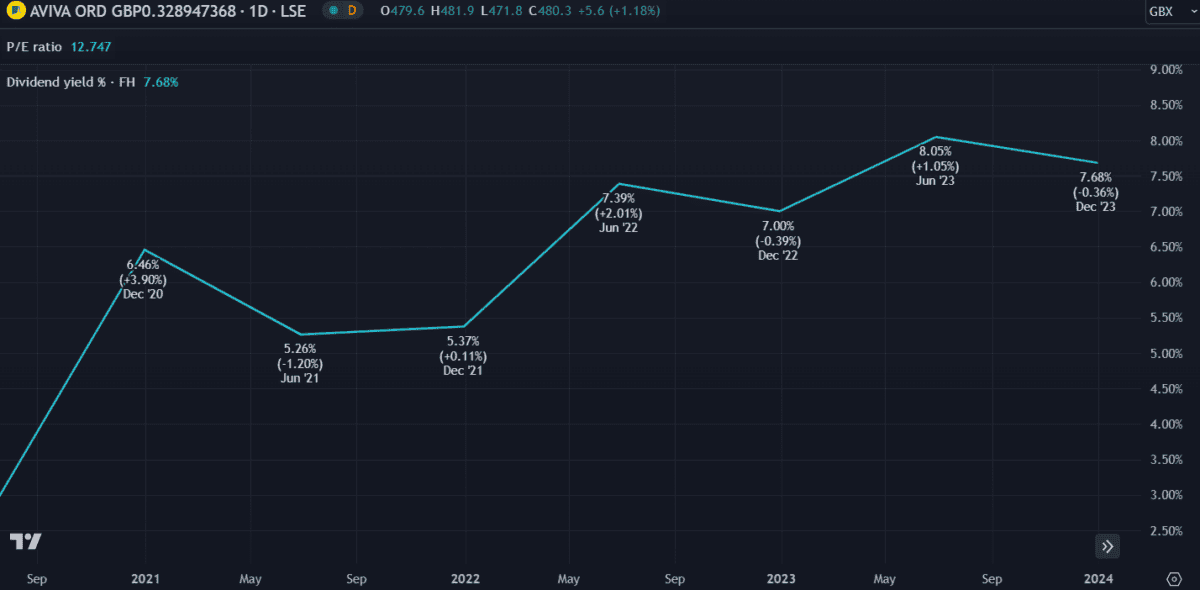

Dividend yield

One in all Aviva’s key worth propositions is that it’s a recognized dividend payer. The power to offer again a portion of income to shareholders is a robust indication that an organization is performing nicely. For the previous 20 years, it’s paid fluctuating annual dividends of between 15p and 30p per share. Total, there hasn’t been a lot development however funds have been constant.

The dividend yield signifies what share of the present share worth is paid yearly. At the moment at 7.68%, we will see from the chart that it’s been rising persistently since 2021. It’s now the seventh-highest dividend yield on the FTSE 100 — albeit barely under competitor Authorized & Normal, in fifth place.

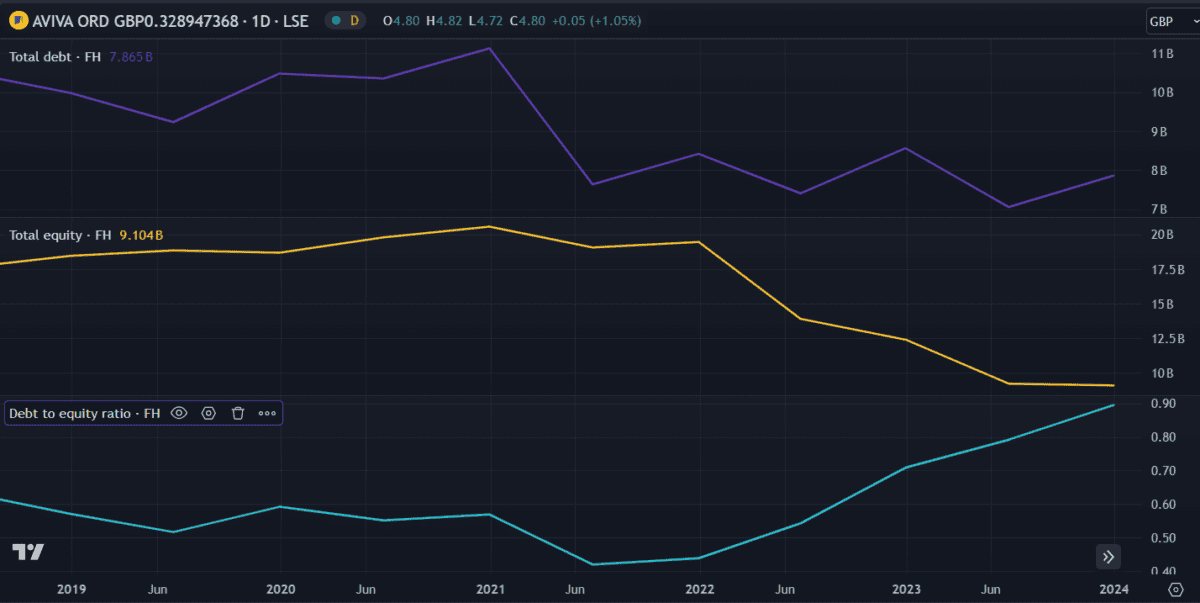

Debt

Debt could be very helpful to an organization if used appropriately. The truth is, it’s thought of a important a part of any profitable firm’s operations. However when used as a lifeline, it will probably grow to be an issue. The under chart reveals three vital metrics: debt, fairness, and debt-to-equity (D/E) ratio. We are able to see that debt has been declining, which is nice. Nonetheless, fairness has declined at a quicker charge, resulting in an increase within the D/E ratio.

The D/E ratio ought to ideally stay under one. With Aviva’s now at 0.9, it’s getting dangerously near having extra debt than fairness. This can be a regarding state of affairs. If an organization doesn’t have adequate fairness or money movement to cowl its debt, it might default — or in a worst-case state of affairs, go bankrupt.

Luckily, Aviva has a number of money and property, in order that’s not a danger for now.

My verdict

Contemplating the above metrics, the Aviva share worth nonetheless appears to be like low cost to me. That is mirrored within the P/E ratio and supported by future earnings estimates, which calculate it buying and selling at 42% under honest worth. However that doesn’t imply it’ll develop.

The UK’s insurance coverage market is cut-throat and Aviva faces many rivals. If an financial restoration is delayed, customers could hunt down cheaper alternate options, threatening income. With fairness declining and debt rising, it will probably’t afford to lose prospects at this important level.

On paper, issues look good and I feel the share worth may enhance from right here. However I wouldn’t anticipate big development. Luckily, the excessive dividend yield provides the inventory nice worth both manner.