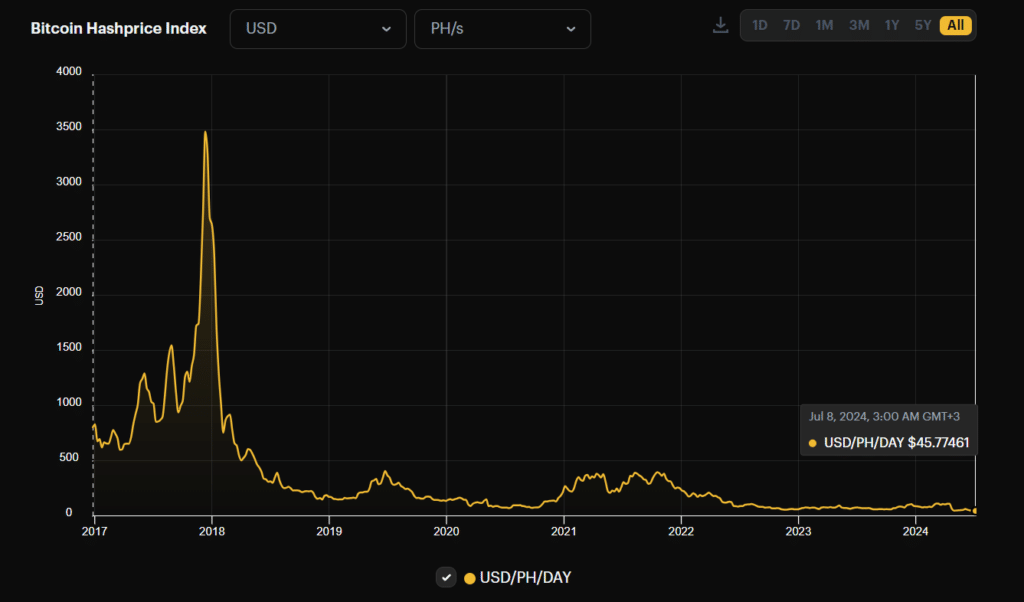

Bitcoin’s value drop final week, exacerbated by German authorities transfers, pushed hashprice to an all-time low of $44.31/PH/day, regardless of a 5% downward issue adjustment.

Final week’s Bitcoin (BTC) value drop, worsened by German authorities liquidations, had pushed hashprice, a metric that represents the miner income on a per terahash foundation, to an all-time low, triggering recollections of the summer season of 2021 when China’s Bitcoin mining ban brought on related disruptions within the crypto’s mining ecosystem.

As per knowledge from crypto mining analytics agency Hashrate Index, final week hashprice plunged all the way down to $44.31 per petahash per day (PH/day), what seems to be the worst metric seen within the crypto market to date. Even in Might 2021, when Chinese language authorities cracked down on crypto mining and buying and selling, hashprice solely fell from 379 PH/day to 203 PH/day.

Bitcoin hashprice chart | Supply: Hashrate Index

Transaction charges on the Bitcoin community have additionally nosedived, with volumes reaching their lowest level since Q3 2023.

On Jul. 8, the Bitcoin blockchain processed simply 12.32 BTC in transaction charges, marking the bottom degree in almost 9 months, says the pinnacle of analysis at Luxor Know-how Colin Harper, including that the final time transaction charges had been this low was in October, 2023, once they hit 11.4 BTC amid Bitcoin’s 28.5% value surge. Hashrate Index says heatwaves might additional exacerbate the stagnation in Bitcoin’s hashrate because the U.S. enters its hottest interval of the yr.

You may also like: Mt. Gox is a ‘thorn in Bitcoin’s aspect,’ analyst says

“For Q3-2024, modifications to Bitcoin’s hashrate will outcome from a continuing tug-of-war between heat-related curtailment, hashprice volatility, and miners deploying new ASICs.”

Colin Harper

The present panorama of consecutive unfavorable issue changes — three in a row — mirrors that of the summer season of 2021, a interval marked by important turbulence resulting from China’s crackdown on Bitcoin mining and buying and selling. This yr, the downturn follows a tumultuous summer season for Bitcoin’s hashrate within the aftermath of the fourth halving, which brought on Bitcoin’s hashrate to drop by 10%.

Learn extra: Bitcoin mining shares slumping in pre-market buying and selling