Picture supply: Getty Photographs

There are a variety of FTSE 100 shares that yield 7%. However that’s nonetheless nicely above the common dividend yield of the flagship London inventory market index. For the time being, one such UK share has risen 17% in worth over 12 months — but it nonetheless yields 7%. On high of that, it has a price-to-earnings (P/E) ratio of lower than 10.

Ought I to purchase?

Low valuation

The share in query is tobacco firm Imperial Manufacturers (LSE: IMB).

Regardless of its current share value efficiency, in 5 years it has gone nowhere, shifting up by underneath 1%. Whereas that P/E ratio certainly appears to be like low, it’s in actual fact increased than it was a number of years in the past.

Created utilizing TradingView

So, is the share a discount?

I feel the valuation displays various components. Cigarettes are seeing declining demand in lots of markets, one thing I count on to proceed over time. However Imperial stays closely depending on them. In the meantime a giant dividend reduce by the corporate in 2020 put many traders, together with myself, off the shares.

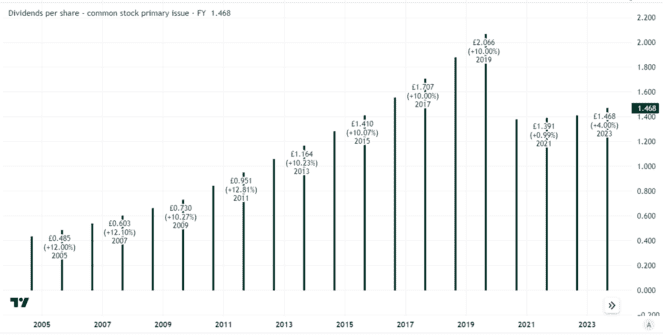

Rising dividend per share

Nonetheless, 7% is what I’d regard as a excessive yield.

Imperial’s dividend reduce was all however inevitable and allowed it to enhance its stability sheet. It has been rising the dividend once more commonly lately.

Created utilizing TradingView

From a dividend perspective, I see each a professional and con to the funding case right here. For a blue-chip UK share, 7% is a powerful yield. It’s not distinctive nevertheless it actually units Imperial aside from most of its friends. The enterprise has a secure of robust manufacturers.

Over time although, I worry the prospect of an additional reduce within the payout. Imperial’s technique of compressing probably the most out of the cigarette money cow whereas it will probably is working for now.

However from a long-term perspective, I query whether or not it will probably change the revenues and particularly income a smaller cigarettes enterprise would possible imply. Imperial has made a lot much less progress in creating a non-cigarettes enterprise than some rivals.

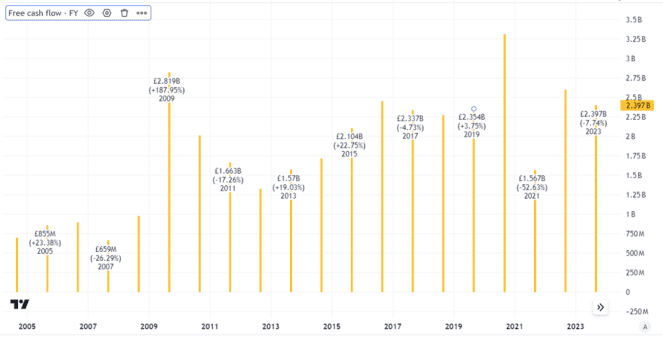

That might damage free money flows. Finally, it’s free money flows that fund dividends. The previous few years have seen inconsistent free money flows at Imperial and over time, as cigarette volumes decline, it could be tougher to maintain present free money flows regardless that cigarette makers together with Imperial get pleasure from robust pricing energy.

Created utilizing TradingView

Is that this an excellent share?

On stability, I feel it is a first rate UK share — however I’m not satisfied it’s a nice one.

The dividend historical past has been inconsistent and the corporate is closely targeted on a market that’s seeing long-term sizeable declines in demand. That might eat into free money flows, one thing that may not solely result in one other dividend reduce however may additionally imply the share value goes nowhere within the subsequent 5 years, because it has up to now 5 – or declines.

So, I’ve no plans so as to add Imperial to my portfolio.