Picture supply: Getty Photographs

The most well liked investing pattern to have come alongside in a few years is undoubtedly synthetic intelligence (AI). Most specialists predict this revolutionary expertise will remodel a number of industries. Naturally then, many buyers beginning out in the present day may have been questioning which is the most effective inventory to purchase within the house.

Up to now, Nvidia (NASDAQ: NVDA) has been the standout winner. Shares of the AI chipmaker have risen by a stonking 2,473% over 5 years — even after a 16% drop in July!

Whereas Nvidia’s chips maintain a dominant place in AI-accelerated knowledge centres, competitors is mounting. Not simply from previous rivals like Superior Micro Gadgets, but in addition its personal prospects, together with Alphabet and Amazon. Each are growing their very own customized AI chips to cut back reliance on exterior suppliers.

Will Nvidia nonetheless be on the high of the AI pile in 5 years time? Maybe, however we don’t know for positive, particularly given how quickly the business is growing.

My technique right here then is to put money into the agency doing a lot of the chipmaking on behalf of all these prospects. That’s Taiwan Semiconductor Manufacturing (NYSE: TSM), the world’s largest chip foundry.

As I write, the inventory has dropped 19% inside a month. Right here’s why I plan to purchase extra shares in August.

Deep moat and eye-popping margins

TSMC, because the agency is thought, has delivered a 17.7% compound annual development price (CAGR) in income since 1994. Its earnings CAGR? 17.2%!

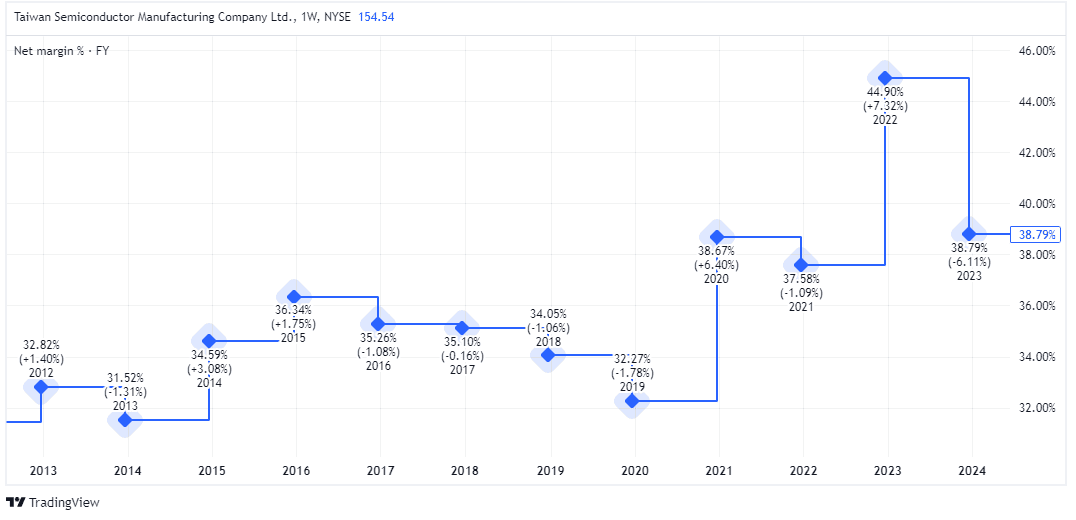

This means that the corporate has a robust aggressive benefit (or moat). Certainly, its internet revenue margin is an unbelievable 38%.

I doubt a $100bn conflict chest would compete with TSMC. I imply, a single trendy foundry prices $10bn-$20bn or extra. Earlier than that, you’d need to construct the availability chain, appeal to high expertise, then match TSMC’s economies of scale and big annual capital expenditure and R&D funds. Good luck with that!

That’s to not say it has no competitors. It does, primarily within the form of Intel and Samsung Foundry, a division of Samsung Electronics. However it stays the worldwide chief, with a 60% market share and a fortress steadiness sheet.

Robust AI demand

In Q2, income surged 32.8% yr on yr to succeed in $20.8bn. Web earnings and diluted earnings per share each elevated 36.3%.

As talked about, most high tech companies use TSMC. Apple and Nvidia are amongst its largest prospects. And chief government C.C. Wei lately informed analysts: “AI is so scorching; proper now all people, all my prospects, wish to put AI performance into their units.”

Given this, you may anticipate TSMC to be buying and selling at some loopy AI-fueled a number of. However the inventory’s ahead price-to-earnings (P/E) ratio is at the moment underneath 20, primarily based on 2025’s analyst estimates.

That’s far cheaper than Nvidia and most different AI-related tech shares.

As with all investments although, there’s threat. The primary one is China invading Taiwan, the place most of TSMC’s manufacturing capability is positioned. One other can be a slowdown in AI spending, which might damage development.

Nonetheless, TSMC has round a 90% share in making essentially the most superior chips. So it’s completely positioned to profit from the AI revolution, no matter which particular person companies find yourself reigning supreme.

With the inventory trying nice worth once more, I intend to purchase the dip in August.