Picture supply: Getty Pictures

I imagine the FTSE 100‘s stuffed stuffed with bargains for the time being. I’ve picked the three I feel presently supply one of the best worth.

Out of vogue

Shares in JD Sports activities (LSE:JD.) presently (16 August) change fingers for 28% lower than the inventory’s 52-week excessive.

It’s been caught within the crossfire following a downgrade in Nike’s gross sales forecast. The American sportswear big is believed to account for 50% of JD Sports activities’ income so this isn’t stunning.

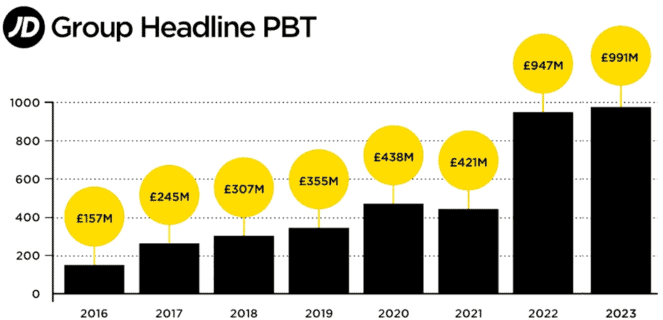

However the retailer sells a number of manufacturers together with some which can be capitalising on Nike’s issues. And the corporate has a formidable monitor file of rising its earnings.

With a price-to-earnings (P/E) ratio of round 10 — half its common over the previous decade — I just lately determined to purchase some inventory.

Ringing the modifications

On the again of stagnant income and falling earnings, Vodafone’s (LSE:VOD) shares look like caught within the 65p-80p vary. I think that’s why the corporate’s restructuring its operations and promoting its under-performing divisions in Spain and Italy.

There’s no assure its turnaround plan will work — others have failed. And I’ve issues concerning the firm’s debt ranges.

However I’ve confidence in its CEO. And the corporate’s current buying and selling replace — for the primary quarter of its March 2025 monetary yr — hinted at a restoration beneath manner. I imagine now could possibly be a great entry level.

To think about the inventory’s potential, I’ve been taking a look at Deutsche Telekom, Europe’s largest telecoms firm. If the identical earnings a number of (13.7) was utilized to Vodafone, its shares can be 46% larger.

Prepared for take-off

Worldwide Consolidated Airways Group (LSE:IAG) shares are presently buying and selling 9% beneath their 52-week excessive. Analysts expect earnings per share of 40.97 euro cents (35.18p) in 2024. If appropriate, this means a P/E ratio of 4.8.

This seems low cost in comparison with easyJet — the one different airline within the FTSE 100 — which has a ahead earnings a number of of 6.9. If the identical valuation was utilized to IAG, its inventory can be 43% larger (243p).

The pandemic reminded us of the dangers related to the airline trade. Additionally, IAG’s income have been impacted by inflation. Gasoline prices are largely out of its management. And a good labour market’s placing stress on salaries. In August final yr, British Airways agreed a 13% pay rise (over 18 months) with its 24,000 workers.

Throughout 2023, these two expense headings accounted for precisely 50% of its working expenditure.

However I feel now could possibly be a great time to contemplate it. Passenger numbers are growing as soon as extra, internet debt’s falling, its dividend has been reinstated (albeit a modest one) and lots of expect oil costs to fall over the following 12 months.

Brokers seem to agree with my evaluation. Of the 16 analysts overlaying the inventory, 11 give it a Purchase ranking and 5 are Impartial.

Financial institution of America and RBC Capital Markets each have a value goal of 230p. After all, there’s no assure the share value will attain this stage nevertheless it illustrates that some price the inventory extremely.

League desk

I already personal two of those shares. And if I had some spare money, I’d add IAG to my portfolio. Nonetheless, rating them in ascending order I’d put Vodafone third (low cost), adopted by IAG (cheaper) and JD Sports activities (least expensive).