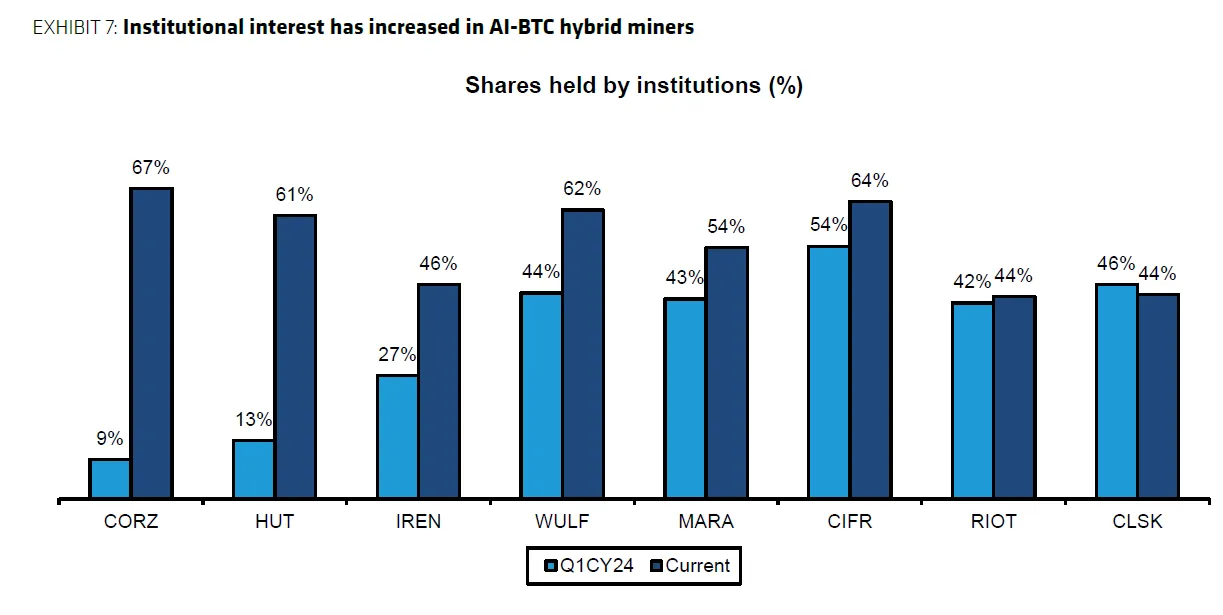

Institutional buyers are being drawn to Bitcoin mining firms for his or her synthetic intelligence (AI) potential, however they might find yourself reaping surprising advantages from cryptocurrency bull markets.

“If we’re proper about our $200K Bitcoin worth forecast, buyers will come for AI and would possibly find yourself having fun with the Bitcoin bull markets, with out asking for it,” a Bernstein report launched Monday states, because it encapsulates a twin alternative that institutional buyers might not have anticipated.

Supply: Bernstein

This surprising synergy between AI infrastructure and cryptocurrency mining is attracting consideration from institutional buyers who see past the normal boundaries of those applied sciences.

In accordance with Bernstein, Bitcoin miners are uniquely positioned on this area because of their substantial energy sources and strategic areas.

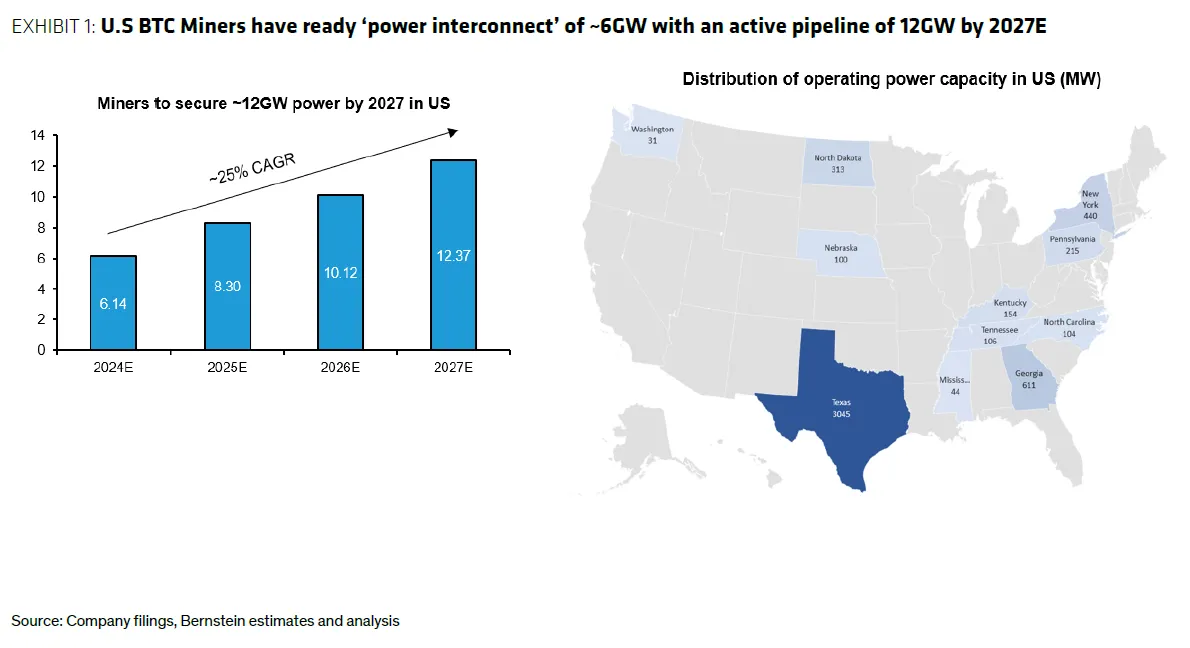

“Collectively Bitcoin miners have entry to 4GW of energy at present, with operational interconnect going to 6GW by finish of 2024,” the report notes, underlining the numerous infrastructure these firms have at their disposal.

Supply: Bernstein

Making a case for the re-rating of Bitcoin miners, Bernstein analysts write that they’ve equal energy portfolios, nevertheless, commerce at a reduction to legacy information facilities. ~$4mn per MW to ~$30-50mn/MW, nevertheless, miners additionally make a fraction of income per MW – $0.6mn per MW vs. $4.7mn per MW.

“As Bitcoin miners execute on their AI information middle campuses, we consider this hole in each income and buying and selling multiples will slim,” Bernstein states.

In accordance with Bernstein’s evaluation, Bitcoin miners have a major edge in relation to energy infrastructure.

These operations presently have entry to 4GW of energy, with projections suggesting this might attain 12GW by 2027.

This huge energy capability, coupled with miners’ expertise in working high-density operations at 70-80KW per rack, aligns with the demanding energy necessities of AI computing.

In contrast to conventional information facilities, Bitcoin miners have strategically constructed their operations round “stranded energy” sources, typically in unconventional areas the place land and energy are plentiful.

This method has led to the event of sprawling websites, some spanning a whole bunch of acres, with energy capacities starting from 100MW to 1GW.

As an example, TeraWulf’s (WULF) Lake Mariner website in Western New York boasts a possible 500MW hydropower capability, full with ample water sources for cooling—an important issue for each cryptocurrency mining and AI operations.

Bernstein additional states that Bitcoin miners’ experience extends past mere entry to energy and that their profitability hinges on subtle energy value administration, together with hedging methods in wholesale buying and selling markets and collaborative relationships with utilities and grid operators.

This know-how may show invaluable in managing the energy-intensive calls for of AI computing.

Edited by Stacy Elliott.