Income for publicly traded Bitcoin (BTC) and different cryptocurrency miners on Wall Road has fallen by 12%. This continues the detrimental response to April’s halving, which diminished block rewards, coupled with low community charges and rising manufacturing prices. In accordance with the newest JPMorgan report, that is making it troublesome for miners to keep up profitability.

Just a few months in the past, the fourth Bitcoin halving occasion befell, lowering the rewards acquired by miners from 6.25 BTC to three.125 BTC. In consequence, miners obtain half as a lot income for his or her work, and the competitors for mining new BTC has considerably intensified.

“The 4th Bitcoin halving occasion reduce the variety of every day cash mined (and all else equal, the every day income alternative) in half, leading to decrease margins and profitability throughout our protection universe,” commented Reginald Smith and Charles Pearce within the JPMorgan report.

The research’s authors additionally level out considerably greater vitality prices, which negatively impression the realized profitability of particular person publicly traded miners. For Marathon Digital (MARA), the most important Bitcoin miner on Wall Road, these prices have already doubled in 2024 in comparison with 2023. The scenario is analogous for different publicly traded miners.

An instance is BitFufu, whose mining prices jumped by 168% over the yr, leading to a major 75% reduce in web revenue. On common, producing one Bitcoin price the corporate $33,000.

Bigger gamers are coping with this drawback by buying smaller ones, resulting in vital business consolidation. We have seen at the least a number of examples of such strikes in current months. Certainly one of them was CleanSpark, which determined to accumulate a Bitcoin mining website in Wyoming.

“Money-rich miners like Riot Platforms and Cleanspark acquired different miners with turn-key amenities to extend near-term hashrate and improve their energy pipeline,” JPMorgan added.

Miners’ Earnings Down 12%

In a separate report ready by VanEck, we learn that BTC miners’ whole every day income fell by 12% month over month to $27.4 million. Evaluating this end result with final yr’s figures, it is an virtually 60% lower.

Surprisinly, VanEck is mostly optimistic and suggests not paying an excessive amount of consideration to those values.

“Whereas Bitcoin mining revenues have confronted challenges on account of post-halving block reward reductions and low community charges, many publicly traded Bitcoin miners are outperforming this yr by capitalizing on alternatives in AI and high-performance cloud computing,” VanEck explains in its newest report.

Many publicly traded miners search their probabilities within the AI and HPC sectors, which might present greater margins per megawatt than conventional cryptocurrency mining.

“AI corporations want vitality, and bitcoin miners have it,” VanEck’s head of digital property analysis, Matthew Sigel, commented. “Because the market values the rising AI/HPC knowledge middle market, entry to energy—particularly within the close to time period—is commanding a premium.”

Bitcoin Miners are Shifting to AI & HPC, Unlocking New Income Via Strategic Arbitrage

We Estimate a $38B Web Current Worth Alternative by Changing 20% of their Collective Capability by 2027.

(For context, the mixed market cap of the shares we checked out is $19B.)

🧵 pic.twitter.com/hudE7PbXH2

— matthew sigel, recovering CFA (@matthew_sigel) August 16, 2024

Examples of such strikes have been evident since final yr. As an illustration, HIVE Blockchain rebranded to HIVE Digital to higher replicate the evolving nature of its enterprise.

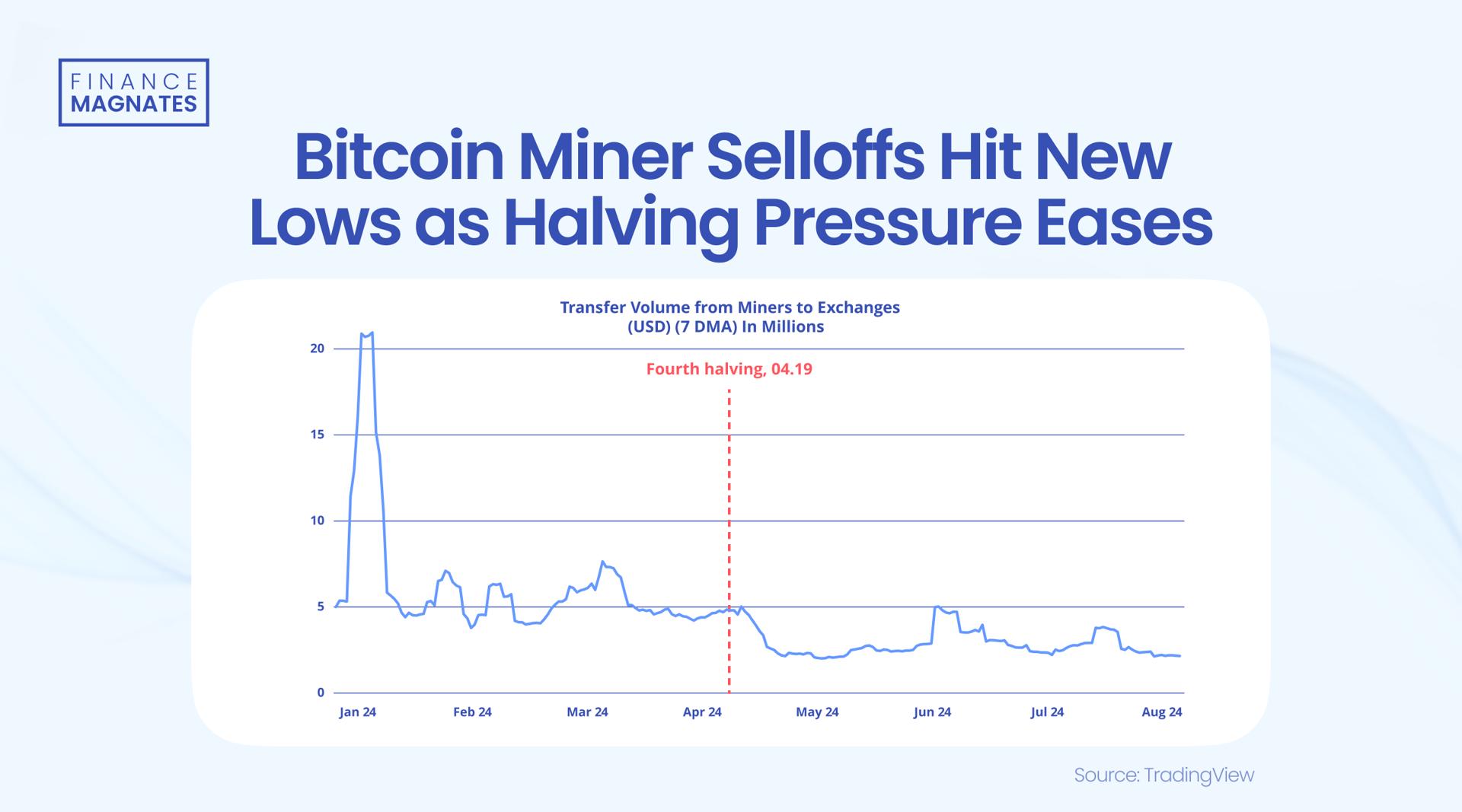

VanEck additionally notes that the tempo of BTC sell-offs by miners is slowing, and switch volumes from their treasuries to exchanges have fallen by 21% over the month. That is stated to sign “stabilization from miners after their post-halving promoting elevated considerably in June and July.”