Picture supply: Getty Photos

Changing into a inventory market millionaire is the stuff of goals. Or is it? I reckon it’s doable to show this dream into actuality by investing in UK shares with excessive development potential.

Pursuing this goal requires threat tolerance and monetary dedication. Nonetheless, there are many shares listed on the London Inventory Change that may ship the returns obligatory to achieve a coveted seven-figure portfolio.

Right here’s how I’d intention for 1,000,000 with £464 a month to speculate.

An bold objective

Reaching a £1m portfolio gained’t occur in a single day. In reality, it’ll probably take a few years. However it doesn’t have to take a lifetime. Merely counting on money financial savings accounts gained’t minimize the mustard nonetheless. I’ll want to purchase shares.

Over the previous 20 years, the FTSE 100 has delivered an annualised return of practically 6.9%. With some good particular person inventory picks, that is beatable. However I don’t need to be too bullish when forecasting what my portfolio of UK shares might ship.

So for my calculations, I’ll plump for an 8% annualised return. I really feel this strikes the correct steadiness between ambition and realism. After all, it’s not assured that I’d obtain this. There’s a threat my portfolio might underperform. On this case, I’d want to speculate extra, or develop my time horizon.

However let’s assume my assumption’s legitimate. If I secured this development fee by investing £464 a month I’d hit my goal in 35 years. Which means if I began investing at 30, I’d be a millionaire in time to get pleasure from a cheerful retirement at 65.

Compound returns

With these caveats and concerns in thoughts, right here’s what my journey to millionaire standing may appear like.

Okay, maybe not. Solely in an ideal world would my returns be this linear. In actuality, there’ll be good and unhealthy years. That’s par for the course with inventory market volatility.

Nonetheless, the graph makes an essential level. The orange sections of the bars mirror simply how essential compounding (curiosity on the curiosity I’ve already earned) will likely be to reaching my objectives. Within the later years, it’ll do a lot of the heavy lifting, even in our imperfect, risky world.

Discovering development shares

Now for the actually thrilling stuff. What UK shares ought to traders contemplate shopping for?

Nicely, one development inventory I’d contemplate for a diversified portfolio is Polar Capital Expertise Belief (LSE:PCT).

This funding belief focuses on tech shares all over the world. It’s delivered distinctive returns and the share value has superior 110% over 5 years.

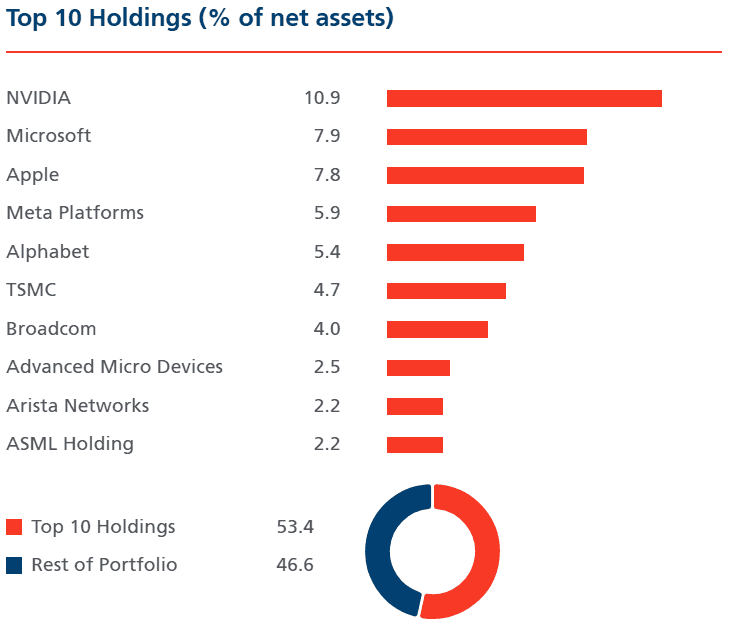

The portfolio incorporates loads of acquainted names, a few of which I already personal.

Synthetic intelligence (AI) is prone to be a key supply of future financial development and I believe this belief’s well-positioned to profit given the character of its holdings. Many shares it invests in are closely concerned in producing the infrastructure powering the AI revolution.

Furthermore, traders contemplating the shares might get them at an 11% low cost to the web asset worth at the moment. That hole won’t final.

Granted, the tech sector’s no stranger to market hype. Speculative valuations are commonplace, particularly within the AI house, and traders ought to brace for giant share value falls alongside the best way. However threat usually goes hand-in-hand with reward.