Picture supply: Getty Pictures

The Authorized & Normal (LSE:LGEN) share worth has fallen nearly 20% over the past 5 years. But it surely’s value noting the dividend means traders who purchased the inventory in 2019 are nonetheless up.

With a 9.3% dividend yield, the inventory appears like a terrific passive revenue alternative. However analysts don’t suppose it’s going to be round for lengthy.

Analyst worth targets

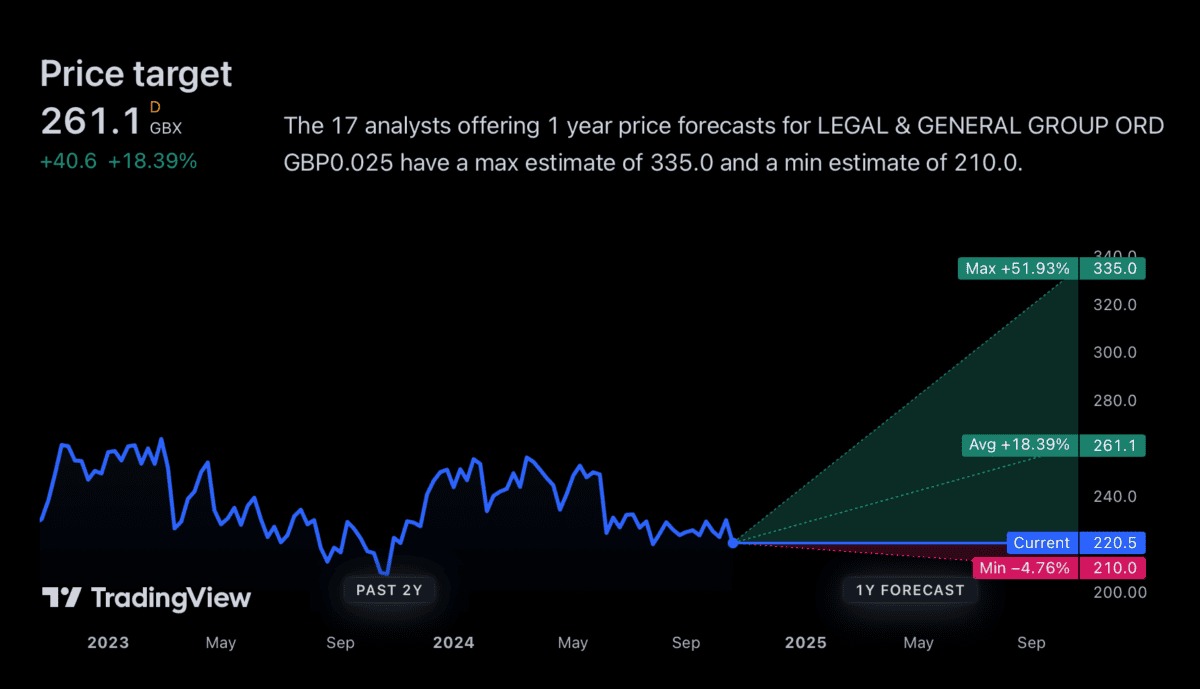

As I write this, Authorized & Normal shares are buying and selling at £2.20. However the common analyst worth goal is £2.61 and essentially the most optimistic is £3.35 – a transparent 51% increased than the present degree.

Even the bottom is barely 4.75% beneath the present share worth. So it appears fairly clear that analysts have an optimistic outlook for the corporate.

By itself, that’s not sufficient to make me need to purchase the inventory. But it surely does give me cause to take a better look and see whether or not there’s one thing that appeals to me right here. As I see it, there could possibly be a few vital challenges forward for the enterprise. The large query is whether or not or not these are already mirrored within the present share worth.

Dangers and rewards

Authorized & Normal’s enterprise entails taking up potential future liabilities in change for big funds. The query subsequently isn’t whether or not there are dangers, it’s how well-managed they’re.

The corporate’s the UK market chief in pension threat transfers. In different phrases, companies pay the agency up entrance to cowl the long run obligations of their pension schemes. This has been a supply of considerable progress for Authorized & Normal over the previous few years. And there could possibly be extra alternatives within the US, the place the agency has a longtime presence.

These are causes to be constructive concerning the inventory – and the dividend. However there are additionally two large points that I feel traders ought to take into account earlier than fascinated with shopping for the inventory.

Challenges

There’s a cause billionaire investor Warren Buffett’s saved Berkshire Hathaway out of this kind of enterprise. It’s that figuring out what premium to cost entails making an attempt to forecast a good distance into the long run.

Not like automotive insurance coverage – the place insurance policies usually final a 12 months – there’s a number of time for issues to go unsuitable with an annuity. And it can lead to vital losses once they do.

To offset this, the likes of Authorized & Normal must try to generate sufficient revenue utilizing the premiums they obtain. And that brings me to the second concern – that is getting tougher.

Falling rates of interest imply bond yields are taking place. And I count on this to proceed subsequent 12 months, presenting a problem for insurers seeking to make investments their premiums at respectable charges.

Is that this a shopping for alternative?

There’s a constructive facet to rising rates of interest – the worth of the bonds Authorized & Normal holds ought to improve. And analysts clearly consider the market’s overestimating the long run challenges.

They is perhaps proper, however I don’t suppose that is in any respect apparent. Even for passive revenue traders, I feel there are higher alternatives to contemplate elsewhere.