Bitcoin mining firm Riot shares are predicted to make a comeback after experiencing a 28.96% decline in year-to-date. Its shares are on an upward pattern in anticipation of the corporate’s Q3 2024 earnings report on Oct. 30.

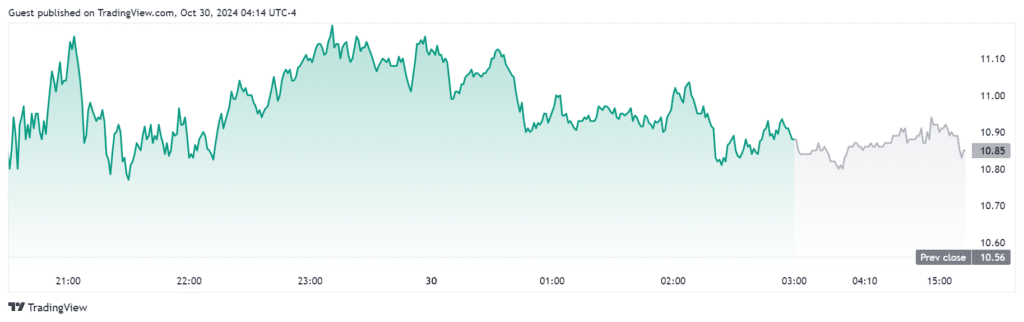

In response to information from Buying and selling View, Riot’s shares are on the rise at practically 3% up to now day. The Bitcoin (BTC) mining firm is anticipated to launch its third quarter 2024 earnings on Oct. 30 after markets shut at 4:00 PM EST.

Riot Platform’s shares have been experiencing a year-to-date decline of 28.96%. Though, its inventory value has seen an increase of 13.91% up to now yr. In reality, the corporate is anticipating a lack of $0.16 per share with revenues of $95.35 million. On the time of writing, the Riot inventory is buying and selling palms at $10.87.

You may also like: Riot Platforms mined 412 Bitcoin in September

Chart exhibiting Riot Platform’s inventory value, October 30, 2024 | Supply: Buying and selling View

Though issues aren’t wanting good, there are indicators that counsel a turnaround for Riot could also be attainable. Riot’s shares are on a bullish run, going above their 5, 20,and 50-day exponential transferring common. If it might keep its bullish strain, Riot Platforms might expertise a comeback.

Furthermore, Riot’s transferring common convergence or divergence is indicated to be constructive, at 0.73. Whereas the shares’ Relative Power Index is at 73.07, which implies that the inventory is presently in overbought territory.

Primarily based on information on Buying and selling View, the inventory has been going up as a result of the same rise additionally present in different crypto mining shares.

Reminder: Riot’s Q3 2024 earnings convention name is tomorrow, Wednesday, October 30, 2024, at 4:30 PM EST!

🖥 For the audio-only webcast, register right here: https://t.co/YOrtZ57wgo.

📞 To dial in from the U.S. or internationally, register right here: https://t.co/yNuMCbHmKX.

— Riot Platforms, Inc. (@RiotPlatforms) October 29, 2024

On Oct. 29, Riot Platforms posted a reminder on its X account that the corporate will likely be holding a convention name to go over its third quarter Q3 2024 earnings report on Oct. 30 4:30 PM EST. Its earlier Q2 2024 earnings report confirmed a complete income of $70 million, lowering by 8.7% in comparison with its Q2 2023 income, which was $76.7 million.

The corporate acknowledged the lower was pushed by a $9.7 million lower in engineering revenues. Although, this was offset by a $6 million improve in Bitcoin mining income.

In response to its press launch, Riot is a Bitcoin mining and digital infrastructure firm centered on a vertically built-in technique. Based in 2000, Riot has Bitcoin mining operations positioned in central Texas and Kentucky, in addition to electrical switchgear engineering and fabrication operations in Denver, Colorado.

You may also like: Bitfarms and Riot attain settlement, reveal board adjustments