Picture supply: Getty Pictures

Halma (LSE:HLMA) has loved one other spectacular yr in 2024. The FTSE 100 inventory — which manufactures security tools and hazard detection gear — continues to ship document performances regardless of the robust financial backdrop.

One other glowing buying and selling replace on Thursday (21 November) has pushed Halma shares 8% increased. This takes whole features because the begin of the yr to twenty%.

Is that this the Footsie‘s greatest progress inventory to purchase at this time?

£1bn gross sales landmark

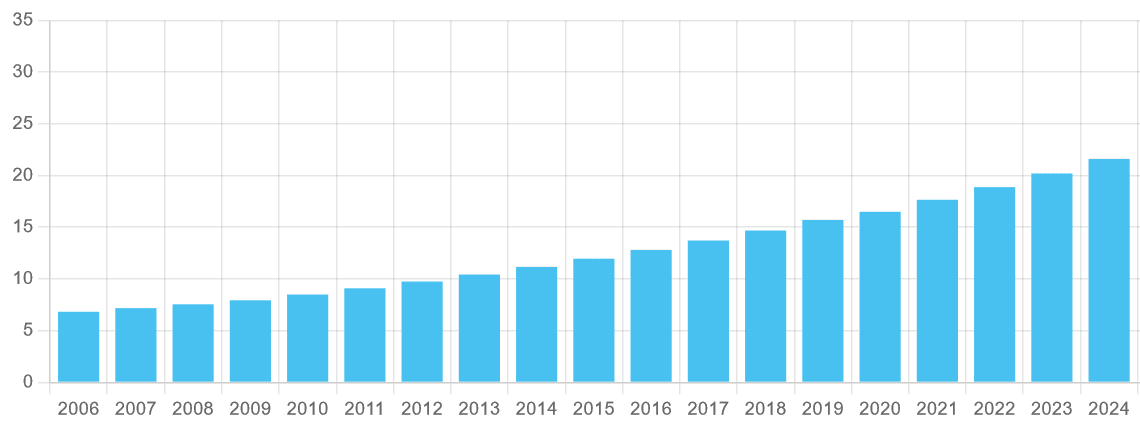

Halma’s a grasp of figuring out profitable acquisitions and squeezing each drop of worth from them. It’s why the M&A-driven enterprise has delivered 21 consecutive years of document income.

Thursday’s replace confirmed that the technique continues to repay splendidly. Revenues soared 13% between April and September to recent all-time peaks of £1.07bn. Natural revenues have been up 11.5% within the interval, with new acquisitions making up the rest.

Halma’s adjusted EBIT margin rose 70 foundation factors, to twenty.7%, due to energy at its Environmental & Evaluation unit. Mixed with these booming gross sales, adjusted EBIT soared 17% to £222.5m.

Pre-tax revenue was up 16% at £174m, additionally a brand new all-time peak.

Causes to be cheerful

Unsurprisingly, this record-setting efficiency — one which beat even Halma’s lofty expectations — has received the market buzzing. However that is solely half the story.

In addition to delivering spectacular revenues and income progress, the Footsie agency additionally reported exceptional money creation for the primary half.

Money conversion clocked in at 108%, surging from 96% in the identical 2023 interval. It was additionally manner forward of the corporate’s 90% goal.

That is vital for 2 causes. Firstly, it provides Halma further energy to make extra earnings-boosting acquisitions. By the way, the agency’s net-debt-to-adjusted-EBITDA ratio additionally fell to 1.27 instances from 1.42 instances, additional inside its objective of two instances and beneath.

Secondly, Halma’s money enhance has enabled it to ship one other spectacular dividend enhance.

At 9p per share, the interim payout has been raised 7% yr on yr. This reinforces the corporate’s attraction as one of many FTSE 100’s greatest dividend progress shares (annual dividends have risen for 45 straight years).

A high purchase?

There’s clearly quite a bit to get enthusiastic about over at Halma then. However would I purchase its shares at this time? I’m not so certain.

That is clearly a high-quality firm with a shiny outlook. It has loads of monetary firepower to capitalise on what it’s described as its “wholesome pipeline of potential acquisitions“. It additionally has appreciable progress alternatives throughout its developed and rising markets.

Nonetheless, I really feel that a lot of that is now baked into Halma’s share worth. Following at this time’s features, the corporate now trades on an enormous ahead price-to-earnings (P/E) ratio of 30.2 instances.

That is greater than double the Footsie common of 14.2 instances.

Halma’s excessive valuation might restrict any additional share worth features. It might even immediate a share worth reversal if the blockbuster buying and selling updates dry up. This may occur, for example, if the worldwide financial system takes a recent downturn.

I’ll give Halma a detailed look if it falls in worth. However for the second I’m completely satisfied to sit down on the sidelines.