Picture supply: Getty Pictures

Investing in FTSE 100 worth shares gives a possibility for share pickers to supercharge their long-term returns. The idea is that undervalued corporations could rebound strongly as market perceptions enhance, delivering spectacular capital positive factors within the course of.

Vodafone Group (LSE:VOD) is one cheap-as-chips Footsie inventory on my radar at present. Its shares appear to supply distinctive worth throughout a spread of metrics, together with predicted earnings and dividends, in addition to the worth of its belongings.

Whereas they’re not with out threat, right here’s why I feel Vodafone shares are value an in depth look from worth traders.

Earnings

First we’ll take a look at how the telecoms titan is valued utilizing the price-to-earnings (P/E) ratio.

For this monetary yr (to March 2025), Vodafone has a P/E of 9.9 occasions. To place that in context, the FTSE 100 common sits on the next 14.3 occasions.

However how does this evaluate with readings throughout the broader sector? Because the desk exhibits, Vodafone additionally scores pretty effectively on this metric versus different main trade gamers.

| Firm | Ahead P/E ratio |

|---|---|

| Telefónica | 15.1 occasions |

| Orange | 9.7 occasions |

| Deutsche Telekom | 16.4 occasions |

| A&T | 10.5 occasions |

| Verizon Communications | 9.6 occasions |

| T-Cell | 25.9 occasions |

Dividends

Telecoms corporations are famed for offering giant dividends because of their steady, recurring revenues and excessive money flows.

Earlier in 2024, Vodafone introduced plans to rebase its dividends with a purpose to reduce debt. But regardless of this, the ahead dividend yield, at 6.3%, nonetheless soars above the Footsie common of three.6%.

Moreover, the yield on Vodafone shares additionally beats the corresponding studying of most of its sector rivals.

| Firm | Ahead dividend yield |

|---|---|

| Telefónica | 6.9% |

| Orange | 7.4% |

| Deutsche Telekom | 2.9% |

| A&T | 4.9% |

| Verizon Communications | 6% |

| T-Cell | 1.2% |

Property

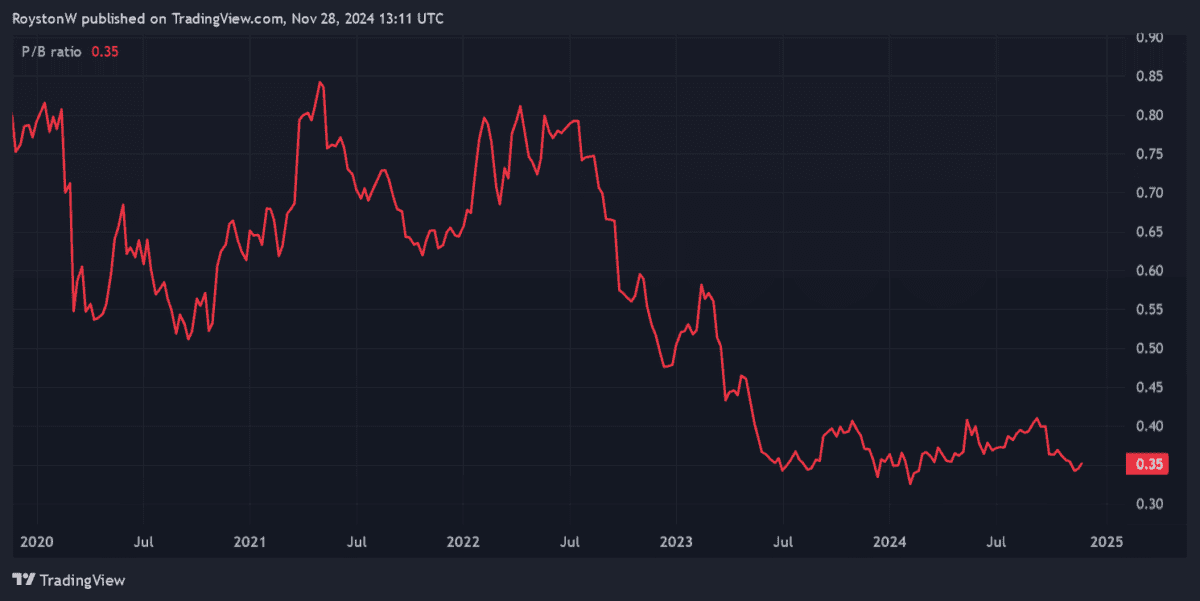

The ultimate factor I’m contemplating is how low cost Vodafone shares are in relation to its e book worth. That is the worth of the agency’s complete belongings minus complete liabilities.

At the moment the price-to-book (P/B) a number of is round 0.4. This comfortably is available in under the worth watermark of 1.

Time to think about shopping for?

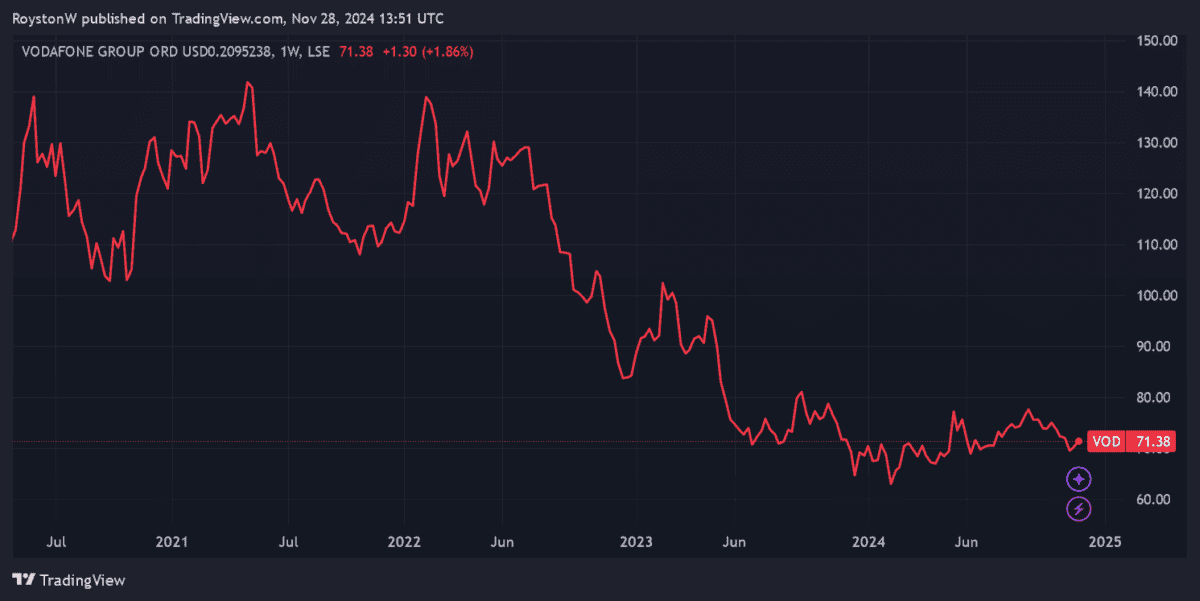

So all in all, Vodafone scores fairly effectively. However certainly there should be a catch? In any case, the agency’s share value is down 54% within the final 5 years, indicating potential inside and/or exterior issues.

Arguably the most important concern is the dimensions of the corporate’s debt pile. Regardless of current divestments, this remained at an eye-watering €31.8bn as of September.

This might considerably affect Vodafone’s development plans and weigh on future dividends. Given how capital intensive its operations are, such excessive money owed are particularly worrying.

But on stability, I imagine the potential advantages of proudly owning Vodafone shares could outweigh the dangers. It nonetheless faces issues in Germany following modifications to service bundling legal guidelines. However gross sales are rising strongly in its different European territories, to not point out in Africa (the place natural first-half revenues soared 9.7%).

Vodafone’s refocussed efforts on its Enterprise division are additionally paying off, with natural service income development dashing as much as 4% within the six months to September.

With its scale and market-leading model, I feel Vodafone might be a good way for traders to capitalise on the rising digital economic system over the long run. At present costs, I feel it calls for critical consideration.