Picture supply: Getty Photographs

In comparison with abroad equities, the returns on UK shares have broadly underwhelmed over the previous decade. A mix of low financial development and excessive political turbulence have restricted share value features as traders have prioritised shopping for overseas shares.

But there have been some spectacular performances from specific British shares over this time. Take these two FTSE 100 blue-chips, as an example:

| Inventory | Common annual return since 2014 |

|---|---|

| JD Sports activities (LSE:JD.) | 17.5% |

| Scottish Mortgage Funding Belief (LSE:SMT) | 14.9% |

To place their sturdy performances into context, the annual returns of FTSE 100 and S&P 500 over the identical timeframe sit approach again, at 6.1% and 12.7%, respectively.

I’m optimistic that they might proceed to outperform these heavyweight indexes for the subsequent decade too. Right here’s why.

Tech belief

Surging demand for tech shares has underpinned the S&P‘s robust features of the previous decade. So it’s not robust to see why Scottish Mortgage Funding Belief — which supplies focused publicity to on-line retailers, software program builders and the like — has delivered superior returns.

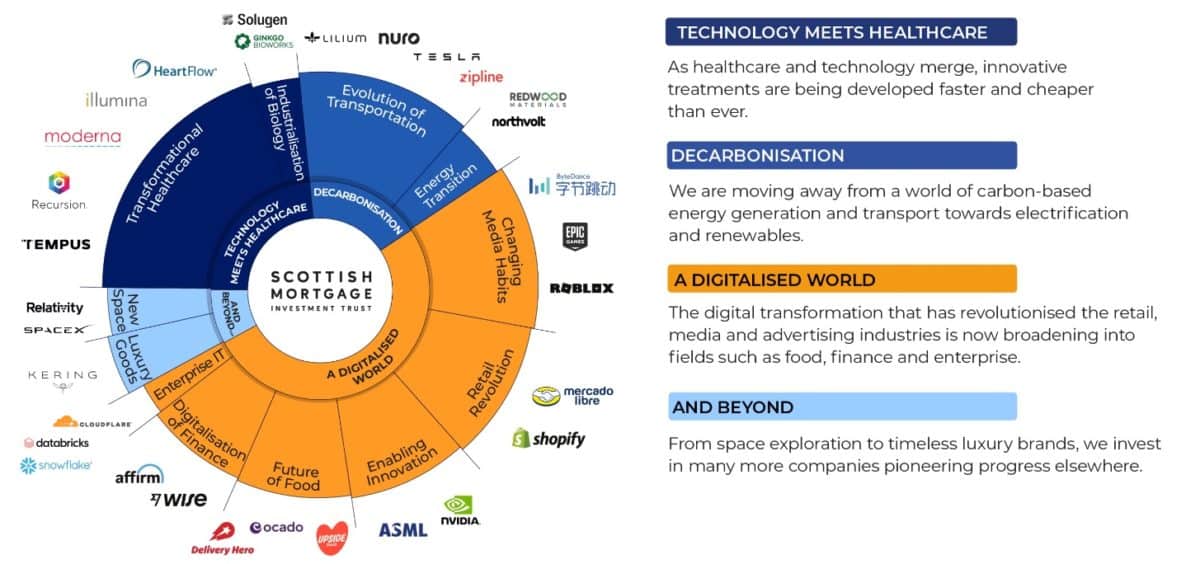

Holdings like Amazon, Tesla and Apple imply the belief has capitalised on scorching developments like e-commerce development, electrical automobile (EV) adoption and hovering smartphone gross sales. In the present day it has stakes in 95 completely different corporations, giving it publicity to a large number of white-hot development sectors for the subsequent decade.

All this being stated, the dangers of proudly owning Scottish Mortgage are rising. I’m fearful that an escalating tech commerce warfare between the US and China might dampen annual returns over the subsequent 10 years.

In December, the US slapped recent restrictions on superior microchip shipments to China. Inside days, Beijing stated it was investigating Nvidia on the grounds of breaking native anti-monopoly legal guidelines.

These tit-for-tat actions might intensify additional as soon as tariff fan and China critic Donald Trump returns to the White Home this month. However regardless of this, there’s an excellent likelihood in my view that Scottish Mortgage will ship one other decade of market-beating returns.

World digitalisation is poised to proceed at fast tempo, offering the belief with terrific revenue potential. Fields like synthetic intelligence (AI) and robotics particularly have important scope for development.

Sports activities star

JD Sports activities had a poor 2024 as inflationary pressures and better rates of interest squeezed client spending. These stay risks throughout the sportswear retailer’s US, UK and European markets within the New Yr and probably past.

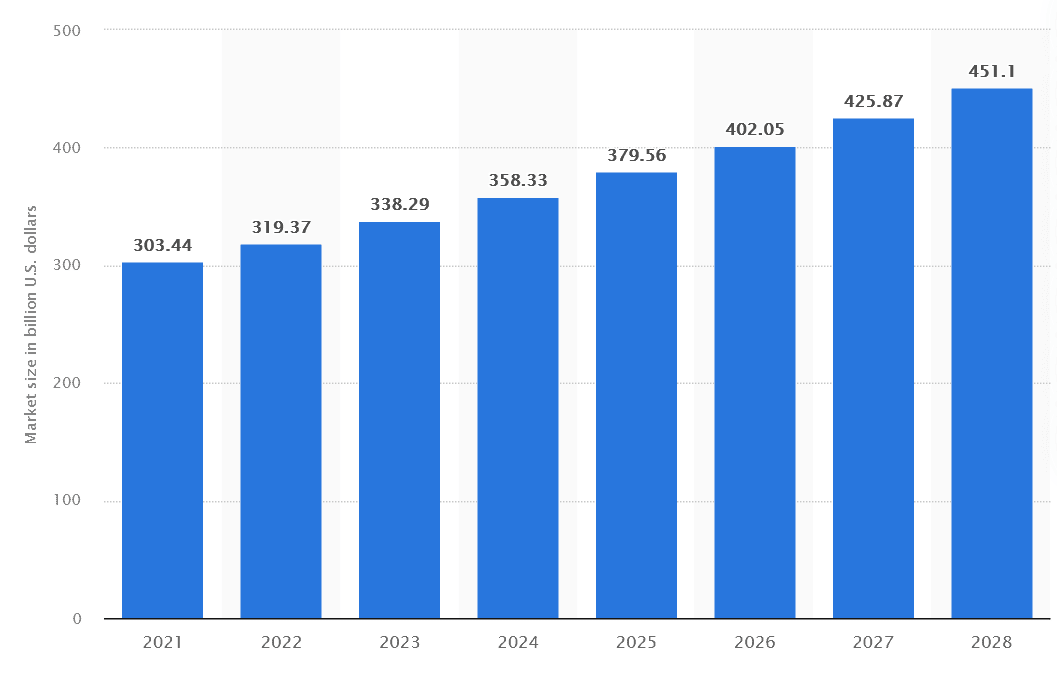

However as with Scottish Mortgage, I believe the potential long-term rewards right here make it worthy of consideration. The worldwide activewear (or athleisure) market is tipped to proceed taking off, because the chart from Statista under reveals.

As we noticed over the last decade, JD ought to be in fine condition to capitalise on this chance. Below its long-running growth scheme, it plans to open between 250 and 350 shops annually via to round 2028.

A powerful stability sheet additionally offers the Footsie agency scope to make extra earnings-boosting acquisitions. Its most up-to-date acquisition was France’s Courir, whose completion in December boosts JD’s presence in Europe’s largest sneaker market.

I additionally like JD’s main place within the premium athleisure market the place development is very robust. Given its low price-to-earnings (P/E) ratio of seven.5 occasions, I believe it has important room for a share value restoration.