Picture supply: Getty Pictures

Taking a diversified method to investing doesn’t must imply disappointing returns. The efficiency of Scottish Mortgage Funding Belief (LSE:SMT) shares over the previous decade gives an ideal illustration of this.

Since across the begin of the Millennium, this funding belief has been targeted on high-growth know-how (and tech affiliated) shares. And since 2015, the FTSE 100 share has delivered a mean annual return of 15.2%.

By comparability, the broader Footsie has delivered a yearly common of 6.2%.

Previous efficiency isn’t a assure of future returns, nonetheless. And there are challenges going through the tech sector that would impression the belief’s future earnings.

So what are Scottish Mortgage’s earnings and share value prospects for the following couple of years? And may I purchase it for my very own portfolio at the moment?

Development alternatives

Acquiring earnings forecasts for funding trusts is difficult. It is because their earnings rely on the efficiency of the underlying investments, which could be extraordinarily risky and tough to foretell.

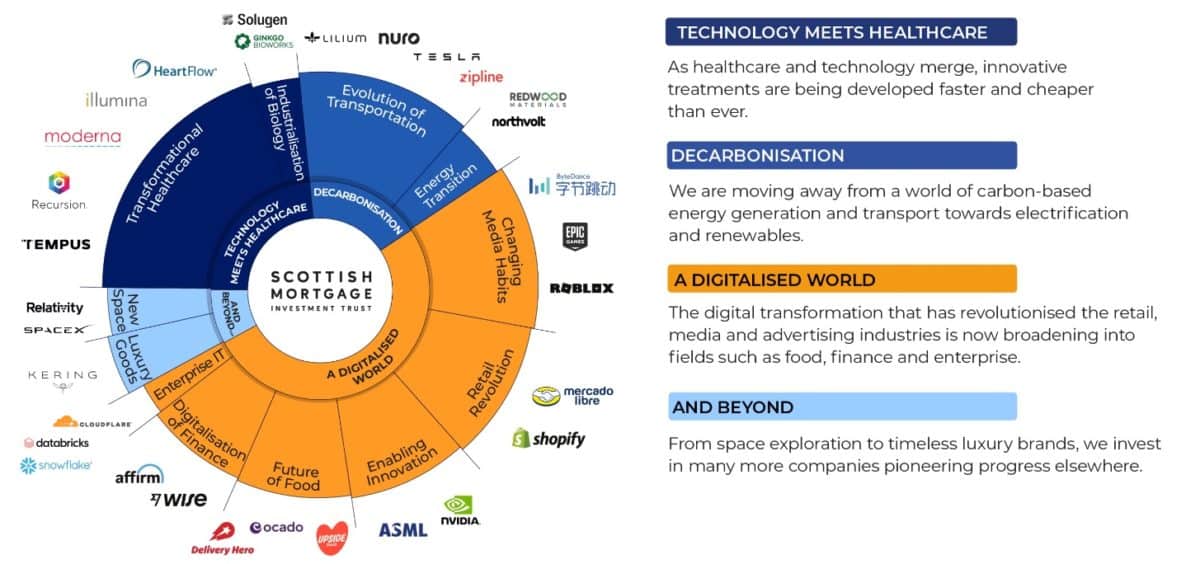

In complete, Scottish Mortgage has holdings in 95 totally different tech shares and trusts. A few of its largest holdings are microchip producer Nvidia, e-retailers Amazon and MercadoLibre and social media large Meta.

Whereas near-term earnings are robust to nail down, the belief has vital progress potential over an extended horizon. Because the graphic under reveals, it gives a large number of the way for buyers to capitalise on the rising digital economic system.

One other good thing about this explicit belief is that it provides buyers publicity to non-listed firms they’ll’t put money into straight. These embody Elon Musk’s area transportation firm SpaceX, whose worth has roughly doubled in a 12 months to round $350bn.

Round 7.5% of the belief is devoted to this particular firm.

Hazard forward?

However like every funding, there are dangers to Scottish Mortgage’s earnings and share value efficiency within the close to time period and past.

One is a possible slowdown within the world economic system that damages company and shopper spending. Expertise shares are among the most cyclical on the market, and so they usually sink sharply in worth throughout downturns.

Recent commerce tariffs throughout key areas are one other hazard that would have an effect on the tech sector particularly severely. Potential penalties embody weaker gross sales, provide chain disruptions, higher manufacturing prices and diminished innovation, all of which may considerably dent the belief’s efficiency.

Right here’s what I’m doing

But I consider these threats could also be baked into the belief’s low valuation. At £10.54 per share, it trades at a near-8% low cost to its web asset worth (NAV) per share of £11.40. This leaves a wholesome margin of error that would defend in opposition to extreme share value volatility.

I have already got vital publicity to the tech sector via a few funds I maintain. Alongside an S&P 500-tracking exchange-traded fund (ETF) from HSBC, I’ve additionally invested within the extra focused iShares S&P 500 Info Expertise Sector ETF.

With out my current tech publicity, I’d critically think about including Scottish Mortgage shares to my portfolio. I believe its diversified method is an effective way to seize progress alternatives whereas concurrently spreading threat.

For buyers looking for publicity to the booming tech sector, I consider the belief is value critical consideration.