Picture supply: Nationwide Grid plc

Over the previous yr, Nationwide Grid (LSE: NG) has moved up 2% on the London inventory alternate. The Nationwide Grid share worth is inside 6% of the place it stood 5 years in the past.

Issues could possibly be worse. At the least the share worth has moved in the fitting route.

For some buyers, the share worth could also be irrelevant. Nationwide Grid is widespread for its dividend. Its place within the utility business is perceived to supply steady money flows that may assist a dividend the agency goals to develop in keeping with inflation.

As an investor although, ought I to take that method and think about simply the dividends?

Why a share worth issues

if I make investments cash in a share and the value falls, I don’t lose something – except I promote. At that time, a paper loss crystallises into an precise one.

So even when I purchased Nationwide Grid shares as we speak and the value fell (it’s down 13% since Could 2022, for instance) I’d solely lose cash if I offered at that worth.

Nevertheless, most buyers in the end will think about promoting shares. Even long-term shareholders might change their monetary aims or view of an organization, for instance.

So a falling share worth generally is a concern if it appears unlikely to get better. Tying cash up for years in shares which have a paper loss also can carry a possibility price as these funds can’t be used for different issues.

How safe is the dividend?

So I would definitely take note of the Nationwide Grid share worth even when I anticipated the dividends to maintain coming.

However utilities aren’t as safe as some shareholders imagine with regards to sustaining their dividends, not to mention rising them repeatedly.

Need an instance? Have a look at SSE. Final yr’s dividend was 60p per share. Again in 2020, it was 80p. In 2015, it was 88.4p. A lot for utilities being dependable long-term dividend payers. No dividend is ever assured.

More and more alarming debt ranges

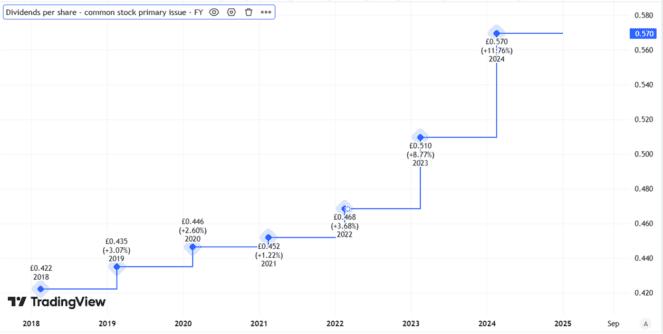

In equity, Nationwide Grid has a superb monitor report with regards to annual dividend progress.

Created utilizing TradingView

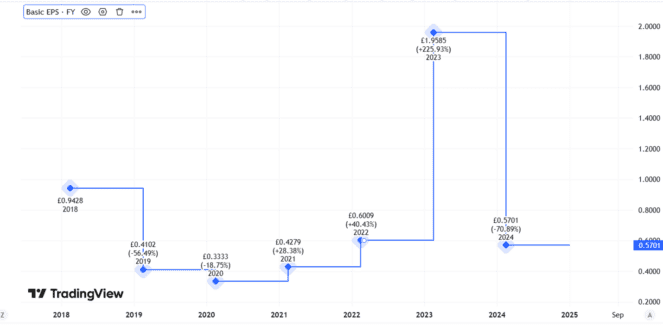

However have a look at the agency’s primary earnings per share.

Created utilizing TradingView

They transfer round lots – and don’t all the time cowl the dividend.

Proudly owning and sustaining an power community is dear enterprise, particularly now at a time when power is being generated and the place it’s being consumed are in flux in comparison with historic norms.

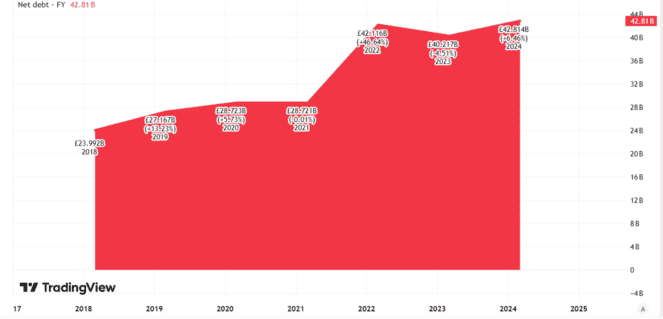

Meaning Nationwide Grid has to spend so much to maintain its enterprise operating. So its internet debt has grown over time.

Created utilizing TradingView

Final yr noticed a rights difficulty designed to assist increase funds out there for gadgets together with capital expenditure. That diluted shareholders.

I see a danger of an analogous transfer in future if Nationwide Grid needs to ship on its purpose of conserving the dividend rising yearly in keeping with inflation. Another, sooner or later, is for the corporate to scale back the payout like SSE has repeatedly carried out. If that occurred, it might ship the share worth tumbling.

So though its distinctive community property will help generate sizeable money flows, I’ve no plans so as to add Nationwide Grid shares to my portfolio.