Trump’s newest tariff hikes on China could shift the worldwide Bitcoin mining trade offshore, as home miners face elevated premiums on {hardware} prices.

Bitcoin (BTC) mining could quickly shift additional offshore as U.S. miners face rising {hardware} prices. On Wednesday, April 9, a brand new report from Hashlabs Mining CEO Jaran Mellerud highlighted the financial affect of U.S. tariffs on the home crypto mining trade. In keeping with the report, these tariffs may improve mining tools prices within the U.S. by not less than 22% in comparison with different international locations.

Particularly, U.S. crypto miners rely closely on imported {hardware} from Asian international locations resembling China, Indonesia, Malaysia, and Thailand — all of which at the moment are topic to a minimal 24% tariff on all items, together with mining rigs.

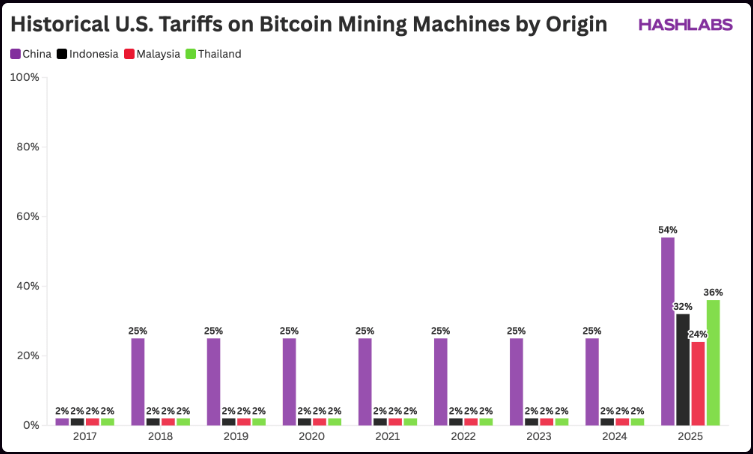

US tariffs on Bitcoin mining tools by nation of origin | Supply: Hashlabs

Even in probably the most favorable situation — sourcing solely from Malaysia, which faces the bottom fee — tools prices would nonetheless rise by 24%. Nonetheless, this situation is unrealistic, as U.S. imports come from a mixture of suppliers throughout the area. Notably, the figures cited within the report don’t but account for the current 50% tariff hike on Chinese language items, which raises the whole tariff fee to 104%.

Nonetheless, there’s a mining tools stockpile within the U.S., which can drive costs down. As these shares are depleted, miners will probably need to pay a premium someplace between 22% and 36% for the tools, in comparison with different international locations. These figures come from Ethan Vera, the CEO of Luxor crypto mining firm, and are echoed within the Hashlabs Mining report.

U.S. Miners scrambled to import rigs forward of tariffs

This report is in keeping with earlier fears by trade insiders. Gadi Glikberg, CEO of CodeStream, acknowledged that whereas tariffs will decelerate the expansion of the US mining trade. Resulting from the price of tools impacting their return on investments, additional enlargement plans are unlikely.

“The newly imposed tariffs are unlikely to set off a mass exodus. Nonetheless, they might decelerate or redirect future enlargement plans, as miners reassess the long-term cost-efficiency of scaling operations inside the US,” Gadi Glikberg, CEO of CodeStream.

Taras Kulyk, CEO of mining tools brokerage Synteq Digital, revealed that his agency was working to hurry deliveries earlier than the tariff hike took impact.

You may also like: BTC mining hashrate hits ATH, intensifying strain on U.S. miners squeezed by tariffs