Picture supply: Getty Photographs

Searching for one of the best low cost UK shares to purchase proper now? Listed here are two I believe deserve critical consideration proper now.

RWS Holdings

The projected rise of synthetic intelligence (AI) poses a danger to an unlimited vary of corporations. This contains RWS Holdings (LSE:RWS), which offers translation and localisation providers to companies across the globe.

But, whereas this disruptive menace calls for critical consideration, I believe the corporate is probably not as affected as some worry. It is because a number of the sectors it covers — assume authorized providers, life sciences, and aerospace and defence, for example — require 100% content material accuracy all the time.

As an example, any inaccuracies in jet design documentation might compromise security, resulting in expensive errors and even catastrophic outcomes. Is it possible that corporations will wish to entrust such duties AI? I’m not so positive, that means companies which have specialist technical information like RWS will stay in excessive demand.

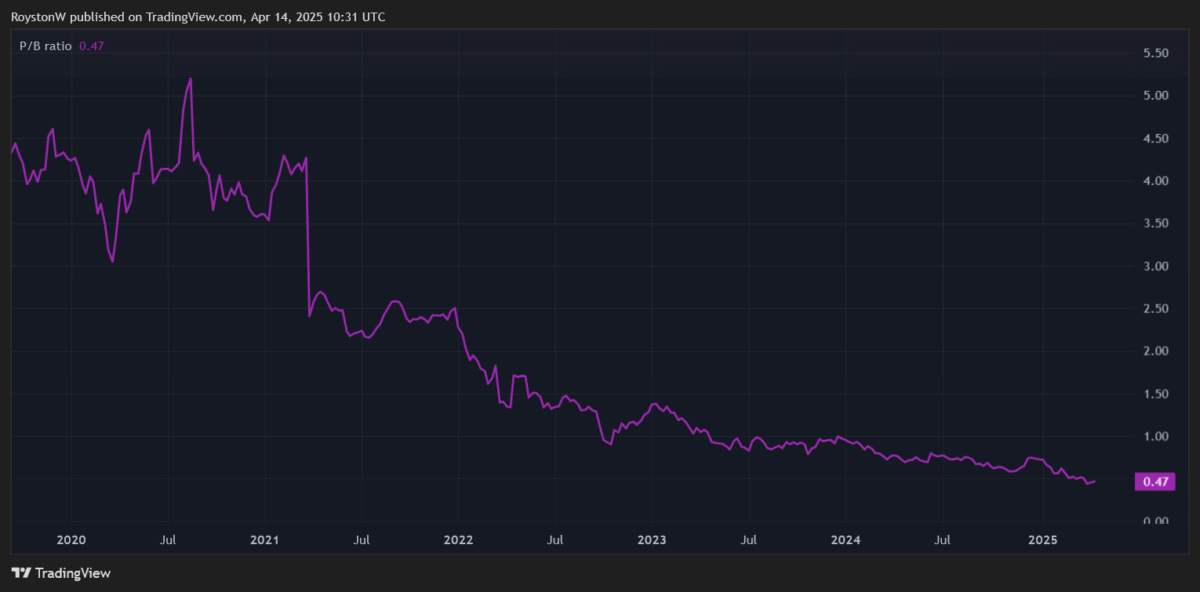

At present costs, I believe the corporate may very well be an excellent cut price share to think about. At 115p, it trades on a ahead price-to-earnings (P/E) ratio of 5.7 occasions, and its price-to-book (P/B) ratio is underneath 0.5.

Any P/B beneath one signifies {that a} share is reasonable relative to the worth of its belongings.

Lastly, with an 11% ahead dividend yield, RWS shares have one of many highest dividend yields on the London inventory market as we speak. Money payouts right here have risen constantly since 2016.

It’s essential to notice that RWS’ sliding share value has pumped the yield as much as present ranges. I’m optimistic that they’ll rebound, however there may very well be extra turbulence within the close to time period if worries over AI and the broader economic system develop.

The Renewables Infrastructure Group

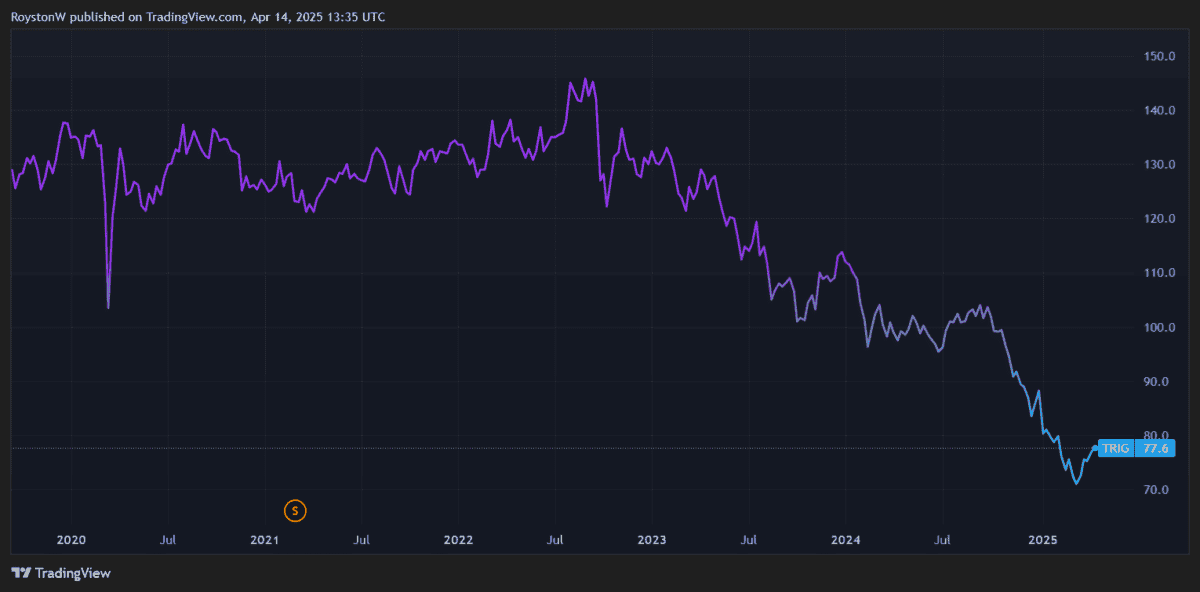

Utilites shares like Renewables Infrastructure Group (LSE:TRIG) have been hit badly by higher-than-usual rates of interest since late 2022. And whereas charges are starting to come back down, indicators of returning inflation might hamper any additional plans by central banks to loosen financial coverage.

But it’s my perception that this menace to Renewables Infrastructure is greater than baked into the cheapness of its shares. Immediately, the corporate trades at 77.9p per share, which is 33.4% decrease than its estimated internet asset worth (NAV) per share.

On high of this, its ahead P/E ratio is an undemanding 9.6 occasions. And the agency’s corresponding dividend yield is a large 9.7%.

I believe excessive value weak spot lately might have created a sexy shopping for alternative for affected person traders. Whereas the corporate might endure some near-term turbulence, I believe income might soar long term as world power demand will increase.

The Worldwide Vitality Company (IEA) forecasts that energy demand from information centres alone will double between now and 2030, a sum equal to your complete electrical energy consumption of Japan as we speak. With nations taking steps to scale back their fossil gas uptake, renewable power shares have appreciable earnings potential.

Renewables Infrastructure is one in every of my favorite performs on this theme. With photo voltaic, wind, and battery storage belongings overlaying the breadth of Europe in its portfolio, it offers a diversified (and due to this fact decrease danger) approach for traders to realize publicity.