Picture supply: Getty Photos

Searching for the best, low cost FTSE 250 shares to purchase proper now? Listed here are three high quality bargains to think about.

Hochschild Mining

The valuable metals value surge has lifted Hochschild Mining (LSE:HOC) shares by the roof in current instances. However buyers can nonetheless get good worth from the gold and silver producer as we speak.

Metropolis analysts suppose annual earnings right here will soar 104% 12 months on 12 months in 2025. That leaves it buying and selling on a price-to-earnings (P/E) ratio of 10.4 instances. On high of this, Hochschild’s corresponding price-to-earnings progress (PEG) ratio is 0.1. Any studying beneath 1 signifies {that a} inventory is undervalued.

The FTSE 250 miner owns a handful of property throughout South America, which leaves earnings at group degree much less delicate to remoted operational issues. Prices stay a large scale subject nevertheless and in January, Hochschild hiked its price forecasts for the 12 months.

But regardless of these pressures, I consider gold and silver’s continued bull run makes the mining large a gorgeous share to consider.

Grocery store Revenue REIT

Buyers looking for safety from an escalating commerce struggle have piled into Grocery store Revenue REIT (LSE:SUPR) shares in current weeks. The belief’s deal with the ultra-stable meals market, mixed with its deal with the UK, make it a pure protected haven as world buying and selling guidelines face a possible earthquake.

But regardless of these value beneficial properties, the actual property funding belief (REIT) nonetheless gives wonderful worth proper now. It trades at a meaty 12.4% low cost to its estimated internet asset worth (NAV) per share.

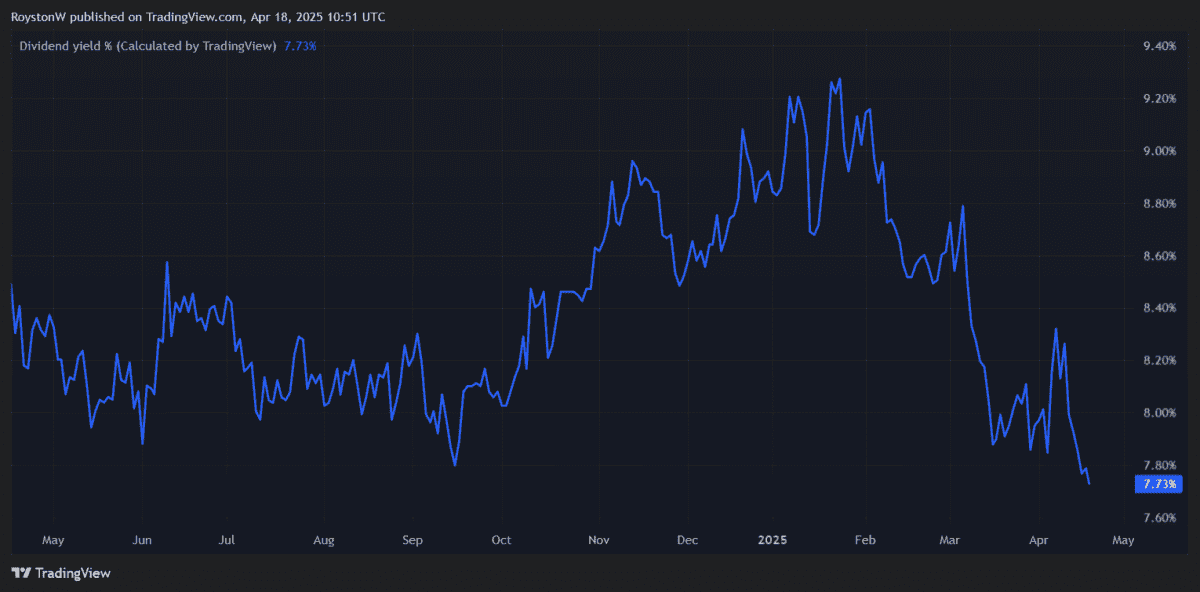

The belief additionally continues to supply market-smashing dividend yields. Approaching 8%, its ahead studying makes mincemeat of the three.7% common for FTSE 250 shares.

Grocery store Revenue — which rents properties out to retail giants reminiscent of Tesco, Sainsbury’s and Carrefour — gives distinct benefits to dividend chasers. In change for tax perks, at the least 90% of its annual rental earnings should be paid out to shareholders.

Be aware when contemplating this one which total returns could possibly be impacted by rate of interest adjustments that hit NAVs and drive up borrowing prices.

Please word that tax remedy relies on the person circumstances of every consumer and could also be topic to alter in future. The content material on this article is offered for data functions solely. It’s not meant to be, neither does it represent, any type of tax recommendation.

Crest Nicholson

With the UK economic system spluttering, a sustained get well for housebuilders like Crest Nicholson (LSE:CRST) is certainly not assured. And that’s not the one menace, as a possible commerce struggle may gasoline inflation and drive up housebuyer prices by larger rates of interest.

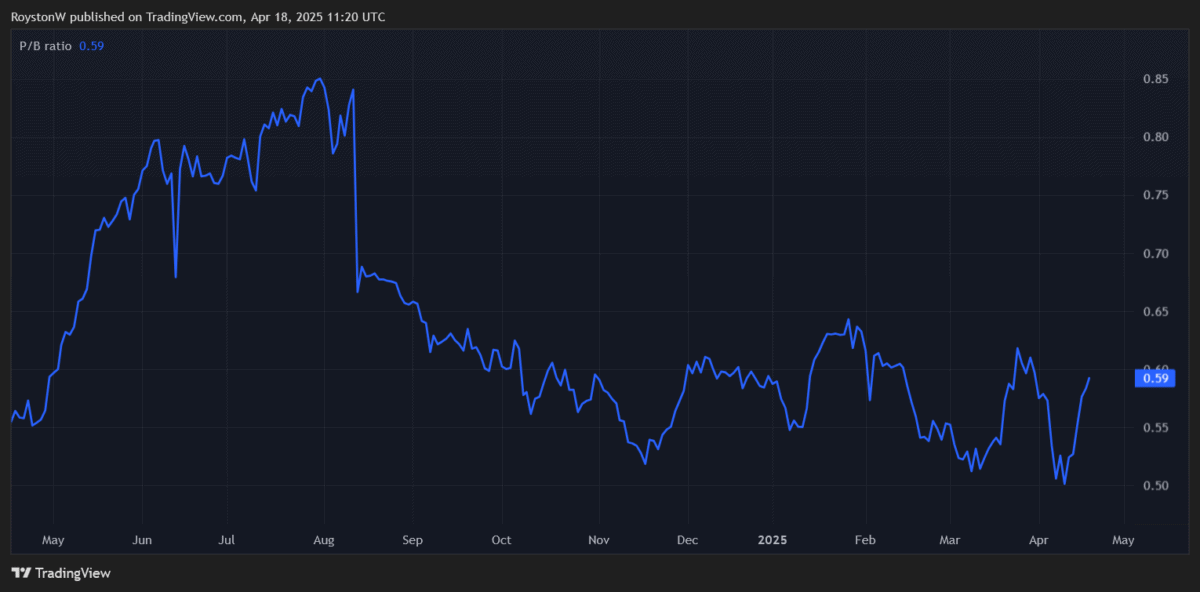

Nonetheless, I feel this menace’s baked into many of those firms’ low valuations. With this specific FTSE 250 operator, its shares commerce on a price-to-book (P/B) ratio beneath 1, which means a reduction relative to the worth of the agency’s property.

Potential buyers right here also needs to be inspired by the resilience of the housing market regardless of powerful financial circumstances. Crest Nicholson’s personal open market gross sales fee (excluding bulk purchases) was 0.61 within the 10 weeks to 14 March, up from 0.5 a 12 months earlier.

Housebuilders like this could possibly be nice long-term investments to analysis too, as Britain’s hovering inhabitants drives demand for brand new houses.