The BP (LSE:BP.) share worth is now (7 Could) 32% under its 52-week excessive. A falling oil worth, considerations over how Trump’s tariffs would possibly affect world power demand, and an inner debate on how ‘inexperienced’ the group must be, have all performed their half in knocking over £25bn off the group’s inventory market valuation.

To compound issues, its 2025 first quarter earnings fell in need of analysts’ expectations. If that wasn’t sufficient to spook buyers, the group additionally reported an surprising leap in web debt of $3.97bn (17%), in comparison with the tip of 2024.

Not all unhealthy

However regardless of its current issues, I believe its shares provide good worth in the mean time.

That’s why, in widespread with activist investor Elliott Funding Administration (EIM), I not too long ago took a stake in BP. Admittedly, my place’s a lot smaller than its 5%, which was disclosed to the market in April.

It’s reported that EIM founder Paul Singer needs BP to considerably minimize its prices. In keeping with the Monetary Instances, he believes it’s doable to extend free money move by 40%. To attain this, he needs to see $5bn of extra (over and above these already deliberate) annual price financial savings.

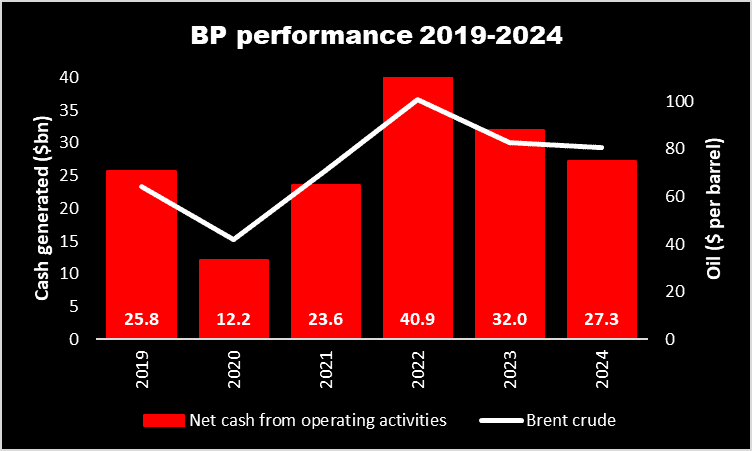

Certainly, the group does seem like bloated. Reuters claims that the power big’s working bills as a proportion of EBITDA (earnings earlier than curiosity, tax, depreciation and amortisation) have elevated from 70% in 2019, to 113% in 2024.

To my shock, BP now employs extra folks than Shell, its a lot bigger FTSE 100 rival.

Moral buyers look away now

EIM additionally needs to see a slower transition to renewable power.

In February, BP advised buyers that it was slicing capital expenditure in its ‘clear’ power division. It additionally deserted its earlier dedication to scale back oil and gasoline manufacturing by 20-30% by the tip of the last decade.

This displays the truth that, regardless of the transfer to web zero, world demand for oil and gasoline continues to rise. And most economists count on this development to proceed for a lot of extra years.

Endurance is vital

It takes time for price financial savings to be carried out, particularly in complicated teams working throughout a number of jurisdictions.

Subsequently, within the quick time period, I believe BP’s outcomes can be extra closely influenced by the value of oil. In keeping with its personal evaluation, a $1 motion in Brent crude has a $340m affect on earnings.

However oil costs are unattainable to foretell precisely.That’s why I’m anticipating some short-term worth volatility. It’s one of many dangers related to the sector.

And till the consequences of BP’s deliberate modifications develop into seen in its monetary efficiency, I’ll take consolation from the beneficiant dividend on provide.

Though BP halved its payout within the second quarter of 2020, it’s been steadily growing it since. In money phrases, it’s now 23.8% decrease than earlier than the 50% minimize. And partially because of its disappointing share worth efficiency, it’s now within the high 10 of FTSE 100 dividend payers, with a yield of 6.8%.

At this stage, it’s unclear how a lot affect EIM could have on the strategic selections made by the oil big. However in February, BP’s administrators acknowledged that the group’s efficiency wanted to enhance. With modifications underway, and EIM performing as a robust observer, I’m optimistic this can occur, though I settle for it’d take a while.