Picture supply: Getty Pictures

I don’t suppose there’s a greater method for me to supply a passive revenue than by shopping for UK dividend shares. London’s inventory market is full of high-yield revenue shares with robust stability sheets and strong market positions, of which many are additionally dependable dividend development shares.

Listed below are two such dividend heavyweights I feel deserve severe consideration. As you’ll be able to see, their dividend yields comfortably beat the FTSE 100‘s potential common of three.4%.

| Dividend inventory | Dividend development | Dividend yield |

|---|---|---|

| Main Well being Properties (LSE:PHP) | 1.7% | 7.2% |

| Tritax Large Field (LSE:BBOX) | 4.4% | 5.6% |

Right here’s why I feel they could possibly be among the many finest dividend shares for traders to think about proper now.

High belief

Underneath actual property funding belief (REIT) laws, Main Well being Properties has to pay at the very least nine-tenths of yearly earnings from its rental operations out in dividends.

Please word that tax remedy will depend on the person circumstances of every consumer and could also be topic to alter in future. The content material on this article is offered for data functions solely. It’s not supposed to be, neither does it represent, any type of tax recommendation.

This could make REITs extra reliable than different UK shares for a big and constant dividend revenue. But it surely doesn’t assure it, as occupancy and lease assortment points can nonetheless strike shareholder returns.

Nevertheless, Main Well being’s give attention to an ultra-defensive trade significantly reduces such dangers. It owns and operates first-contact properties like GP surgical procedures and neighborhood well being centres, websites that stay busy in any respect factors of the financial cycle.

Moreover, virtually all of its rental agreements are underpinned by NHS and authorities our bodies, offering added stability over time.

Don’t be mistaken in pondering this sector is simply brilliantly boring, nevertheless. It additionally has substantial alternative for development below the federal government’s new 10-year Well being Plan to “[move] care from hospitals to the neighborhood“.

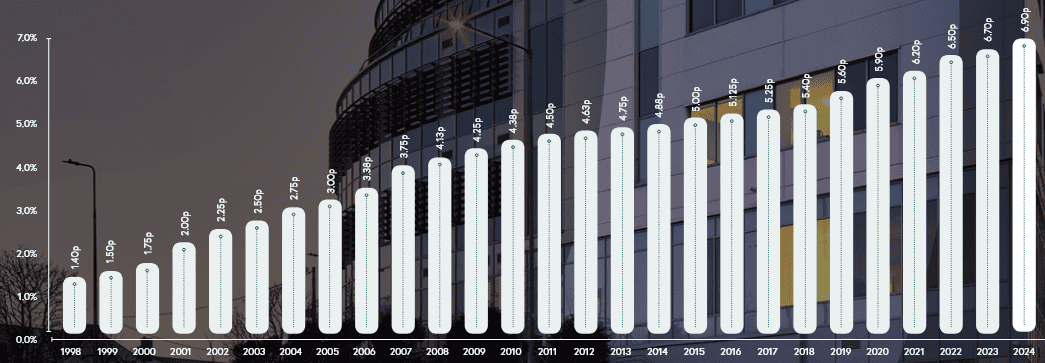

Main Well being has grown annual dividends annually because the mid-to-late Nineties. Threats to future development embrace future modifications to NHS coverage and sector oversupply than dents rental rolls.

However on stability, I feel it’s an awesome inventory to think about, and one I maintain in my very own Shares and Shares ISA.

Boxing intelligent

Tritax Large Field’s dividend development coverage isn’t fairly as spectacular as that of its FTSE 250 counterpart. One cause is that it’s solely been in existence since 2013. Another excuse is that the annual dividend fell for the primary time in the course of the top of the pandemic 5 years in the past.

However this REIT has grown shareholder payouts steadily since then, and is tipped to proceed by way of to 2027 at the very least. In actual fact, predicted dividend development for this 12 months is greater than double the speed predicted for the broader UK share complicated.

Tritax Large Field doesn’t function in defensive sectors, which may depart earnings susceptible throughout lean durations. However its portfolio composition helps to cut back (if not completely get rid of) the risk to dividends and its share worth.

It has greater than 128 tenants on its books unfold throughout 102 properties. These cowl a number of industries and embrace blue-chip corporations like Amazon and Ocado, offering power by way of diversification.

With on-line procuring nonetheless rising, provide chains being onshored, and knowledge centre demand growing, I anticipate demand for its large field property to rise over time. This might in flip ship sustained long-term dividend development.