Picture supply: Getty Photographs

I’m not simply thinking about excessive near-term dividend yields once I’m shopping for shares for passive earnings. I would like dividend shares that may present a sustainably massive and rising dividend over time.

As this desk reveals, Greencoat UK (LSE:UKW) is anticipated to ship impressively on each counts in the course of the subsequent few years:

| Yr | Dividend per share (forecast) | Dividend yield |

|---|---|---|

| 2025 | 10.38p | 8.6% |

| 2026 | 10.70p | 8.8% |

| 2027 | 11.01p | 9.1% |

It’s crucial to do not forget that dividends are by no means, ever assured. What’s extra, Metropolis forecasts (upon which these yields are based mostly) can shoot each below and above.

But, I’m assured this dividend star an ship a long-lasting second earnings for buyers. If projections are correct, a £10,000 lump sum at present will present dividends of £2,653 between now and 2027 alone.

Right here’s why I’m contemplating the FTSE 250 firm for my very own portfolio.

Good and dangerous

Holding renewable power shares may be problematic at occasions. When the solar doesn’t shine or the wind doesn’t blow, income can tumble as power technology slumps, doubtlessly impacting dividends.

This can be a fixed risk for Greencoat UK, all of whose belongings are situated in Britain, as its title implies. Nevertheless, this tighter geographic footprint additionally has its benefits.

Britain is famed for its wonderful wind speeds and lengthy coastlines, and offshore wind capability usually exceeds 50%, making it one of many world’s main locations to construct generators. Capability on future wind farms is tipped to rise as excessive as 65%, too, as expertise improves.

The UK can also be turning into one of the crucial supportive environments on the planet for inexperienced power. Simply final Friday (4 July), the federal government introduced new plans to turbocharge the onshore wind business via steps like simplifying the planning course of and boosting provide chains.

In doing so, the federal government is trying to virtually double complete onshore wind capability, to 27GW-29GW by 2030.

A dividend hero I’m contemplating

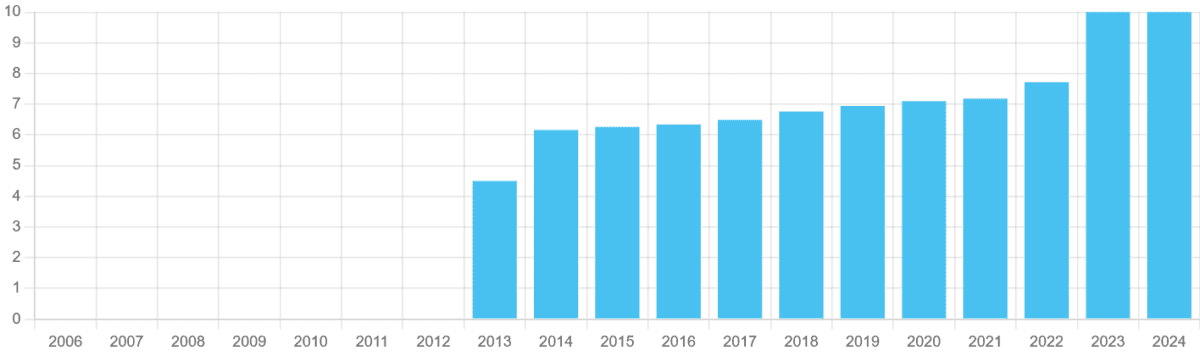

This supplies vital scope for Greencoat UK, which at present owns 49 wind farms, to maintain its progressive payout coverage going. As you may see, annual dividends right here have risen persistently because it listed on the London Inventory Change greater than a decade in the past.

The one exception got here in 2024, when the corporate reduce its long-term power technology forecasts by 2.4%, resulting in a drop in asset values. However with these modifications made, Metropolis analysts predict dividends to start out chugging greater once more from 2025.

The graphic additionally underlines one other engaging characteristic of renewable power shares like this. Electrical energy demand stays typically steady throughout all financial circumstances, even throughout excessive inflation and pandemic-related downturns. So whereas these corporations can hold producing the power, the revenues and money flows proceed to steadily roll in.

Whereas it’s not with out dangers, I’m contemplating including Greencoat UK to my very own portfolio for a long-term earnings.