Inventory alternate market idea, Hand dealer contact on digital pill with graphs evaluation candle line on the desk in workplace, diagrams on display.

Holders of Greggs (LSE:GRG) shares (together with myself) have endured a very depressing time since final autumn. Since indicators of gross sales weak spot emerged in September, the FTSE 250 inventory has plummeted, leading to an near-40% fall on a 12-month foundation.

Greggs’ share worth droop displays market fears that its former breakneck gross sales development might now be historical past.

I’ve not been tempted to promote my very own shares, although. It is because I count on the retailer to recuperate strongly from present turbulence and ship tasty long-term returns.

However what are Metropolis analysts anticipating on the share worth and dividend entrance over the approaching 12 months?

Perky worth forecasts

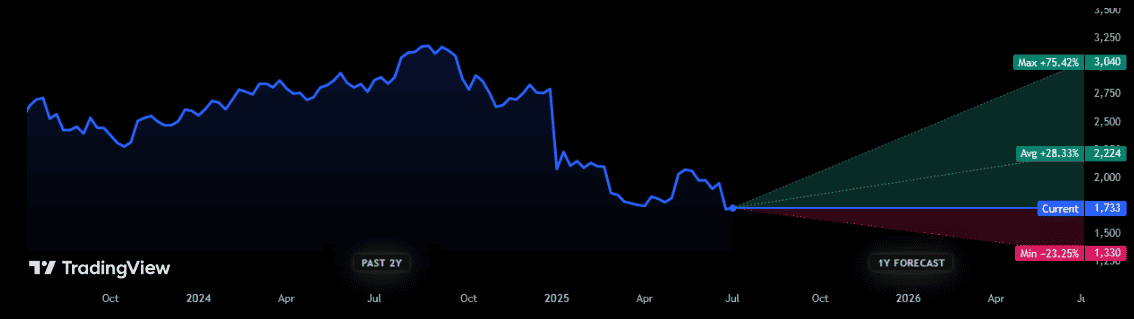

If dealer forecasts show correct, the battered baker’s shares will rebound extra sharply than some might count on. The 9 analysts with rankings on it assume there can be positive factors approaching 30% from right now’s ranges.

But, it’s value making an allowance for that opinions among the many analyst neighborhood are combined. On the optimistic facet, one dealer thinks Greggs shares will rebound by round three-quarters from present ranges and reclaim the £30 per share marker.

However on the different finish of the size, one less-convinced forecaster believes a fall of almost 25% is on the playing cards.

Given Greggs’ newest poor replace, they maybe can’t be blamed. It mentioned this month (2 July) that gross sales rose 6.9% within the first six months of 2025, lower than half of what Metropolis analysts predicted. Like-for-like gross sales development additionally remained extremely subdued, at 2.6%.

What about dividends?

Broadly talking, the near-term outlook within the Metropolis for the corporate’s dividends isn’t fairly as promising. Analysts predict 2025’s dividend to be pared again in anticipation of a 12% annual earnings decline. They predict a 67.3p dividend, down from 69p final 12 months.

Encouragingly, analysts tip Greggs to return to revenue development (+4%) in 2026, although. In consequence, in addition they forecast an elevated money reward of 69.8p per share.

The excellent news is that regardless of this anticipated volatility, latest share worth weak spot means these projections give traders market-beating dividend yields to get pleasure from. These are 3.9% and 4% for 2025 and 2026, respectively.

Is Greggs a purchase?

Newest outcomes present that even sellers of low-cost foods and drinks are struggling amid the cost-of-living disaster. With Britain’s financial system going through a interval of low development, it’s potential that Greggs’ earnings might stay underneath stress for a while.

Subsequently short-term traders might wish to keep away. However for long-term share pickers, I believe the corporate’s share worth plunge makes it value severe consideration. With plans to supercharge retailer numbers, it has vital scope to develop gross sales and earnings (it’s seeking to develop its portfolio from 2,649 shops right now to three,500 ultimately).

This technique additionally consists of having a larger proportion of franchise shops (presently 20%), lowering the associated fee burden. Extra shops may even be positioned in high-footfall journey hubs like airports and practice stations.

As a shareholder myself, I’m additionally optimistic that steps to spice up like-for-like gross sales will repay, from enhancing its supply proposition to extending opening hours to grab the profitable night commerce.

It’s not with out danger, however I’m assured Greggs will recuperate strongly from its present issues and ship glorious returns.